After a brief recovery on September 10, 2024, the overall crypto market once again appears for a massive decline. Following the release of the United States Consumer Price Index (CPI) and the opening bell of the US market, major cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and others, have fallen significantly.

Crypto Market Massive Recent Decline

According to the coinmarketcap, in the past hours BTC, ETH, SOL, and DOGE have experienced price declines of 1.95%, 1.85%, 2.10%, and 2.35%, respectively.

This price decline suggests that investors and crypto enthusiasts aren’t happy with the latest CPI report. Although CPI has dropped to 2.5%, significantly lower than the previous month’s 3.0%, it indicates that inflation is cooling down.

The Potential Reason for Bitcoin Price Decline

However, the potential reason behind the market sell-off is the notable Bitcoin dump by short-term holders and miners.

A prominent crypto analyst made a post on X (previously Twitter) stating that Bitcoin short-term holders seized the recent price jump on September 10, and offloaded nearly 14,816 BTC worth $850 million. In another post, the analyst noted that Bitcoin miners have also sold off a significant 30,000 BTC worth $1.71 billion in the past 72 hours.

Bitcoin Technical Analysis and Upcoming Levels

According to the expert technical analysis, BTC appears bearish as it recently broke the previous day’s low and fell below the $56,000 level. Additionally, the 200 Exponential Moving Average (EMA), a technical indicator often used by traders to spot long-term trends, shows Bitcoin is in a downward trend.

Based on the historical price momentum, if BTC closes a daily candle below the $56,000 level, there is a high possibility that it could drop to $54,000 or lower if the bearish trend continues.

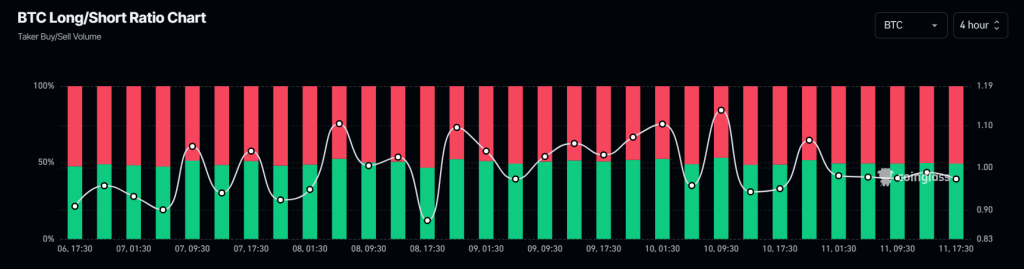

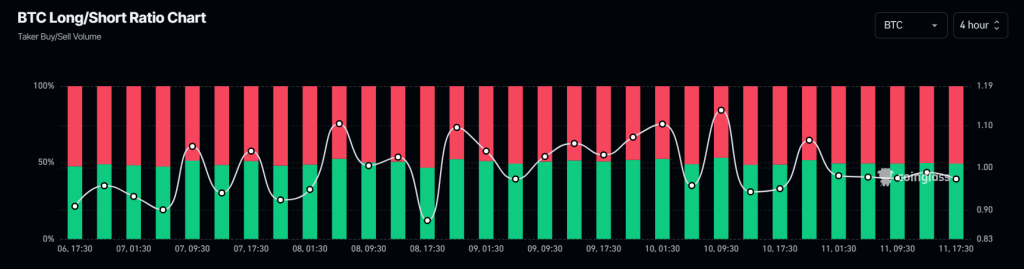

Bearish On-chain Metrics

However, this bearish outlook is further supported by on-chain metrics. Coinglass’s BTC Long/Short ratio currently stands at 0.881 (the value below 1 indicates bearish market sentiment). Additionally, BTC’s future open interest has also dropped by 1.5% and continues to decline.

Meanwhile, 53.14% of top Bitcoin traders hold short positions, while 46.86% hold long positions, highlighting that bears are currently dominating the asset and have the potential to create additional selling pressure.