Crypto markets have been bleeding profusely since Donald Trump entered the White House. The crypto veterans and the proponents believed Bitcoin and the other cryptos would thrive under his rule, but with stricter impositions, the crypto markets are facing extreme repercussions, which may push the market participants into a deep sea of uncertainty and fear. Bitcoin, which was on its way to mark a new ATH, drained heavily to form the local button close to $91,000. Besides, the altcoins also plunged with a very huge margin, letting off huge bearish waves across the crypto markets.

What Went Wrong? Why Crypto Markets Plunged Hard?

Investors foresaw the strengthening of the crypto markets as soon as Donald Trump won the elections, which kept the markets elevated. During the past week, Trump imposed 25% tariffs on imports of goods from Canada and Mexico and 10% on China. Moreover, he has announced additional tariffs on Chinese goods and imported cars.

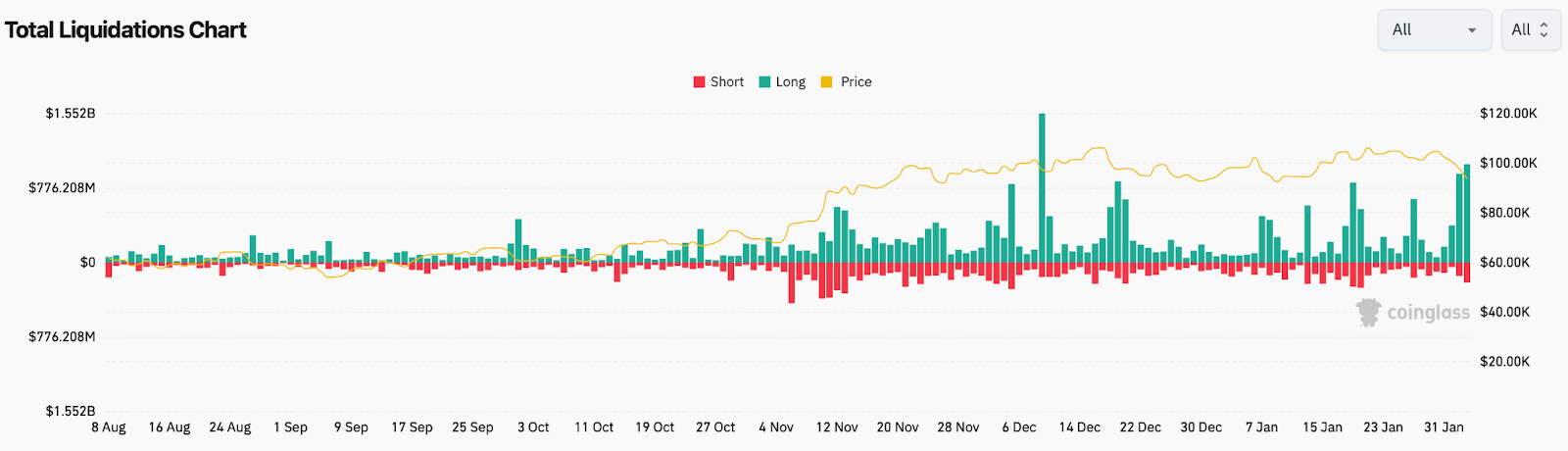

With this, the rates are expected to increase for Americans, leading to a rise in inflation and layoffs. This is the prime reason for a billion-long liquidation during the past weekend, wherein more than 700,000 traders were liquidated, with the total liquidations raised over $2 billion.

Apart from this, the DXY index, which measures the strength of the U.S. dollar, surged above 109.7 while the Treasury yield rose to 4.54%, which is not good for the BTC price and the entire crypto space.

What’s Next for the Crypto Markets? Will Bitcoin Price Rise Back to $100,000?

With the institutions remaining uncertain about the next market trends, the fate of the spot ETF remains hung. Besides, some reports suggest hedge funds are betting on a stock market correction and the data from Goldman Sachs indicates a massive rise in the short positions of the U.S.-based stocks. More importantly, the latest pullback has helped the BTC price complete a massive bearish pattern, which is circulating bearish waves across the crypto markets.

The weekly chart of Bitcoin suggests the price is testing the neckline of a massive double-top or ‘M-shape’ pattern. The bulls are trying hard to keep up the levels above the crucial support range between $91,408 and $92,285. Meanwhile, the weekly MACD underwent a bearish crossover while the Bull Market Support Band (BMSB) and Direct Movement Index (DMI) are heading for a similar price action. On the other hand, the Chaikin Money Flow (CMF) and Relative Strength Index (RSI) face a bearish reversal and are plunging towards the lower range.

Hence, the overall sentiments for the Bitcoin price and the crypto markets have turned negative and hence the traders also seem to be staying away until the market conditions stabilize.