Despite a bearish weekend and a negative start this week, the BTC price bounces back with a surge in trading volume. Supporting the uptrend, the Bitcoin ETFs and the hype before the FOMC meeting fuel the sentiments.

With the reclamation of the $60K zone, will Bitcoin continue the bull run this week with a potential rate cut? However, will the $54K support hold if FOMC decides otherwise? Let’s find out.

Bitcoin Price Performance

With a bullish recovery this Tuesday, Bitcoin bounces 3.61% to create a bullish engulfing candle. The recovery rally undermined the 3-day crash and delayed the death cross event between the 50 and 200-day EMA.

However, the higher price rejection led to a closing at $60,316. Currently, the BTC price is struggling to sustain dominance above the $61,000 mark as it forms a minor doji candle.

However, the recent recovery run from the $54,000 mark has led to a 12.26% surge over the last 11 days within two weeks. As the recovery run surpasses the 23.60% Fibonacci level and the two dynamic moving averages, the uptrend will likely hit the $63,847 mark or the 50% Fibonacci level.

The BTC price is currently trading at $60,227.88 with an intraday gain of 2.98%. Yesterday, the BTC price reached the height of $61,331. However, with the FOMC meeting just today, the speculations in the crypto market are on the rise.

Bitcoin ETFs Support The Run

Bitcoin Spot ETFs continue the recovery and mark the fourth consecutive day of inflows. As the sentiments improve, the US spot Bitcoin ETFs recorded a $187 million net inflow, continuing a streak of four days of gains on September 17.

While Grayscale’s GBTC had no outflows, Fidelity’s FBTC experienced an inflow of $56.6 million, and Bitwise’s BITB saw an inflow of $45.4 million. Currently, the total net assets held by the ETFs are worth $54.84B

Will the BTC Price Hit $66K?

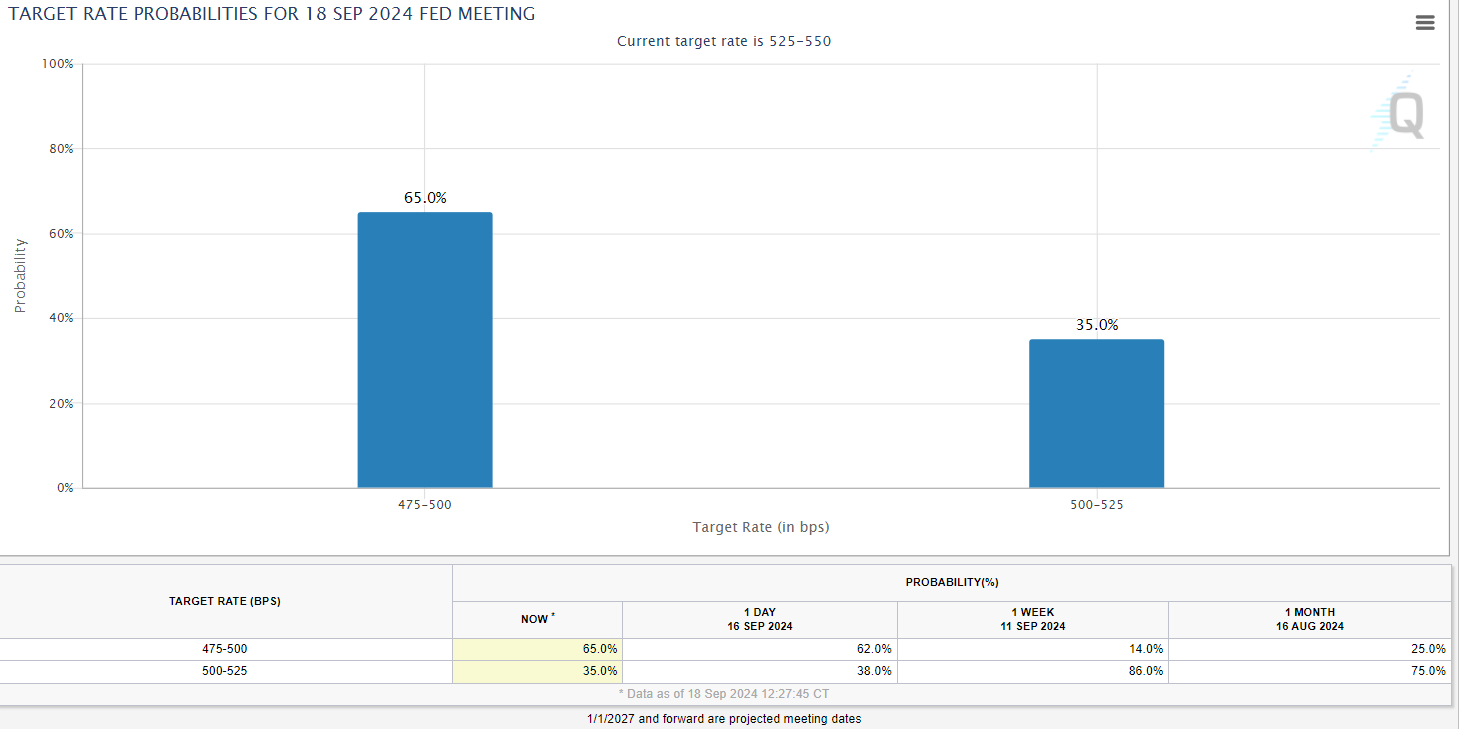

The BTC price is expected to surge with a rate cut as the speculations support the ongoing bull cycle within a long-channel pattern. Further, the bullish sentiments are rising as 65% of market participants anticipate a rate cut of 500 basis points.

The rate cut eases the lending process and brings funds into riskier assets like Bitcoin. This year, Bitcoin has recorded almost 10% jumps multiple times, fueled by global market catalysts. A similar move, a 10% surge from the current market price, with the rate cuts, will challenge the overhead trendline near the $66,000 mark.

The RSI line is above the 50% half-line, and the 14-day SMA line maintains an uptrend. Hence, the momentum indicator reflects a surge in bullish momentum and increases the upside chances.

On the flip side, if the FOMC meeting decides to maintain the current rates or, in unlikely cases, increase the rates, the BTC price could crumble back to the $54,000 support level and, in extreme cases, might break the $50,000 support level near the declining trendline.

Curious if Bitcoin will end 2024 on a bullish note to hit $100,000 after September rate cuts? Find out now in Coinpedia’s BTC price prediction for 2024 and years ahead!