As FTX begins its repayment process and injects liquidity into the market, there’s a downward pressure on the price chart. As a result, Bitcoin is having trouble building the buying momentum that analysts had anticipated would increase following FTX’s repayments.

FTX Distributes $1.2 Billion in First Phase

FTX has started paying back its creditors on February 18, signaling a move toward wrapping up a crisis that had a massive impact on the market. Many people affected by the exchange’s downfall experienced significant financial losses, including those who had set aside money for big life plans like buying homes or paying for their children’s education.

Specifically, those who lost up to $50,000, will get back 100% of their claimed amount plus 9% interest annually, calculated from November 11, 2022—the day FTX went bankrupt.

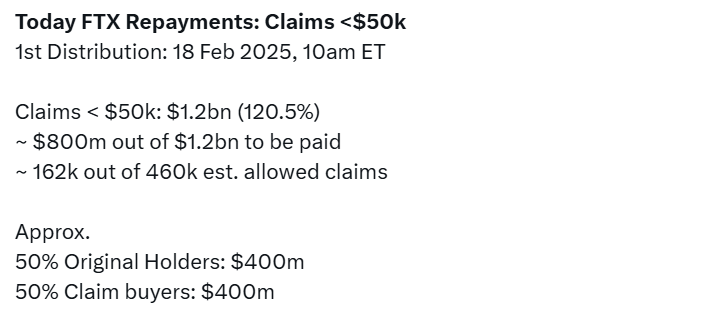

In a tweet, FTX creditor Sunil mentioned that the first round of repayments totals $1.2 billion, with around $800 million already distributed. This has reached about 162,000 accounts, covering 35% of the approximately 460,000 accounts that are eligible to receive claims.

In terms of the distribution of these funds, half of the money has been paid directly to the original account holders, while the remaining half has been allocated to those who have acquired the debts.

This method of repayment addresses both the initial victims of the collapse and the secondary parties who have since taken on the risk by purchasing these debts.

Also read: FTX Repayments Worth $16B to Begin Tomorrow—Will This Flow into Bitcoin and Altcoins?

Many recipients of FTX repayments are expected to reinvest their funds in cryptocurrencies, with some buying Bitcoin or Bitcoin ETFs and others investing in altcoins like Ethereum. However, it’s uncertain if these repayments will impact Bitcoin’s price significantly as BTC price failed to gain any significant buying demand.

In recent hours, the price of BTC declined heavily as it dropped from a high of $96,730. It is now aiming for a consolidation at around $94K.

What to Expect from Bitcoin Next?

The impact of these payments on the market is still unclear. Some experts think that some of the money might flow back into cryptocurrencies, enhancing liquidity.

However, since the repayment plan targets creditors with smaller claims, it may not greatly influence market prices right away. Additionally, many recipients may choose more secure investments over re-entering a market that continues to be volatile.

Currently, Bitcoin is declining unexpectedly following the repayment. The RSI level has reached the selling zone at level 31, suggesting that Bitcoin might continue to trend downward.

Buyers are now aiming for a retest of the $92K region to validate further trends. If Bitcoin rebounds above that zone, we might see a consolidation below $95K. On the other hand, a drop below $92K will send the BTC price toward $89K.