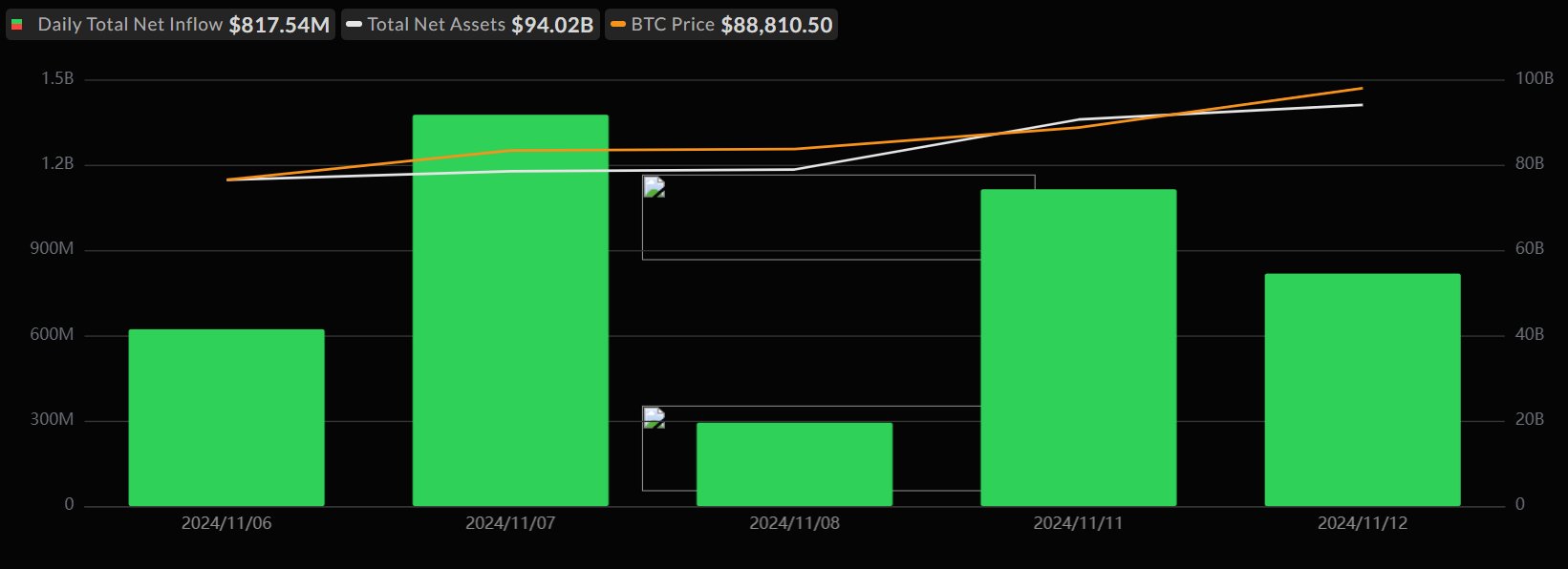

In the US as of November 12, 2024 spot Bitcoin  $88,102 ETFTotal net capital inflow reached 817 million dollars. Thus, these funds recorded net inflows for five consecutive days. BlackRock‘s ETF IBIT stood out by attracting $778 million in net inflows in just one day. Besides that Fidelity‘s spot Bitcoin ETF attracted a net inflow of $37 million on the same day.

$88,102 ETFTotal net capital inflow reached 817 million dollars. Thus, these funds recorded net inflows for five consecutive days. BlackRock‘s ETF IBIT stood out by attracting $778 million in net inflows in just one day. Besides that Fidelity‘s spot Bitcoin ETF attracted a net inflow of $37 million on the same day.

Interest in Spot Ethereum ETFs Grows

Although not as large as the large inflow of capital into spot Bitcoin ETFs in the US spot Ethereum  $3,382 ETF‘s also showed a positive performance on November 12. There was a total of $135 million inflows into spot Ethereum ETFs.

$3,382 ETF‘s also showed a positive performance on November 12. There was a total of $135 million inflows into spot Ethereum ETFs.

The bulk of this inflow was into BlackRock’s spot Ethereum ETF, with $131 million flowing into the fund. On the other hand GrayscaleThere was an outflow of $33 million in ‘s spot Ethereum ETF on the same day. Thus, investor interest in spot Ethereum ETFs presented a balanced outlook.

Continuous Increase in Corporate Interest

Spot Bitcoin and Ethereum in the USA ETFThe latest figures on currencies show that institutional investors’ interest in cryptocurrencies is clearly increasing. The consecutive net capital flows to spot ETFs indicate continued institutional support, especially in the market. High investment inflows into Bitcoin and Ethereum ETFs reveal that cryptocurrencies are increasingly gaining ground in traditional financial markets. This trend will continue in the long run, especially if major players such as BlackRock maintain strong fund flows. cryptocurrency market may have a significant impact on the

These developments are accompanied by the increasing demand for spot ETFs. BTC And ETHIt shows that ‘s continues to strengthen its role in the world of institutional investment. The fact that corporate funds are increasing their investments in these two cryptocurrencies is considered a harbinger of a new wave of growth in the sector.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that crypto currencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.