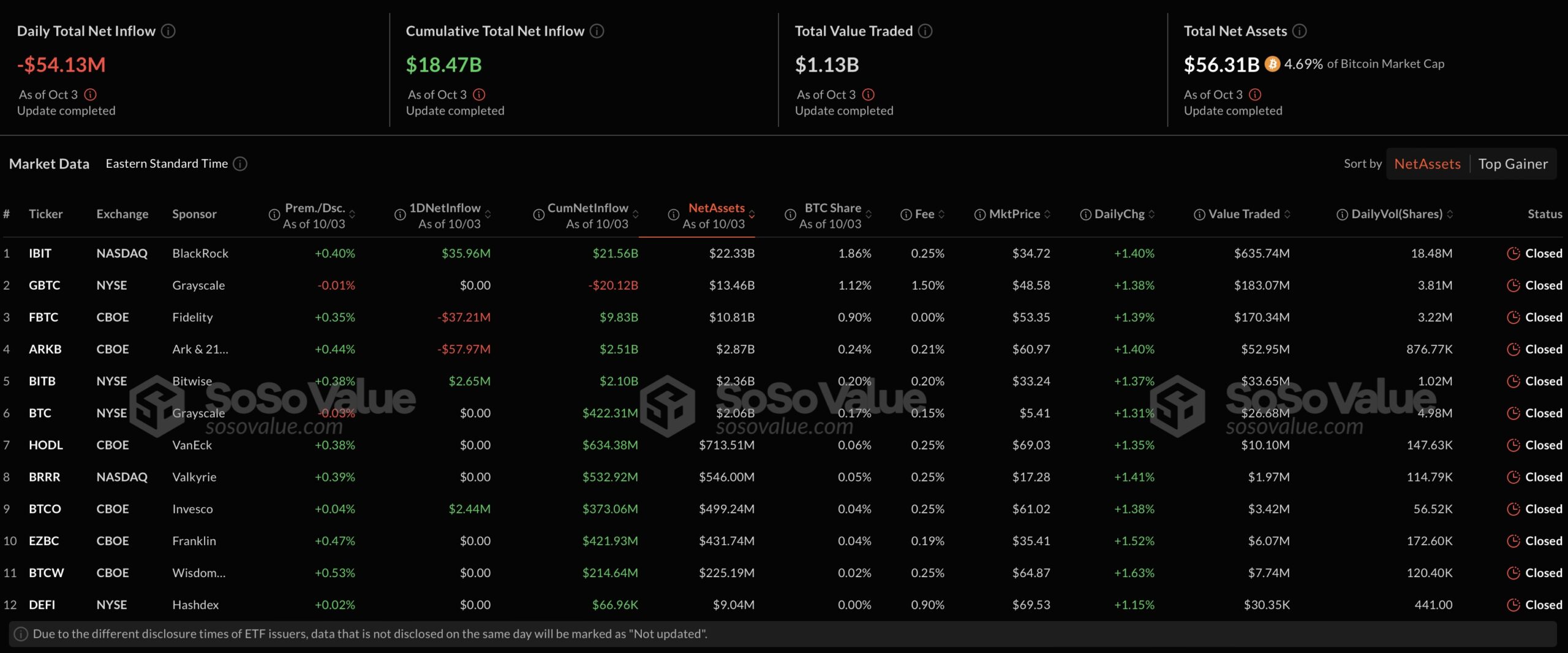

Spot Bitcoin  $60,521 Exchange-traded funds (ETFs) recorded net outflows for the third day in a row in the US. There was a net outflow of $54.13 million on Thursday, and the total net outflow for the last three days exceeded $388 million. In particular, Ark Invest and 21Shares’ ARKB fund led this process with an outflow of $ 57.97 million. Fidelity’s FBTC fund also experienced an outflow of $37.21 million on the same day. On the other hand, BlackRock’s IBIT fund was the fund with the highest net inflow with $35.96 million.

$60,521 Exchange-traded funds (ETFs) recorded net outflows for the third day in a row in the US. There was a net outflow of $54.13 million on Thursday, and the total net outflow for the last three days exceeded $388 million. In particular, Ark Invest and 21Shares’ ARKB fund led this process with an outflow of $ 57.97 million. Fidelity’s FBTC fund also experienced an outflow of $37.21 million on the same day. On the other hand, BlackRock’s IBIT fund was the fund with the highest net inflow with $35.96 million.

Latest Situation on Spot Bitcoin ETFs

on thursday spot Bitcoin ETFThe total daily transaction volume of ‘s was recorded as 1.13 billion dollars. This figure represents a significant decrease compared to the previous day’s volume of $1.66 billion. However, BlackRock IBIT While the fund attracted a net inflow of $35.96 million, Bitwise BITB fund is $2.65 million and Invesco BTCO The fund attracted a net inflow of 2.44 million dollars.

On the other hand, Grayscale GBTCSeven other funds, including , did not report any inflows or outflows.

These funds, launched in January, reached a total net inflow of $18.47 billion. Spot Bitcoin ETFDespite the decrease in the transaction volume of some funds, the fact that some funds can still provide net inflows shows the effects of the market-wide fluctuation.

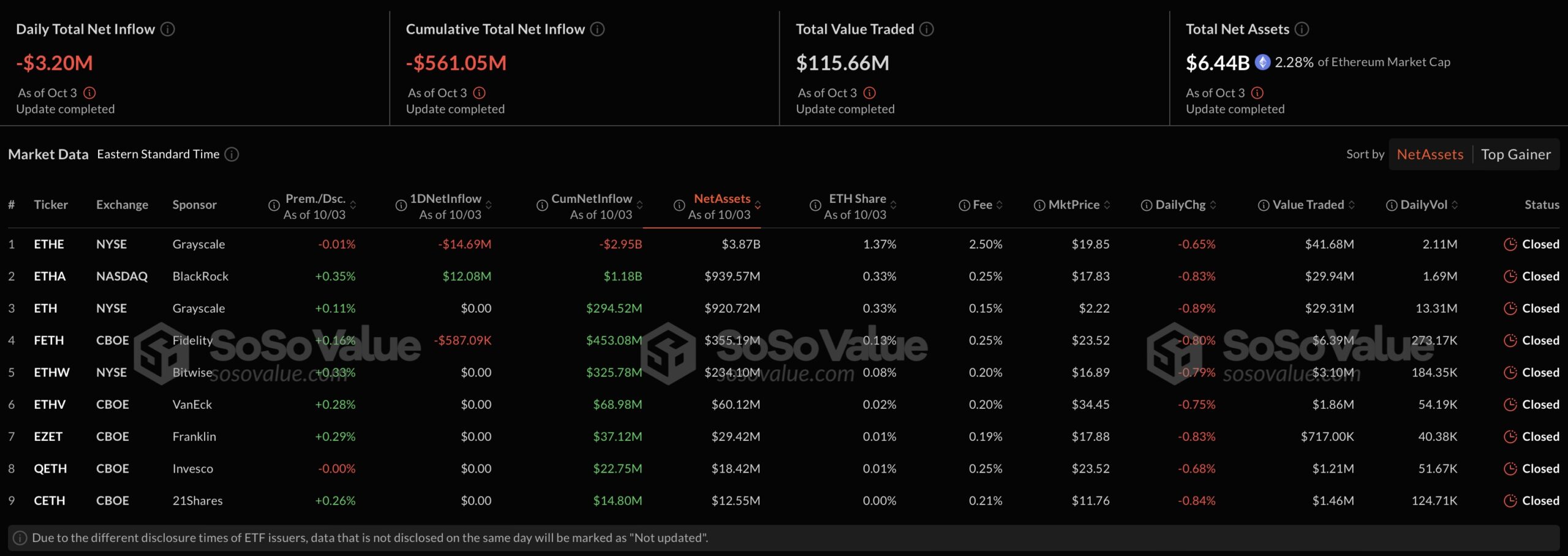

Outflows Also Accelerated in Spot Ethereum ETFs

Similar to spot Bitcoin ETFs spot Ethereum  $2,336 ETF‘s also continued to experience clear outflows. There was a net outflow of $3.2 million from spot Ethereum ETFs in the US on Thursday. Grayscale’s ETHE While the fund was the fund with the biggest exit with $14.69 million, Fidelity’s CONQUEST There was an outflow of 587 thousand 90 dollars from the fund. However, BlackRock ETHA The fund had net inflows of $12.08 million, partially offsetting outflows.

$2,336 ETF‘s also continued to experience clear outflows. There was a net outflow of $3.2 million from spot Ethereum ETFs in the US on Thursday. Grayscale’s ETHE While the fund was the fund with the biggest exit with $14.69 million, Fidelity’s CONQUEST There was an outflow of 587 thousand 90 dollars from the fund. However, BlackRock ETHA The fund had net inflows of $12.08 million, partially offsetting outflows.

The trading volume of spot Ethereum ETFs was recorded as $115.66 million on Thursday. The previous day, this figure was 197.82 million dollars. The spot released in July Ethereum Its ETFs have experienced a total net outflow of $561.05 million since then. This shows that investor interest in Ethereum has decreased due to the impact of market fluctuations.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that crypto currencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.