Ether, the second largest cryptocurrency, has fallen more than 20% against Bitcoin in the last six weeks. With the ETHBTC ratio remaining near a two-month low, sellers are pushing to stabilize the price below $3,400. This pressure has led to a significant drop in an important on-chain metric, indicating potential further declines in its price.

Ethereum’s Decline Might Be Short-Term

The price of Ethereum has been experiencing mixed reactions in the market as both buyers and sellers face liquidations. According to Coinglass, Ethereum saw a total of $35 million in liquidations over the past 24 hours, with $14 million coming from buyers and $21 million from sellers.

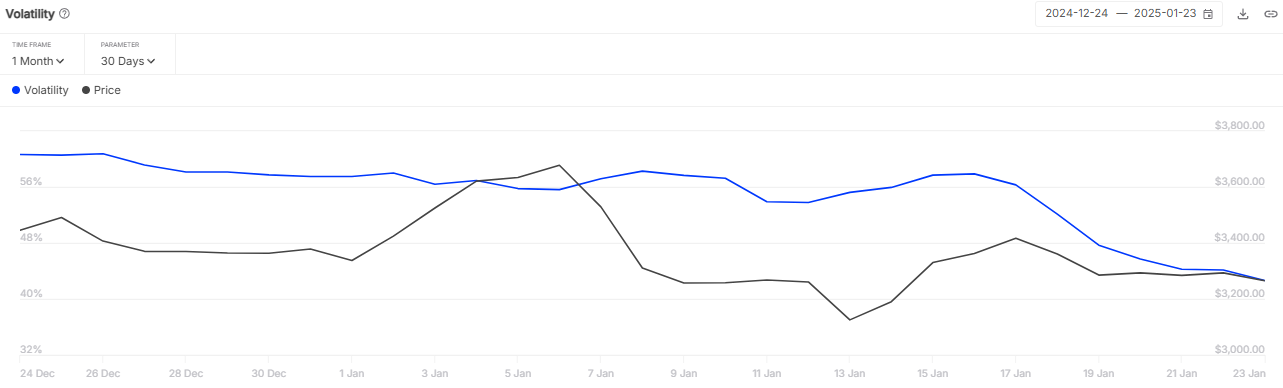

Data from IntoTheBlock indicates that Ethereum’s volatility has been decreasing over the last 30 days. A significant drop in volatility could be a negative sign for Ethereum because it suggests less trading activity, which could reduce the chances of the price moving above key resistance levels. Currently, the volatility rate stands at 42.6%.

At the time of publication, the ETH/BTC ratio, which indicates Ether’s value relative to Bitcoin, stands at 0.03194 according to TradingView data. This ratio has decreased by 19% since December 5, when Bitcoin reached $100,000 for the first time.

However, in the previous bull market cycle, the ETH/BTC ratio hit a low of around 0.03 in March 2021 and then climbed to 0.077 within two months. During this time, the price of Ether rose by 110%, reaching $3,817.

Also read: Ethereum Price Prediction 2025, 2026 – 2030: Can ETH Price Hit $5k?

As Bitcoin’s adoption now grows, being bearish on Ethereum will be a mistake. Some believe that while many are focused on what US President-elect Donald Trump might do with Bitcoin during his tenure, Ether could also benefit indirectly from Bitcoin’s wider adoption.

Apollo co-founder Thomas Fahrer stated that if the Strategic Bitcoin Reserve is implemented, it could drive Bitcoin’s price up to $1 million this cycle. He also noted that this would be positive for Ether, suggesting that a price target of $4,000 could be achievable.

What’s Next for ETH Price?

Ethereum’s price has been climbing sharply, breaking past previous resistance levels and now trying to push above the immediate Fibonacci channel. However, it’s facing some selling pressure around the declining resistance line, posing a significant challenge for buyers. Currently, Ethereum is trading at $3,343, having increased by 1.01% in the last 24 hours.

The ETH/USDT trading pair is hovering just below $3,430, which could present a significant hurdle. If it can maintain above this level, it could be beneficial for buyers, potentially driving the price up to $3,730, and possibly even to $4K.

Conversely, if the price falls below the EMA20 trend line on the 1-hour chart, sellers could drive it down to around $3,200. Nonetheless, the Relative Strength Index (RSI) at 52 suggests there could be an uptick soon, as it indicates continued buying interest.