The Bitcoin price is plunging! The token has held the resistance at $65,500 throughout the weekend, suggesting a probable bullish close for the quarter. Woefully, the sluggish behaviour of the bulls enabled the bears to intensify their activity and cause significant harm to the rally. Although it appears to be another higher low, from a wider perspective, the BTC price rally may still kick-start and mark new highs soon.

Bitcoin emerged as an investor’s favourite this past week, recording a price rise of over 4% and marking an interim high above $66,000. This indicated the price may soon hit $70,000 in the first few days of October, followed by a new ATH somewhere in the mid of Q4. However, the current pullback could hinder the progress of the rally, but the market conditions suggest a wider price action could soon follow.

A popular on-chain data provider, Cryptoquant, lists a few that hint the trend is still in bullish favour, regardless of the interim setbacks for the BTC price.

Rising Bitcoin ETF-Netflow

Ever since the BTC price broke down from the consolidation above $71,000, the net flow of the spot ETF dropped heavily. Moreover, some days recorded ‘0’ inflows while the outflows remained on the higher side. However, the rise above $65,000 appears to have increased the demand for the Bitcoin spot ETF. Institutions like BlackRock, Fidelity, and ARK reported combined inflows of $324 million in the recent past, indicating a strong demand from U.S. investors.

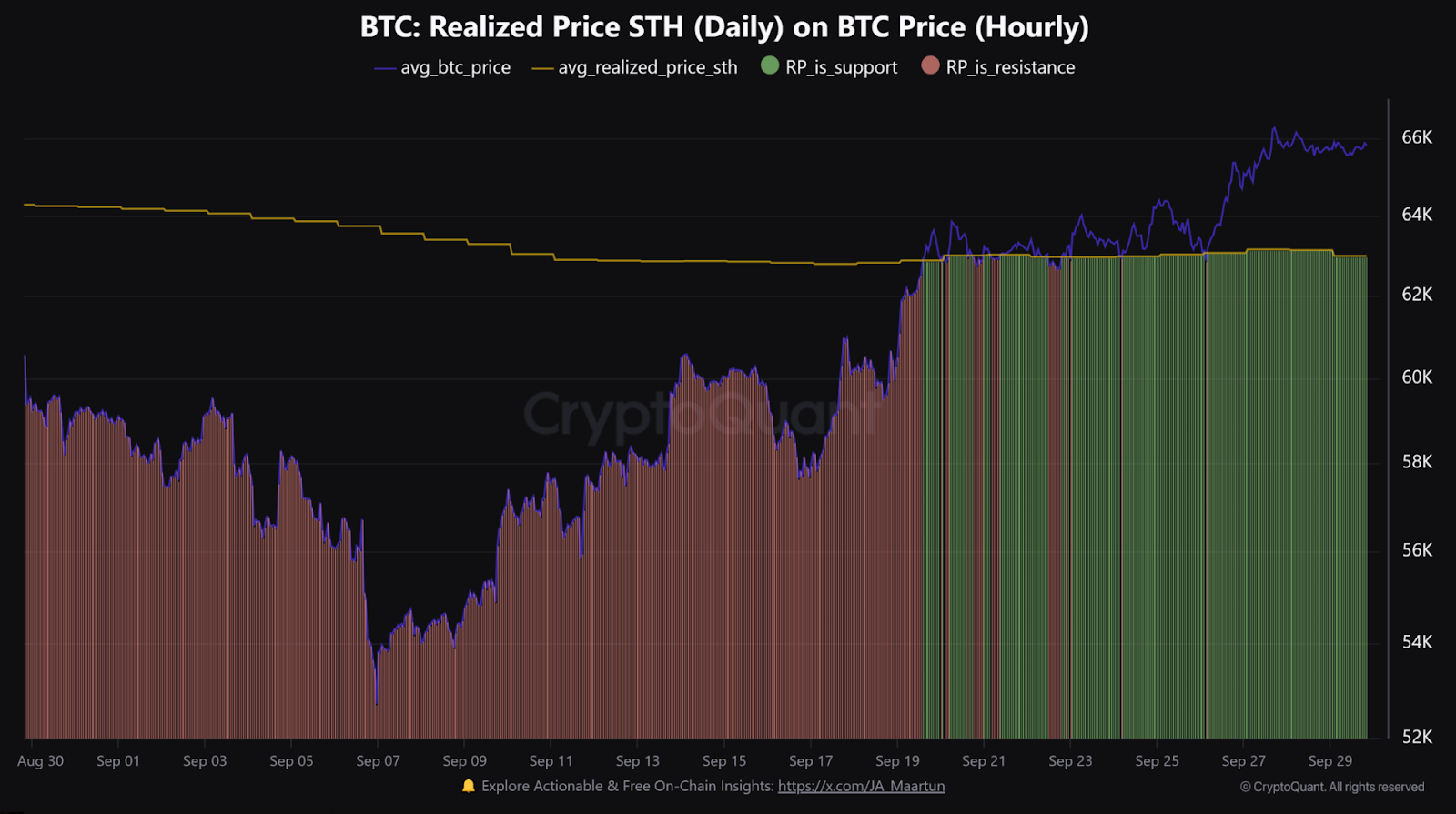

Short-Term Holders Back in Profit

The rise in market dynamics has elevated the Short-term holders into profit zone. As the BTC price soared above the crucial resistance at $62,500, the short-term holders who moved their tokens in the last 155 days with an average purchase price of nearly $63,000 are now expected to as a strong support.

The Future Market is Heating Up

The open interest refers to the amount of Bitcoin futures contracts open on all derivative exchanges in the sector. Currently, the future market is heating up, meaning, that the investors are opening up more positions. Whenever this happens, all overall leverage in the market goes up with leverage. Currently, the open interest is around $19.1 billion, the seventh occurrence above $18 billion since March 2024. Each time it resulted in a huge drop, and if the current attempts succeed, then a fine BTC rally may begin.

Spot ETH Holdings Transforming into Long-Term Holders

The growing market dynamics appear to have flipped the spot BTC ETF holders into long-term holders. The total coins held have passed 155 days, which seems to be bullish as it occurs in the past phase of a bull market.

The current market dynamics suggest September close may be choppy; meanwhile, the beginning of the fresh quarter is flashing the possibility of a fresh upswing. Therefore, despite the prevailing bearish pullback, the Bitcoin (BTC) price is primed to mark new highs, achieving a new ATH above $75,000.