Analysis company CryptoQuant, in its latest market analysis report Bitcoin $63,953He stated that (BTC) increased by over 23 percent in three weeks. As it is known, the largest cryptocurrency gained strong momentum, rising from 52 thousand 500 dollars to above 65 thousand dollars. CryptoQuant cited increased demand for spot Bitcoin ETFs as one of the biggest reasons behind this rise. The analysis company emphasized that the average purchase price of short-term Bitcoin investors is 63 thousand dollars and that this level will serve as support in current market conditions. However, there are some signs of risk in the futures market.

Critical Level for Short-Term Investors

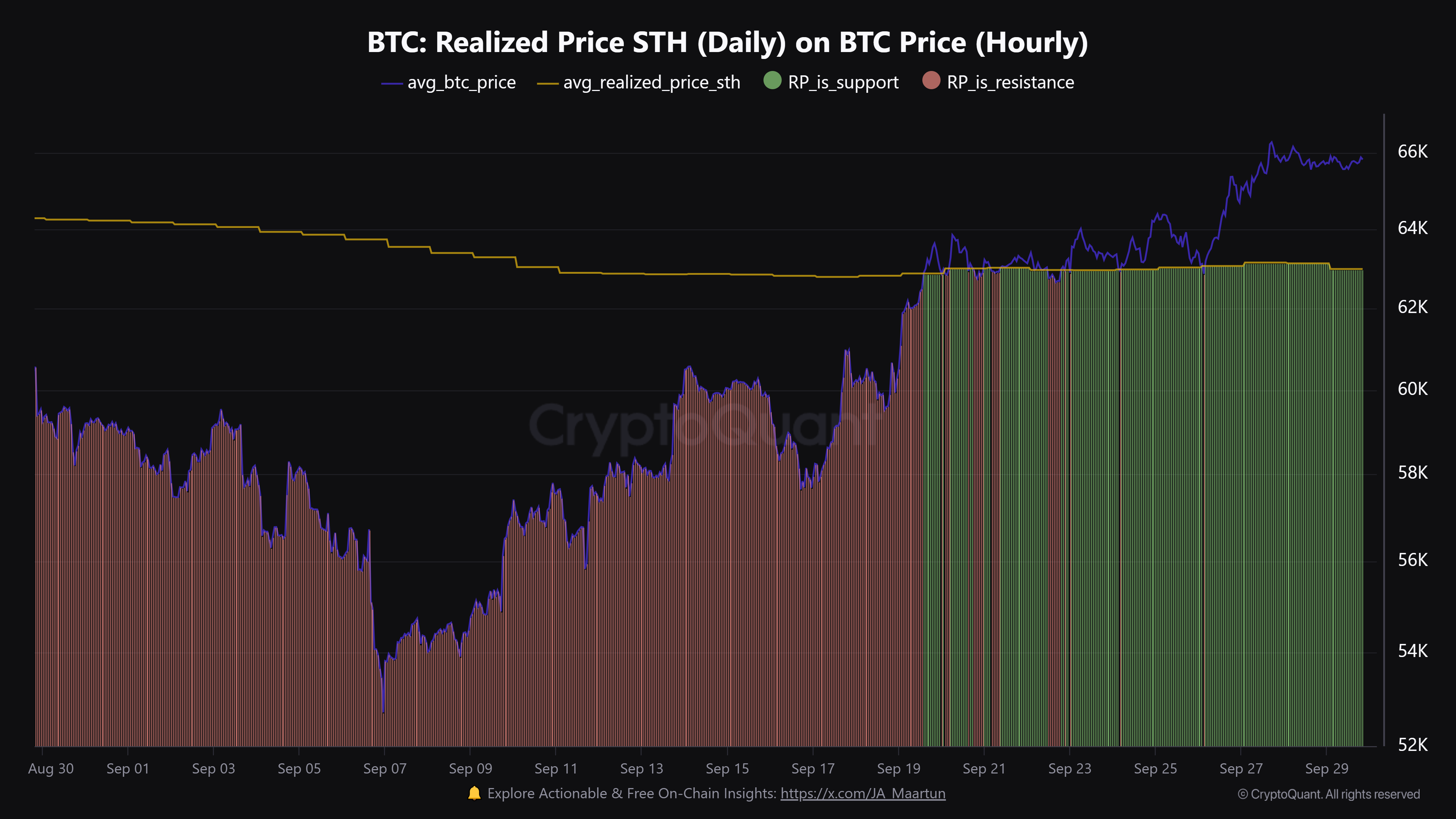

Short-term investors are investors who have bought or sold Bitcoin in the last 155 days. CryptoQuantAccording to , the average purchase price of these investors is around 63 thousand dollars.

With the recent rise of BTC, this short term investors It turned black again. This level is also expected to play an important role as a support level. So, if the price falls, it is possible to find support at the level of 63 thousand dollars.

On the other hand, there is a negative situation for the market. The futures market is showing signs of overheating. Currently, the value of open interest in futures contracts has reached the level of 19.1 billion dollars. Such highs have led to price corrections six times in the last six months. Now it is being repeated for the seventh time.

Spot ETFs and Long-Term Investors

With all this spot Bitcoin ETFThe increase in demand in ‘s affects the supply of long-term investors in the market. Although this development is interpreted as a positive sign, it is a change generally seen towards the end of the bull market. Therefore, investors need to follow the market carefully. Demand for ETFs is high among long-term investors BTCIt may increase its holdings, but it may also mean that the market cycle is nearing its peak.

Generally Bitcoin marketThere are both positive and risky indicators. While the $63,000 level is considered a critical support point for short-term investors, overheating in the futures market and intense interest in ETFs should be followed carefully.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that crypto currencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.