Ahead of the US inflation report, Bitcoin’s price is experiencing a bearish correction. This drop is triggered by significant sell-offs among investors, creating intense bearish pressure in the $95K-$100K range. Meanwhile, various on-chain metrics indicate mixed sentiments regarding Bitcoin’s next direction, as traders on both sides continue to heavily influence the price chart.

Bitcoin’s MVRV Ratio Dropped During Upward Correction

News that Binance, a major global cryptocurrency exchange, had sold nearly all of its Bitcoin, Ether, Solana, and other cryptocurrencies seemed to increase the market’s instability. As a result, Bitcoin is currently facing difficulties, fluctuating around the $98K level and recently undergoing a correction to $95K.

According to data from Coinglass, total liquidations for Bitcoin soared to $32.21 million, with buyers facing liquidations of approximately $23.7 million and sellers around $8.41 million.

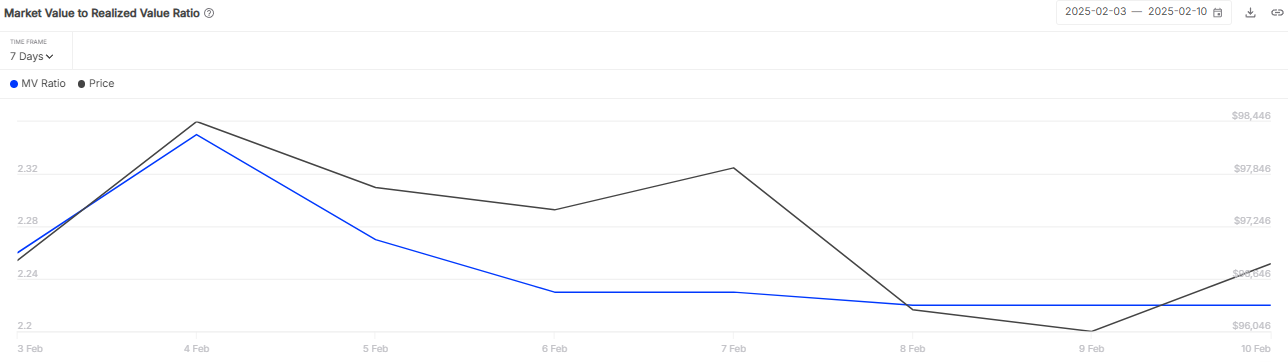

Additionally, IntoTheBlock data indicates that Bitcoin’s MVRV ratio has decreased as its price rose over the past 72 hours. The ratio fell from a high of 2.35 to 2.22 while Bitcoin made a push toward $99K.

A declining MVRV ratio during a price surge often indicates that long-term holders are taking profits. These holders sold their Bitcoin, which they previously bought at lower prices, thus realizing their gains. This is one of the reasons behind the current bearish pullback.

Additionally, Bitcoin’s volatility rate has sharply decreased from a high of 38.12% to 33.52%. This drop in volatility could keep Bitcoin’s price stable within a certain range for now. However, there are indications that Bitcoin could be gearing up for a potential breakout soon.

Several analysts view the current downturn as a chance to buy Bitcoin at a lower price. It is anticipated that buying will increase if Bitcoin reaches a dip, potentially establishing a solid support level. This could lead to a significant upward correction for Bitcoin.

What’s Next for BTC Price?

Bitcoin’s price recently attempted to move above $98K but has since consolidated, and is now showing a bearish trend as it struggles to break above the 23.6% Fibonacci retracement level. As bearish domination rises, the price of Bitcoin is aiming for a hold below the $95K mark. Currently, Bitcoin is priced at $95,027, having decreased by 3% over the last 24 hours.

The BTC/USDT pair is facing continuous selling pressure as it drops below the crucial ascending support line. As the price now holds below that trend line, Bitcoin might soon aim for a retest of the crucial support level at $91K. Staying above this threshold could benefit buyers, potentially pushing the price towards $98K and possibly even $102,000.

Conversely, if Bitcoin continues to trade below the EMA20 trend line on the 1-hour chart, there could be downward pressure, potentially driving the price below $89K.