An on-chain and macro research specialist, Alex Adler Jr, in his recent X post, notes that the average funding rate across Binance, Bybit and OKX – the three top exchanges – has slipped to zero. Interestingly, he also points out that every such occurrence in this cycle has triggered a macro bull run. The big question is: Is a bull run coming in the Bitcoin market?

Bitcoin Futures Funding Rate Hits 0%

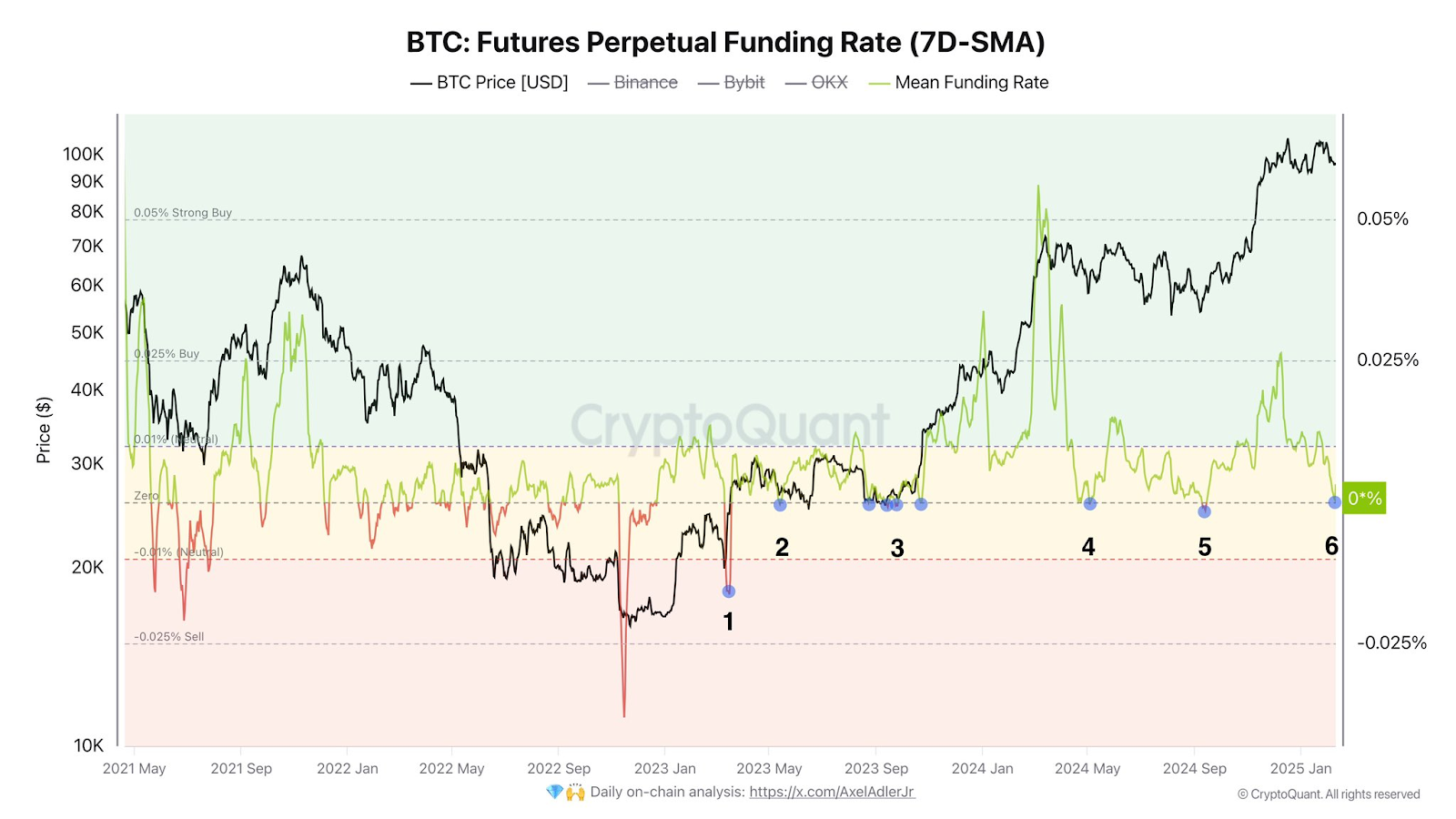

According to a chart, titled ‘BTC: Futures Perpetual Funding Rate (7D-SMA)’, shown in Alex’s post, the average funding rate across the three top exchanges of Binance, Bybit and OKX has declined to zero.

What the chart convery is how the funding rate for Bitcoin futures contracts has changed over time, using a 7-day simple moving average.

- If the funding rate is positive, it means more traders are betting on Bitcoin’s price going up. In other words, it indicates the dominance of long positions.

- If the funding rate is negative, it means more traders are betting on Bitcoin’s price going down. In other words, it suggests the dominance of short positions.

In our chart, the funding rate remains at zero. This implies that there is no clear dominance between long and short traders. In short, this reflects market uncertainty.

Historical Trends: Bullish Signals from Neutral Funding Rate

Alex points out that in the current cycle, the Bitcoin market has often shown bullish momentum immediately after the funding rate touched the neutral point.

This means that there is a high chance for the BTC market to go up in the coming days.

- Also Read :

- Top Analysts Predict Crypto IPO Boom and Bitcoin in U.S. Balance Sheets – Bullish Signal for 2025?

- ,

Bitcoin’s Current Price and Market Sentiment

At the start of this month, the price of Bitcoin stood at $102,417.80. Between February 1 and 5, the market sharply slipped nearly 5.67%. Between February 6 and 9, the market remained within a tight range of $96,615 and $96,440. With a strong bullish push, on February 10, BTC broke above this range.

In the last 24 hours, the market has surged by around 0.9%. However, the market has not yet recovered from the early February correction. In the last 14 days, the market has dropped by 4.3%.

In conclusion, Bitcoin’s funding rate has dropped to zero, signalling market indecision. If history repeats itself, Bitcoin could soon see an uptrend.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Bitcoin funding rates are periodic payments between long and short traders in perpetual futures contracts, ensuring price alignment with the spot market.

A negative funding rate can be bullish as it signals bearish sentiment, potentially leading to a short squeeze and upward price movement.

You can check Bitcoin funding rates on exchanges like Binance, Bybit, and OKX under their futures trading sections or use market data aggregators.

High funding rates indicate strong bullish sentiment, meaning more traders are paying to hold long positions, but it can signal an overheated market.