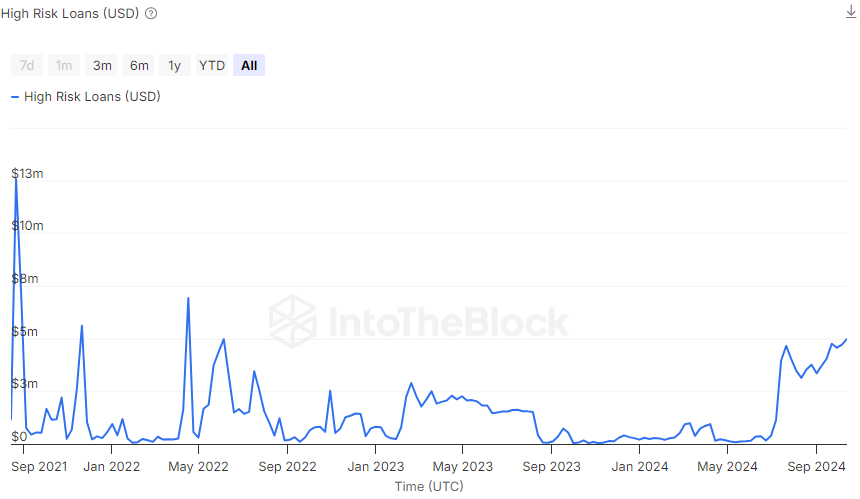

cryptocurrency marketThere is a significant increase in high-risk loans. The total amount of these loans rose to $55 million on Wednesday, according to data provided by IntoTheBlock. This figure was recorded as the highest level since June 2022. High-risk loans are defined if the loan amount is 5 percent away from the liquidation price. This means that if the price of the assets pledged as collateral falls by 5 percent, the loan will be liquidated.

The Risk of a Liquidation Wave Is Increasingly High

Cryptocurrency investors get loans from decentralized lending protocols. cryptocurrencyHe locks his money as collateral. However, if the value of the assets given as collateral falls below a certain level, the protocol liquidates the debt and puts the collateral on sale. If the collateral price drops by another 5 percent, the debt begins to no longer cover the collateral. At this point, liquidation is triggered and the repayment of the debt is achieved by selling the collateral.

This may trigger a process called a liquidation wave. Liquidation The wave causes prices to fall rapidly with successive liquidations. This rapid decline in prices causes more loans to be liquidated. Thus, the market becomes even more unstable and regular spot investors as well as borrowers suffer losses.

Market Liquidations and Bad Debts

IntoTheBlockwarned that such large liquidations affect the value of collateral, putting more loans at risk of liquidation. The analysis company emphasized that sudden drops in market values would not be enough to cover the loan and as a result, lenders would suffer losses. This can lead to increased bad debts. Bad debts negatively impact market liquidity and make it difficult to trade large orders at stable prices.

Bad debts tend to affect not only lenders but the market as a whole. Lenders need to take new steps to prevent potential losses liquidity Hesitation to add it will disrupt the general liquidity balance of the market. This can lead to large price fluctuations and liquidity squeezes in the cryptocurrency market.

The increase in high-risk loans in the cryptocurrency market and the potential risk of liquidation indicate that investors and lenders should act more cautiously. The current situation in the market indicates that major losses may occur in the event of a possible sharp price drop.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that crypto currencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.