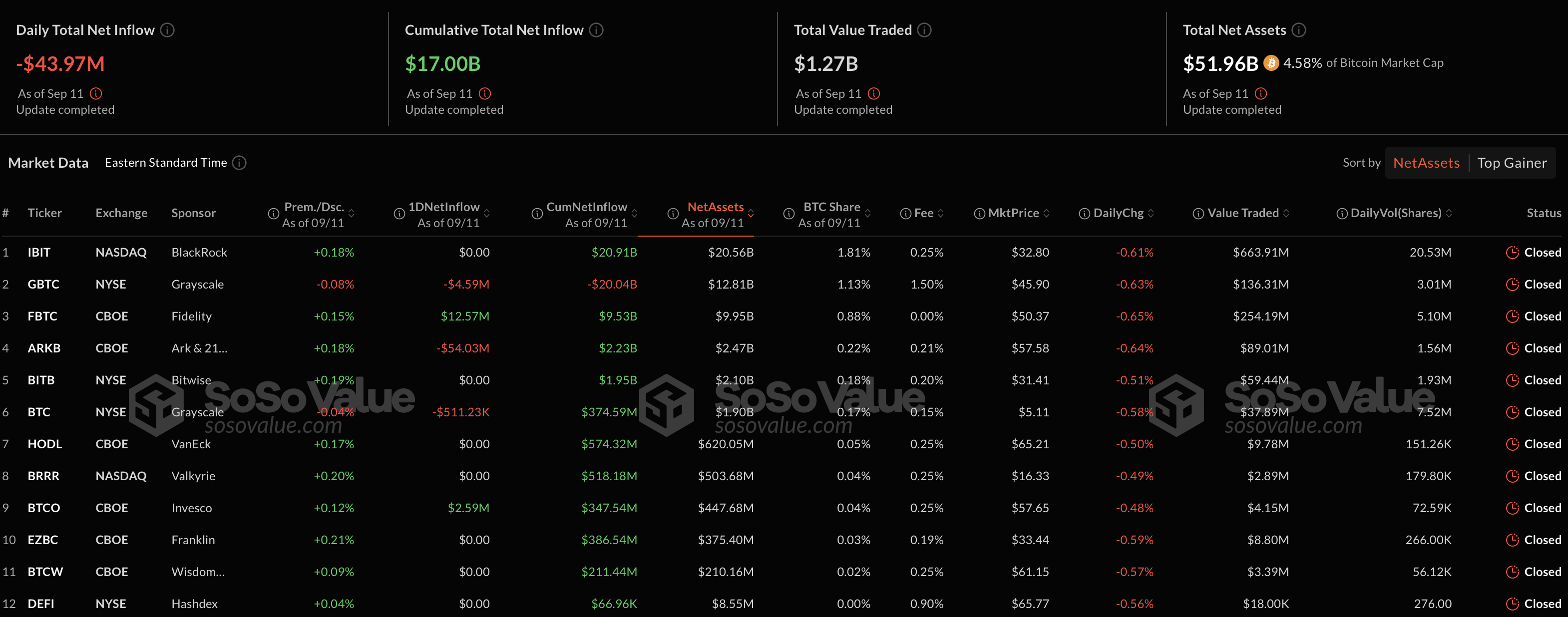

Spot in the USA Bitcoin $56,474.79 exchange-traded funds (ETFs) saw net outflows totaling $43.97 million on Wednesday, marking the end of a two-day streak of positive inflows. Net outflows cryptocurrency ETF marketThis is attributed to investor reaction to recent US economic data, which reflects the ongoing volatility in the

Spot Bitcoin ETFs Break Two-Day Entry Streak

Among the ETFs, Ark Invest and 21Shares are among the top holdings, according to data from SoSoValue ARKBwas the fund with the largest outflow, with a net outflow of $54.03 million. Grayscale’s GBTCalso saw a significant rise with investors withdrawing a net $4.59 million, while Grayscale Bitcoin Mini Trustsaw a net outflow of approximately $511,230.

In contrast, Fidelity FBTCled the inflows for the day, reporting net inflows of $12.57 million, followed by Invesco, which saw inflows of $2.59 million BTCO‘ followed. On the other hand, BlackRock’s IBITThe remaining seven funds, including IBIT, reported no daily inflows or outflows. IBIT, in particular, has seen no net inflows since August 26, signaling a broader trend of cautious investor sentiment.

12 Spot Bitcoin ETFrecorded a total trading volume of $1.27 billion on Tuesday, a significant increase from $712.25 million the previous day. Despite these outflows, bitcoin funds have accumulated a total net inflow of $17 billion since their launch in January, underscoring the enduring interest in digital assets despite short-term fluctuations.

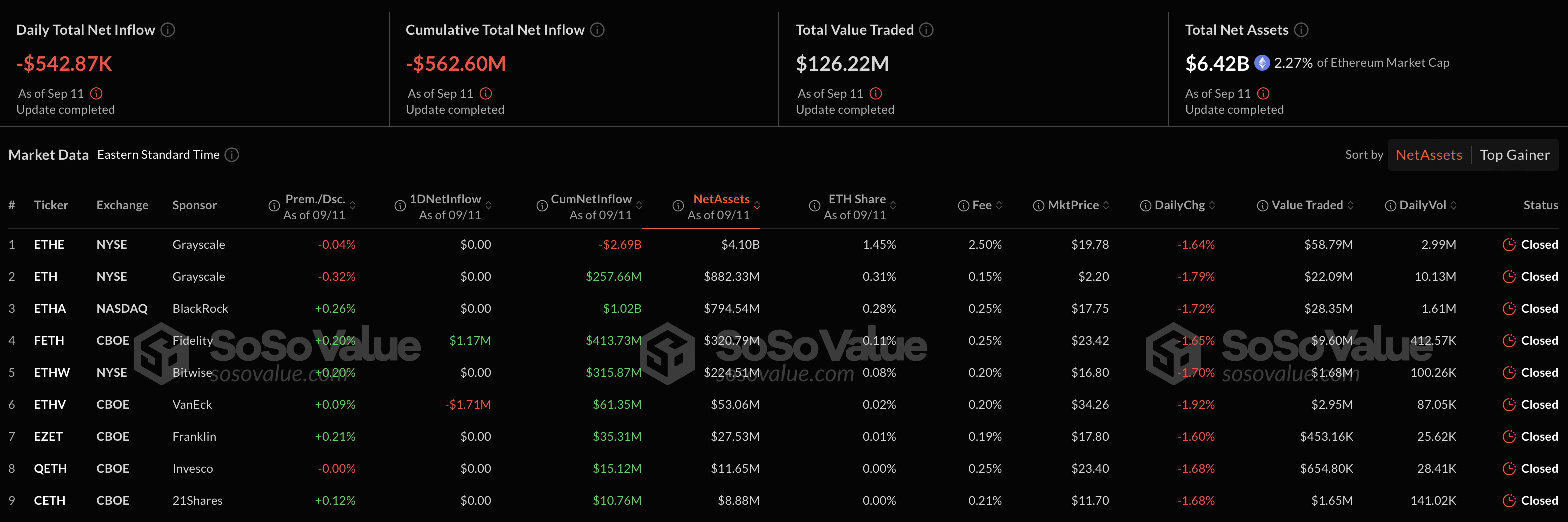

Spot Ethereum ETFs Also Dominated by Outflows

Spot Ethereum  $2,324.80 There were also outflows from ETFs. Accordingly, spot Ethereum ETFs in the US recorded a net outflow of approximately $542,870. Seven of the nine funds did not report daily inflows or outflows. VanEck ETHVrecorded a net outflow of $171 million, while Fidelity CONQUESTwas the only fund in the category to see positive activity, with net inflows of $1.17 million.

$2,324.80 There were also outflows from ETFs. Accordingly, spot Ethereum ETFs in the US recorded a net outflow of approximately $542,870. Seven of the nine funds did not report daily inflows or outflows. VanEck ETHVrecorded a net outflow of $171 million, while Fidelity CONQUESTwas the only fund in the category to see positive activity, with net inflows of $1.17 million.

Spot Ethereum ETFTotal trading volume for ETFs rose to $126.22 million on Wednesday from $102.87 million on Tuesday. However, reflecting a challenging environment for Ethereum-based ETFs, cumulative net outflows stood at $562.06 million.

Disclaimer: The information contained in this article does not contain investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.