The post Bitcoin to Move Towards $70,000 :Market Data Suggest appeared first on Coinpedia Fintech News

Bitcoin faced a 4.88% rejection from the $65,500 zone and took support at $62,800. The price spent 4 days in a consolidation zone above $65,500, then why did it revert back? Why $65,000 did not hold the support, let’s unveil the mystery with market data.

The Tired Bitcoin Bulls

The bearish month of September ended and instead of taking a huge surge, bitcoin fell from its support level. Well, this might be fearful for some but for the market to take a rise this was very much necessary. The buyers were exhausted in their attempt to make the market survive above $65,000 and sellers started to pull down, this battle caused formation of consolidation area.

Currently BTC is trading at $63,895 and looks like a rejection from the $64,000. Even though the price was falling, the RSI was still in uptrend highlighting the upcoming turning of event. There might be another downwards movements however, the diversion shows bulls are soon coming back to action and this will breach $64,160. This time the zone of $65,500 should not take much power to break and in the next few days, we will see the price around $70,000.

Other Market Metrics

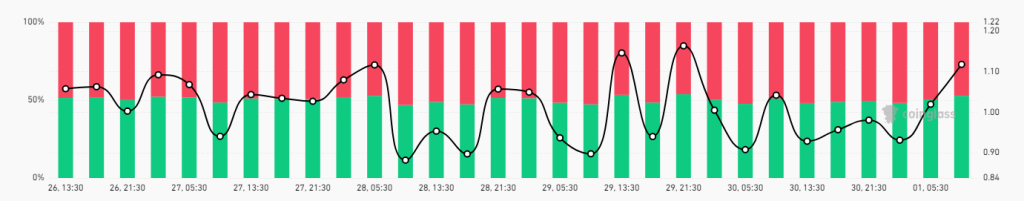

The Bitcoin long/short ratio for the last four hours shows buyers are regaining confidence as the ratio stands at 1.1182. This indicates more longs are being opened compared to shorts, reflecting a bullish sentiment. The fear and greed index currently sits at 50 points, highlighting a neutral sentiment that shifted towards bullish in the last four hours.

The liquidation heat map for BTC also shows the presence of a liquidity area above $64,000. This suggests we can see the movement of price towards this price area during intraday trading. If price closes above this point for the day, we can expect more movement towards $70,000 sooner than expected.

Looking Ahead!

The bullish sentiment in the market is growing and the market data is suggesting the same, we should expect the price movement in the upward direction. Bitcoin might take some healthy little correction during its journey but that is important to cement the support zones.

Also Read : Gemini to Close Operations in Canada – What You Need to Do Now!