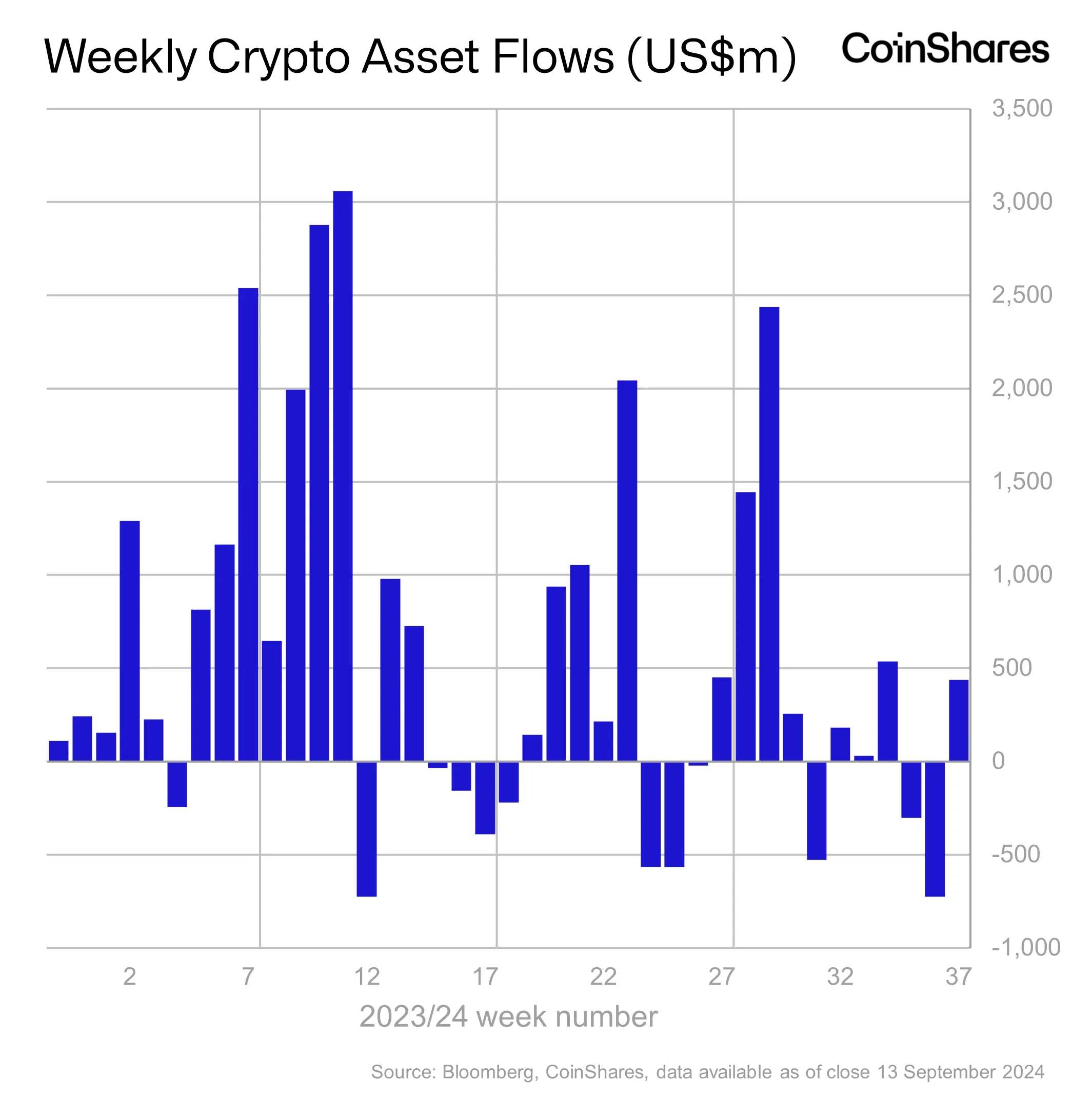

Europe’s largest digital asset management company CoinShares with a significant return crypto fundsna reported an inflow of $436 million last week. The $436 million inflow shows a reversal of the $1.2 billion outflow trend recorded in the previous week. It is stated that the change in market expectations regarding a possible 25 basis point interest rate cut planned for September 18 and the shift of expectations to a 50 basis point cut were effective in this recovery. Especially the former New York Fed President Bill Dudley‘s comments seem to have played an important role in influencing this positive atmosphere.

Last Week’s Figures for Crypto Funds

Bitcoin (BTC) $59,001was the biggest beneficiary of the inflows, attracting $436 million after a total outflow of $1.18 billion over 10 days. The inflow of funds marked a significant recovery for the largest cryptocurrency, with $8.5 million in outflows from short Bitcoin funds following three weeks of consecutive inflows.

Against this Ethereum (ETH)  $2,318 There was an outflow of $19 million from the funds offered for , indicating that the negative picture continues for the altcoin king. Analysts attribute Ethereum’s struggle to the ongoing problems with profitability of Layer 1 solutions following the recent developments regarding the Decun update. The $19 million outflow has brought Ethereum into the hands of short Bitcoin funds, as well as several other cryptocurrencies that have recorded negative fund flows this week. crypto fundmakes it one of the.

$2,318 There was an outflow of $19 million from the funds offered for , indicating that the negative picture continues for the altcoin king. Analysts attribute Ethereum’s struggle to the ongoing problems with profitability of Layer 1 solutions following the recent developments regarding the Decun update. The $19 million outflow has brought Ethereum into the hands of short Bitcoin funds, as well as several other cryptocurrencies that have recorded negative fund flows this week. crypto fundmakes it one of the.

On the other hand To the left (SOL) funds showed significant strength by attracting inflows for the fourth week in a row, with $3.8 million in inflows.

USA Number One Again

Regionally USA once again stood out with a total inflow of $416 million, significantly more than the inflows from other regions. Switzerland And GermanyThere were also notable flows from , with inflows of $27 million and $10.6 million respectively. CanadaReflecting a more cautious approach in the North American market outside the US, there was an exit of $18 million.

Despite the overall positive inflow trend, trading volumes in Exchange Traded Funds (ETFs) remained low throughout the week, averaging $8 billion, well below the $14.2 billion average trading volume since the first of the year. The decline in ETF activity suggests that despite the strong recovery in inflows into crypto funds, trading enthusiasm is still being dampened by broader market uncertainties.

With all this Blockchain companiess shares rose, benefiting from a $105 million inflow spurred by the launch of several new ETFs in the United States.

Disclaimer: The information contained in this article does not contain investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.