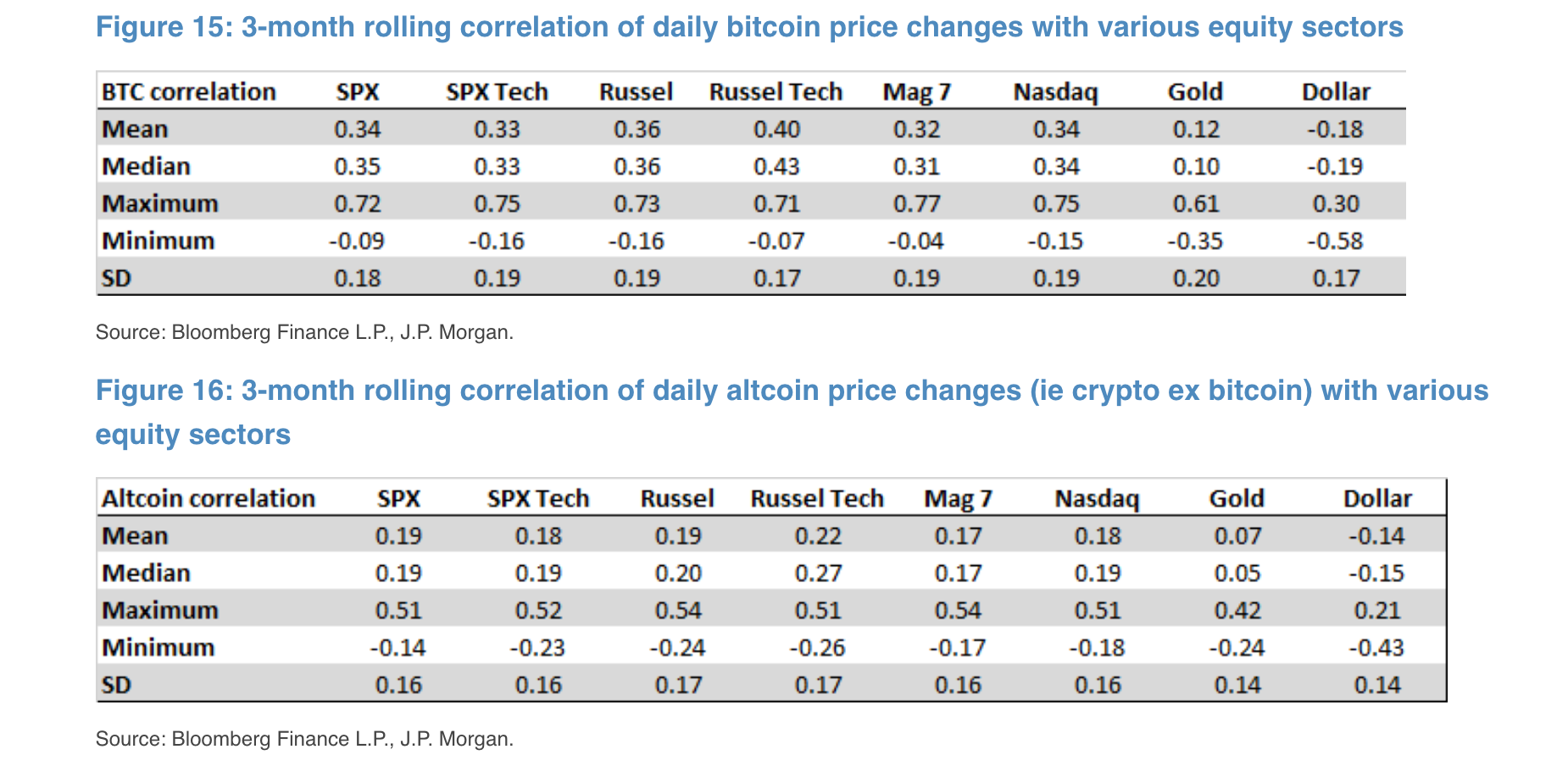

Jpmorgan Analysts focused on the relationship between crypto currencies and stocks. Research Bitcoin $105,198.9He showed that his performance is mostly compatible with small -scale technology companies in the Russell 2000 index. Analysts explain this situation with the structure of the venture capital of crypto currencies and the intensification of technological innovations in small companies. Especially in 2020 and 2024 technology -oriented rise and the collapse of 2022, the correlation between Bitcoin and stocks said.

Technology shares and common dynamics of crypto currencies

According to JPMorgan Crypto Money Market Two factors lies at the basis of the link between the shares of technology. The first is the high impact of individual investors in both markets. Individual investors shape price movements with both leveraged transactions and risk -taking tendencies. The second is Blockchain And artificial intelligence Innovations such as both technology companies and crypto currencies directly affect.

The fact that small companies play a leading role in technological breakthroughs strengthens the correlation. For example Russell 2000Most of the companies in the company operate in areas such as crypto infrastructure or software development. This leads to parallel progress of market movements.

JPMorgan analysts based on this reality “Technology sectorEvery major fluctuation in the crypto money market also has echo. ”

Why does the correlation peak?

On the other hand, the research reveals that the crypto-hisse deed connection is not fixed. Accordingly, the correlation goes to the highest levels during the periods when the technology sector is re -evaluated. As it will be recalled, the increase in the demand for technology during the 2020 pandemi process had a positive impact on Bitcoin. Similarly, in 2024, artificial intelligence and developments in cloud informatics played both markets at the same time.

However, in 2022, when the Fed’s interest rate hikes declined, Bitcoin fell hard. JPMorgan stressed that this synchronized movement reflects the investor psychology. The escape from risky assets or the increase in risk appetite causes similar reactions in both markets.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.