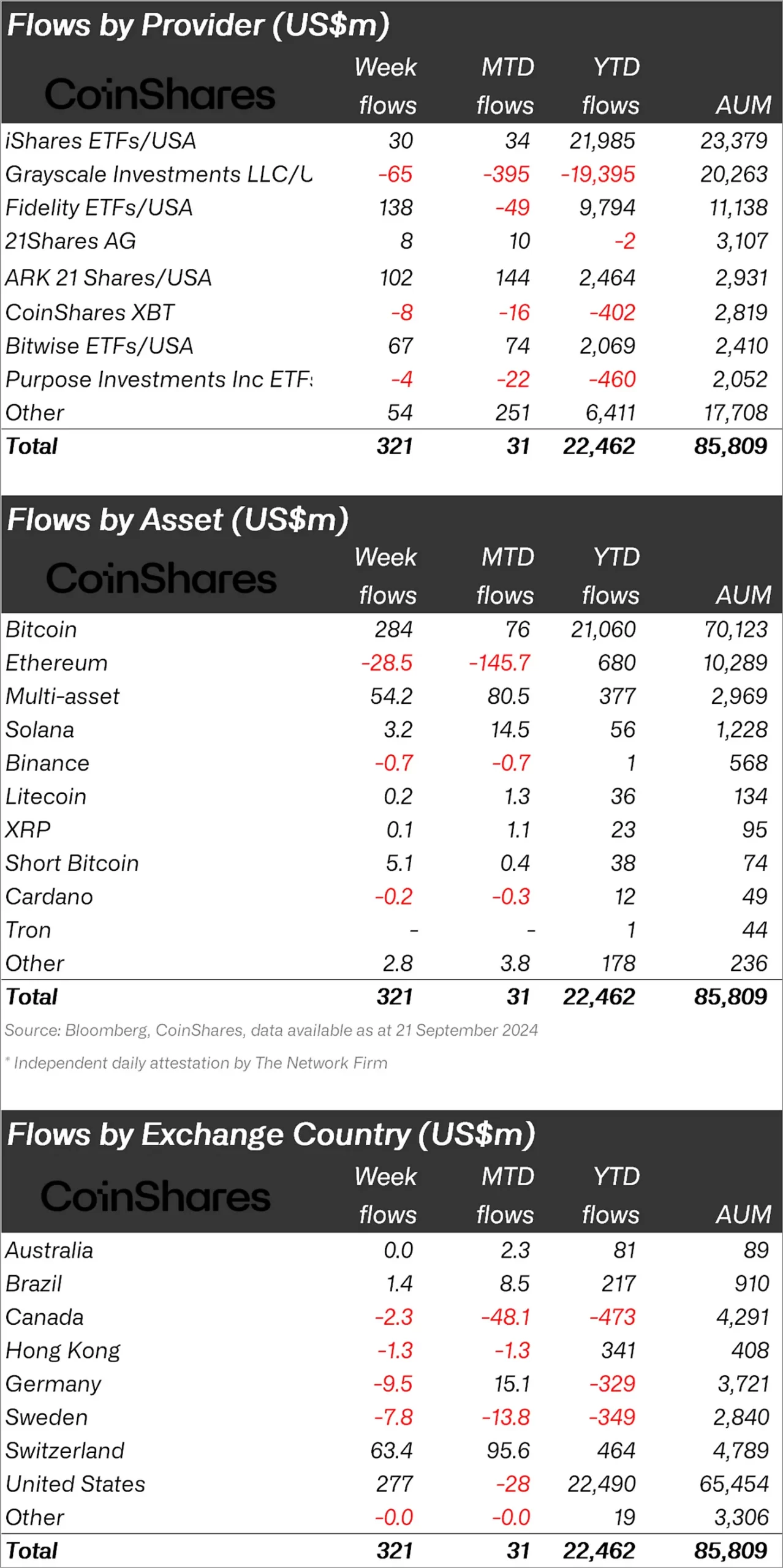

Digital asset investment products With the second consecutive week of inflows, the total inflow reached $321 million. The main reason for the increase in inflows and the continuation of inflows Federal Open Market CommitteeThe FOMC’s (FOMC) dovish stance last week was to cut interest rates by 50 basis points, exceeding expectations. After the rate cut, total assets under management (AuM) in digital asset funds increased significantly, growing by 9 percent.

Bitcoin Highlights with Entries

Bitcoin (BTC) $63,547led the way in inflows to digital asset funds, reaching $284 million in inflows. The volatility in Bitcoin’s price after the interest rate cut led to an inflow of only $5.1 million into short Bitcoin investment products. This shows that investors are focusing on the rise rather than the fall in Bitcoin.

Ethereum (ETH)  $2,653 The opposite trend was seen. Ethereum investment products faced outflows for the fifth week in a row, with a total of $29 million in outflows last week. This was due to ongoing outflows from the existing Grayscale Trust and low interest in recently launched exchange-traded funds (ETFs).

$2,653 The opposite trend was seen. Ethereum investment products faced outflows for the fifth week in a row, with a total of $29 million in outflows last week. This was due to ongoing outflows from the existing Grayscale Trust and low interest in recently launched exchange-traded funds (ETFs).

Popular altcoins To the left (SOL) continued to see small but steady weekly inflows. Solana investment products attracted a total of $3.2 million in inflows last week, indicating continued investor interest in alternative projects.

Regional Distribution of Entries: US in the Leading Seat

On a regional basis, the highest inflow was $277 million. USAComing from, Switzerland recorded its second-biggest weekly take of the year with $63 million. Germany, Swedish And Canadasaw exits of $9.5 million, $7.8 million, and $2.3 million, respectively.

Interest in digital asset investment products by Fed interest rate reduction It is seen that there is an increasing trend with the decisions of the central banks. While investors follow the policies of the central banks carefully, they continue to evaluate the opportunities in the market.

Disclaimer: The information contained in this article does not contain investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.