This week, the US is set to witness several key economic events, including the US Core PPI YoY, the US Core Inflation Rate YoY, the US Retail Sales MoM, the US Philadelphia Fed Manufacturing Index and the US Housing Starts Index. Apart from the scheduled index releases, at least four Fed speaker events are also expected to take place this week. Let’s analyse the scenario a bit deeper. Ready?

Key Index Releases This Week in the US

US Core PPI YoY

The US Core Producer Price index, which measures average changes in prices received by domestic producers for their output, excluding volatile products like food and energy, will be released tomorrow.

In October, it rose from 3.2% to 3.4%. In November, it showed no change. The expectation is that it will drop to 3.2%.

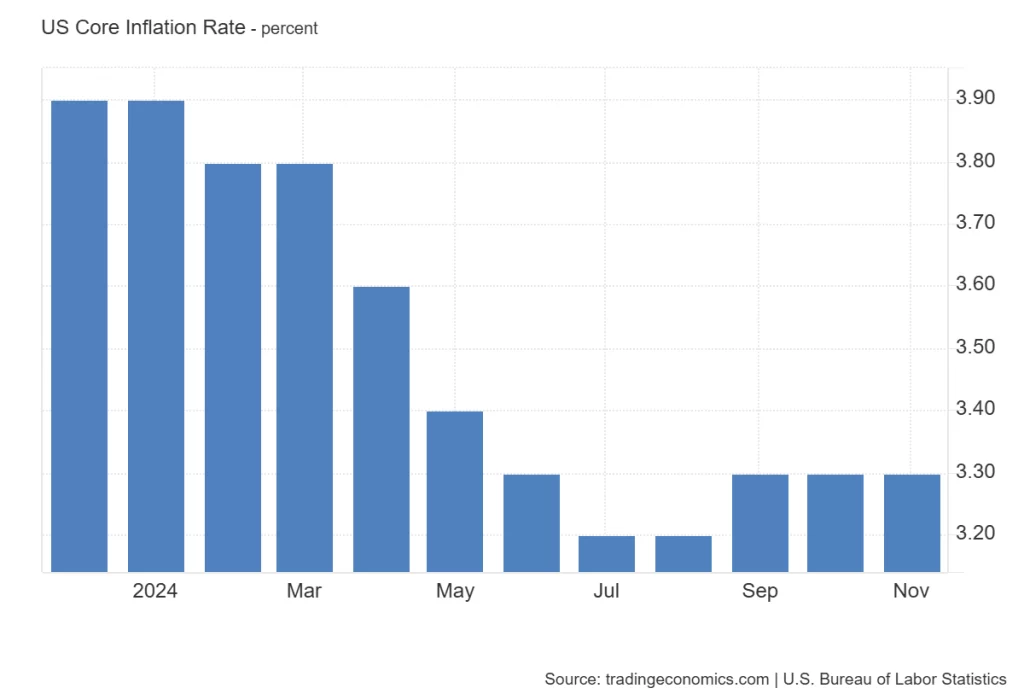

US Core Inflation Rate YoY

The US Core Inflation Rate index, which evaluates changes in prices that consumers pay for a basket of goods, excluding volatile food and energy, will be released the day after tomorrow.

In September, it grew from 3.2% to 3.3%. In the last three releases (September, October and November), it demonstrated no change. The expectation is that it will show no change this time as well.

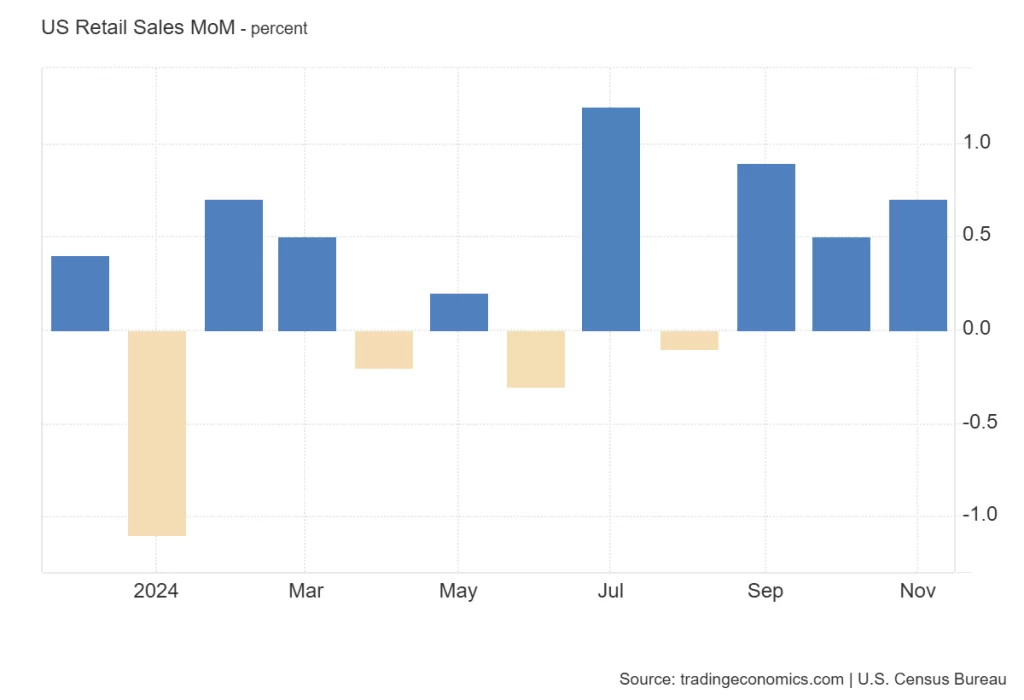

US Retail Sales MoM

The US Retail Sales MoM index, which gives an aggregated measure of sales of retail goods and services over a period of a month, will be released on Thursday.

In November, it climbed from 0.5% to 0.7%. The expectation is that it will drop from 0.7% to 0.5%.

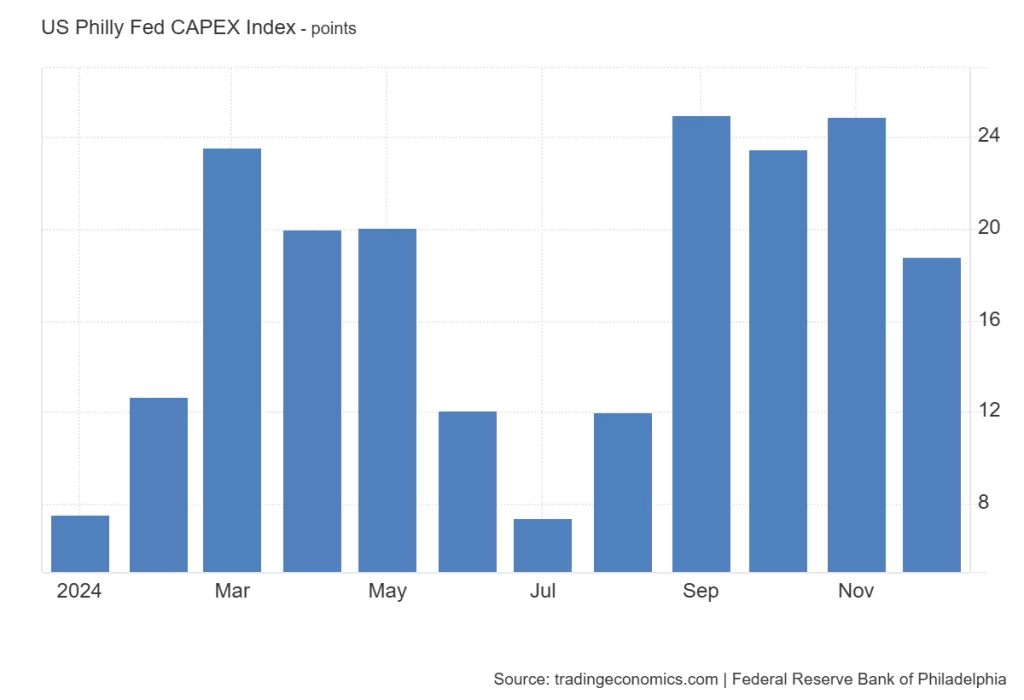

US Philadelphia Fed CAPEX

The Philadelphia Fed Manufacturing Index, which measures the direction of change in overall business activity in the US state, will be released on Thursday.

In December, it declined from 24.9 points to 18.8 points. In January 2024, it was 7.5 points. In September, it touched an yearly peak of 25 points.

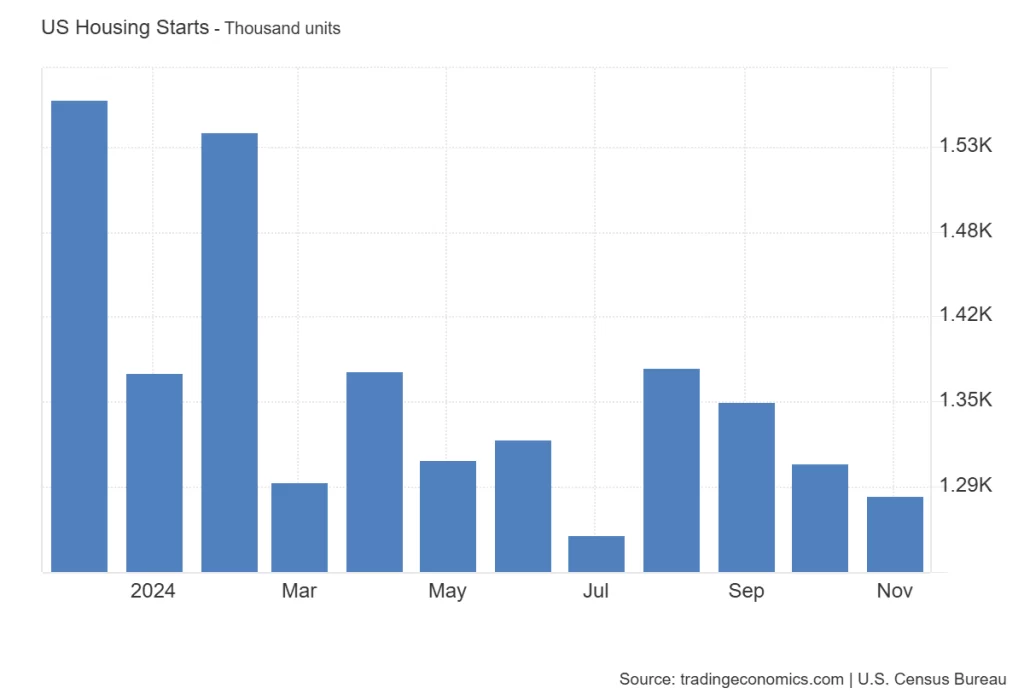

US Housing Starts

The US Housing Starts index, which examines the number of new residential construction projects that have begun during any particular month, will be released on Friday.

In November, it dropped from 1.31 million to 1.29 million. The expectation is that it will rise to 1.31 million from 1.29 million.

Key Fed Speeches This Week in the US

- Kansas City Fed President and CEO Jeffrey Schmid will address the press tomorrow.

- New York Fed President and CEO John Williams, Richmond Fed President and CEO Tom Barkin, and Minneapolis Fed President and CEO Neel Kashkari will address the press separately the day after tomorrow.

In conclusion, these economic events are likely to have a significant impact on the cryptocurrency industry. A potential drop in US Core PPI or inflation rates could bolster Bitcoin and other crypto assets, as reduced inflation signals lower interest rates. Retail sales date may indicate shifts in consumer spending, influencing crypto adoption. The speeches by Fed officials could hint at future monetary policies, impacting investor sentiment toward risk assets like cryptocurrencies. If housing starts or manufacturing indices show growth, they may counter crypto gains, as traditional markets may seem more stable. This week’s date will be crucial in shaping the crypto market’s trajectory.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.