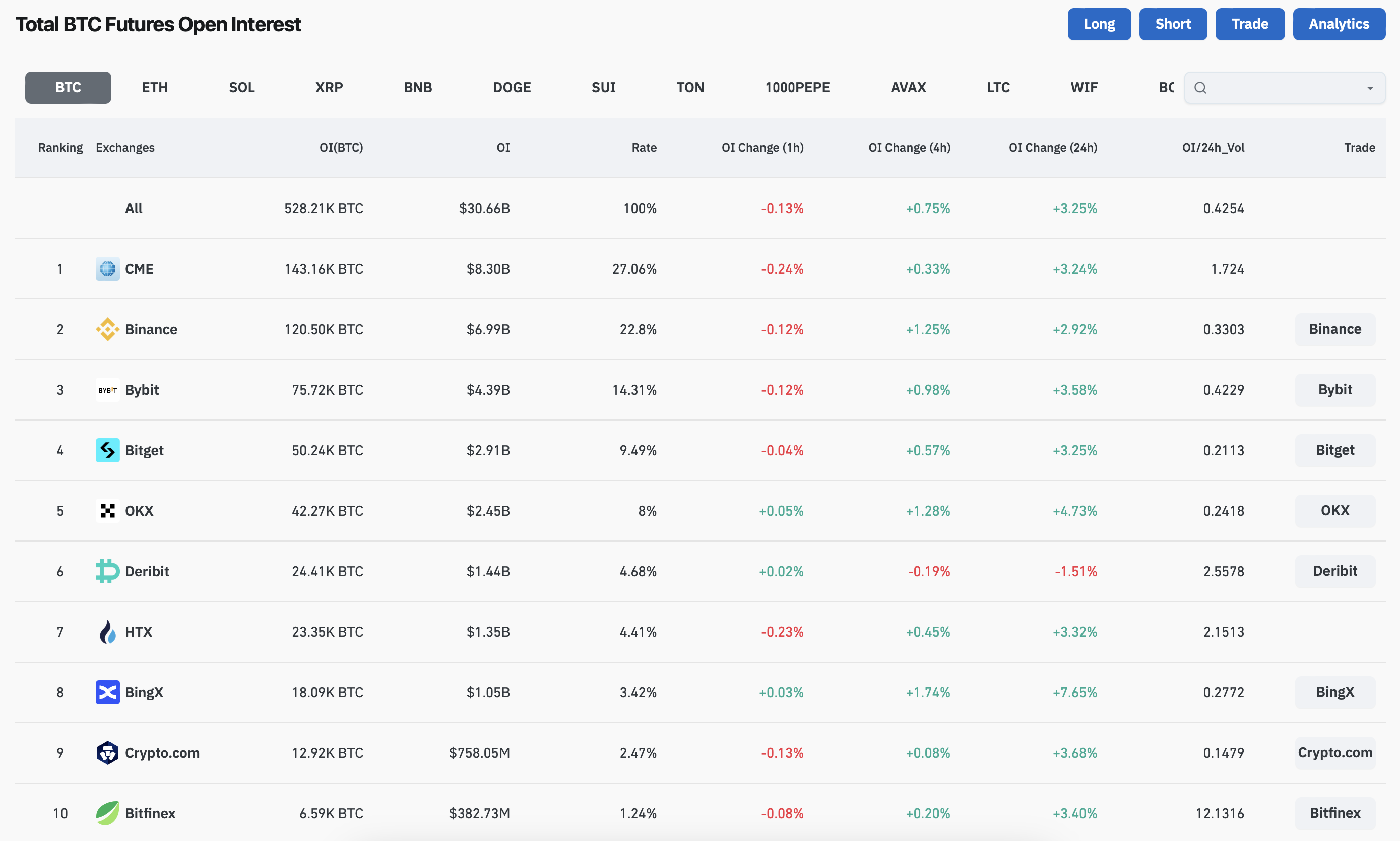

According to the latest data from Coinglass, the market as a whole Bitcoin $58,156 The total amount of open interest in futures contracts has increased to 528,220 BTC worth approximately $30.71 billion. This significant increase in open interest reflects a strong sentiment among traders and investors, signaling that market activity will increase in the coming days.

CME Ranks First with $8.31 Billion Open Interest Support

Chicago Mercantile Exchange (CME) is the market leader with the largest share of Bitcoin futures open interest, holding 143,160 BTC worth approximately $8.32 billion. This CMEBy placing at the forefront of Bitcoin futures trading, it highlights its importance among institutional investors and large-scale traders who are increasingly participating in the Bitcoin futures markets. CME’s dominance reflects the ongoing institutional interest and confidence in BTC as a suitable asset class for portfolio diversification and hedging strategies.

Following CME closely Binancehas the second largest Bitcoin futures open interest with 120,550 BTC and approximately $7.01 billion. Binance’s significant market share serves a wide range of traders from retail investors to professional market participants. cryptocurrency futures marketreflects its status as a major player in the market. The exchange’s ample liquidity and diverse offerings make it a preferred choice for futures trading, contributing to its significant open interest figures.

What Does the Increase in Open Interest Mean?

Open interestAn increase in the price generally indicates that market participants are expecting increased volatility or a potential breakout in Bitcoin’s price. High open interest generally means that more money is flowing into the market. This tells us that the price is likely to make sharp moves in either direction, depending on market conditions and investor sentiment.

Market analysts closely monitor key derivatives data such as open interest because high open interest, combined with an increase in trading volume, is a signal of significant price changes. Bitcoin price It is currently near critical levels, and traders are speculating on future movements, which could lead to increased market volatility in the short term.

As open interest continues to rise, market participants are alert for potential catalysts that could push Bitcoin’s price higher in the short to medium term. Whether the recent increase in open interest will lead to an uptrend or a downtrend remains to be seen, but current levels are likely to be bullish on major exchanges. Bitcoin futuresreveals how interest is increasing.

Disclaimer: The information contained in this article does not contain investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.