With Kamala’s strong stance in the US presidential debate putting a dent in the Bitcoin price trend, the recent Bernstein report stands true. As reported, the crypto favors Trump’s side, because the minor increase in Kamala’s chances led to a price drop.

The broader market remains unfaced, but the BTC price takes a quick test at $56,500. Will Bitcoin bounce back for a bull run above $60K this week?

Bitcoin Price Performance

Following the bull cycle of four consecutive bullish candles, accounting for a price jump of 6.85%, the Bitcoin price takes a quick reversal from the $57,500 mark. With a price fall of 1.98%, the Bitcoin price is currently trading at $56,505 and makes a bearish engulfing candle.

In the four-hour chart, the bull cycle was successful in surpassing a local resistance trendline and reached a 38.20% Fibonacci level at $58,300. However, the recent turnaround puts Bitcoin back to 50 EMA support.

The pullback phase is seen as a potential retest of the 23.60% Fibonacci level breakout at $55,646 or of the broken resistance trendline. However, the critical reason fueling the recent drop in Bitcoin is the presidential debate.

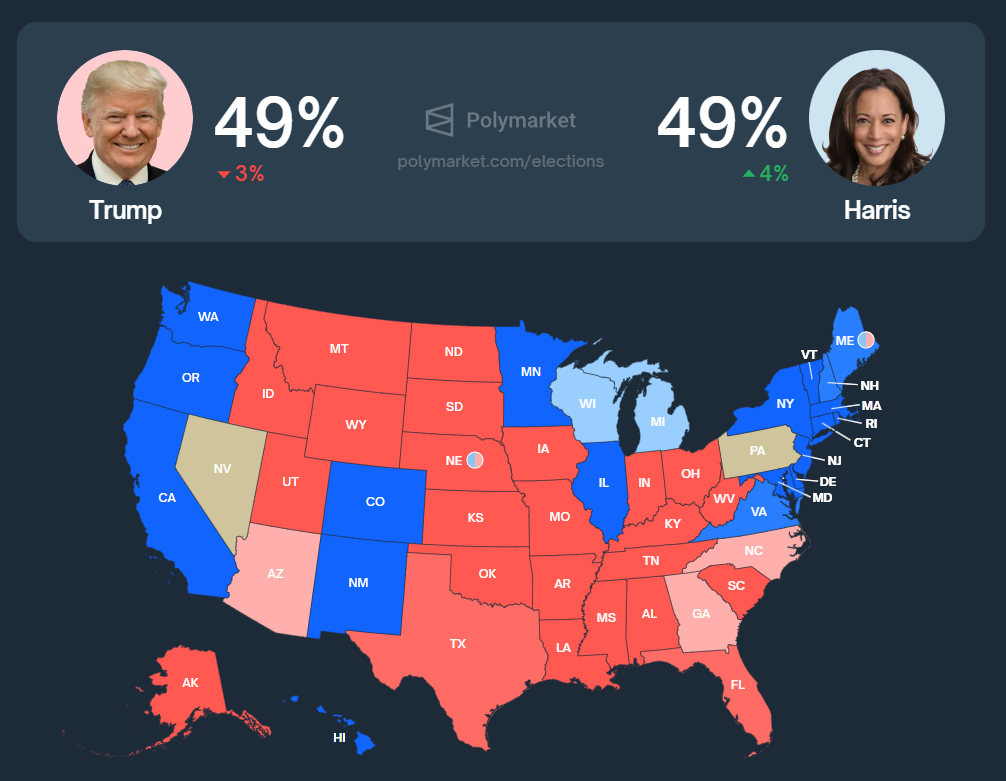

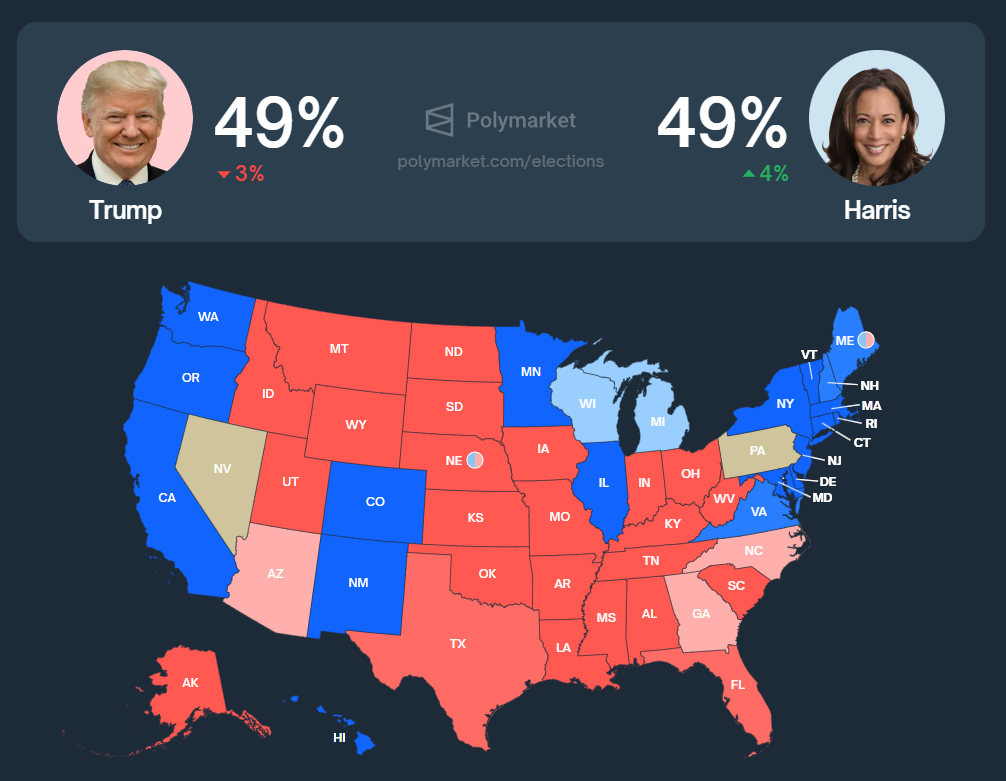

With Kamala Harris going against Donald Trump over the presidential debate, the Bitcoin price quickly plunged as Polymarket revealed a turn in sentiments. Based on the polymarket’s betting platform, the chances of becoming the next president are equal for Trump and Harris at 49%. The crypto market is likely to turn more volatile amid such increasing uncertainty and the voting days coming closer.

Bitcoin Market Data

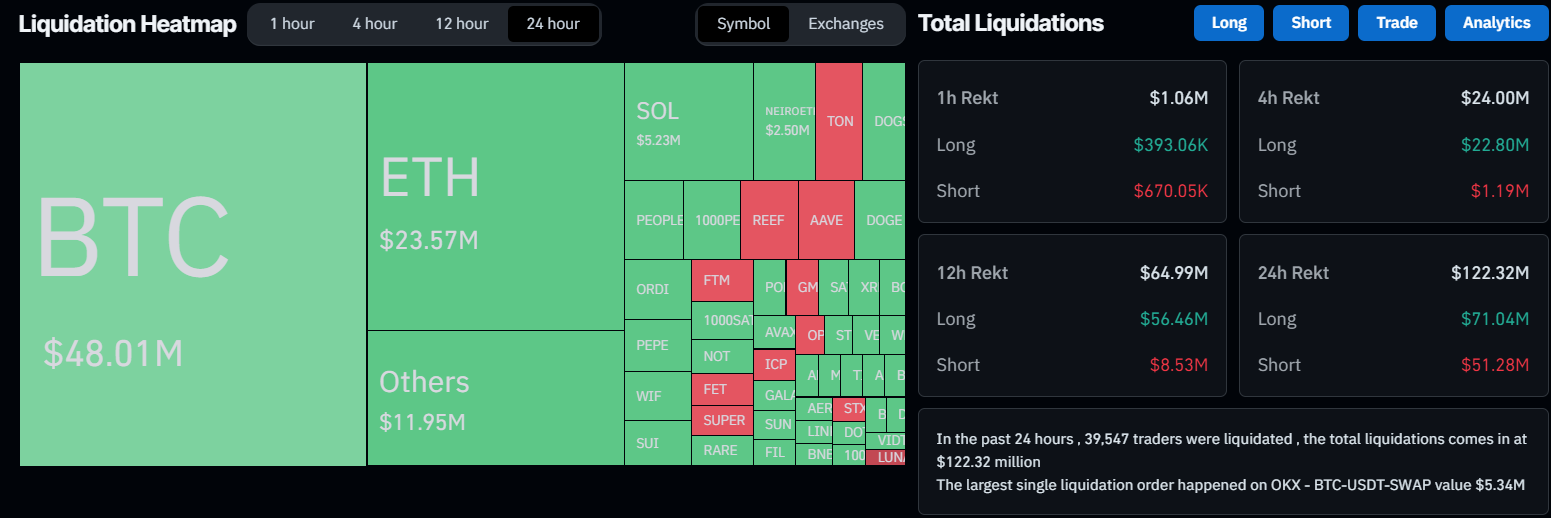

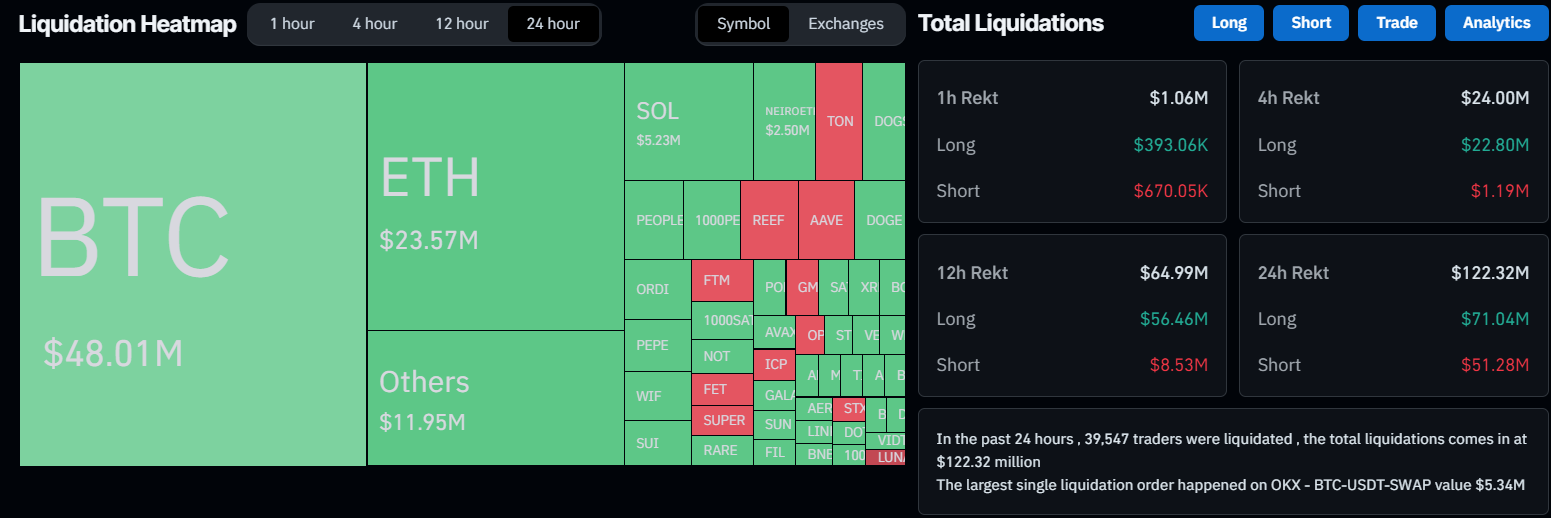

Amid the minor pullback, the liquidations data reveal a massive hit in the long-side positions. In the last 24 hours, the crypto market has witnessed a $122 million wipeout, of which $71 million comes from the long-side positions.

With $50 million short-sided positions liquidated, the increased volatility in the market is clearly visible.

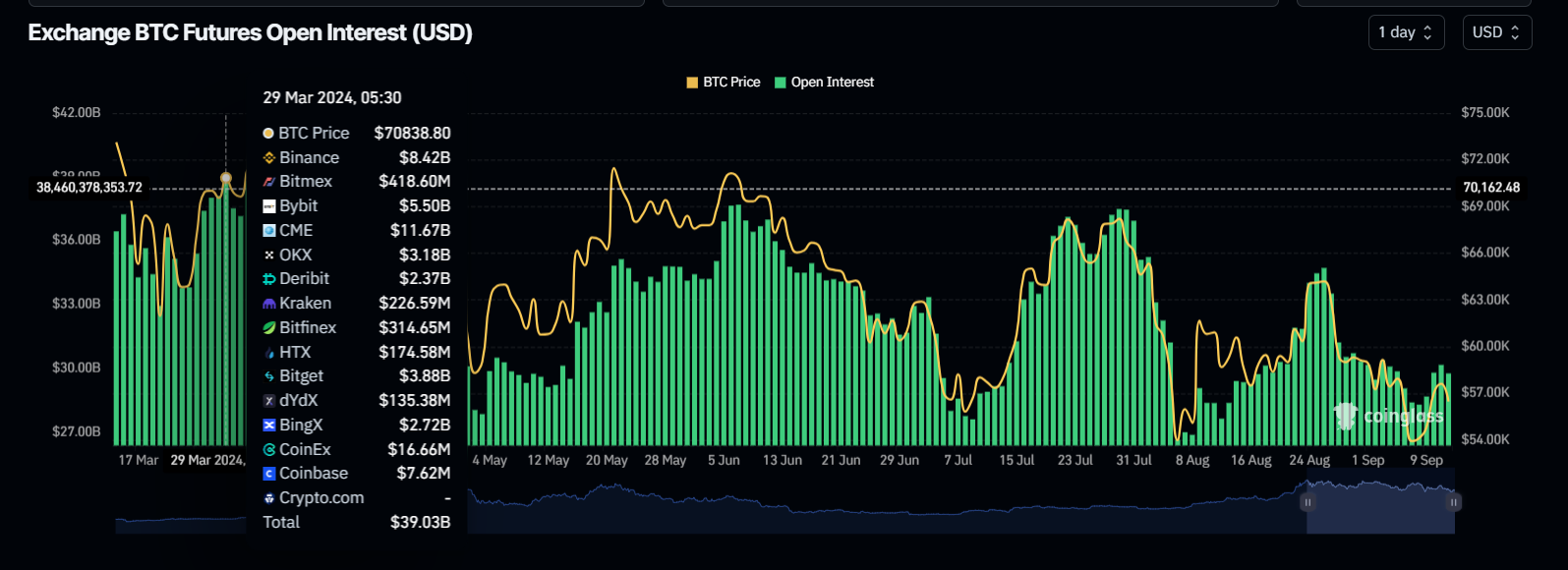

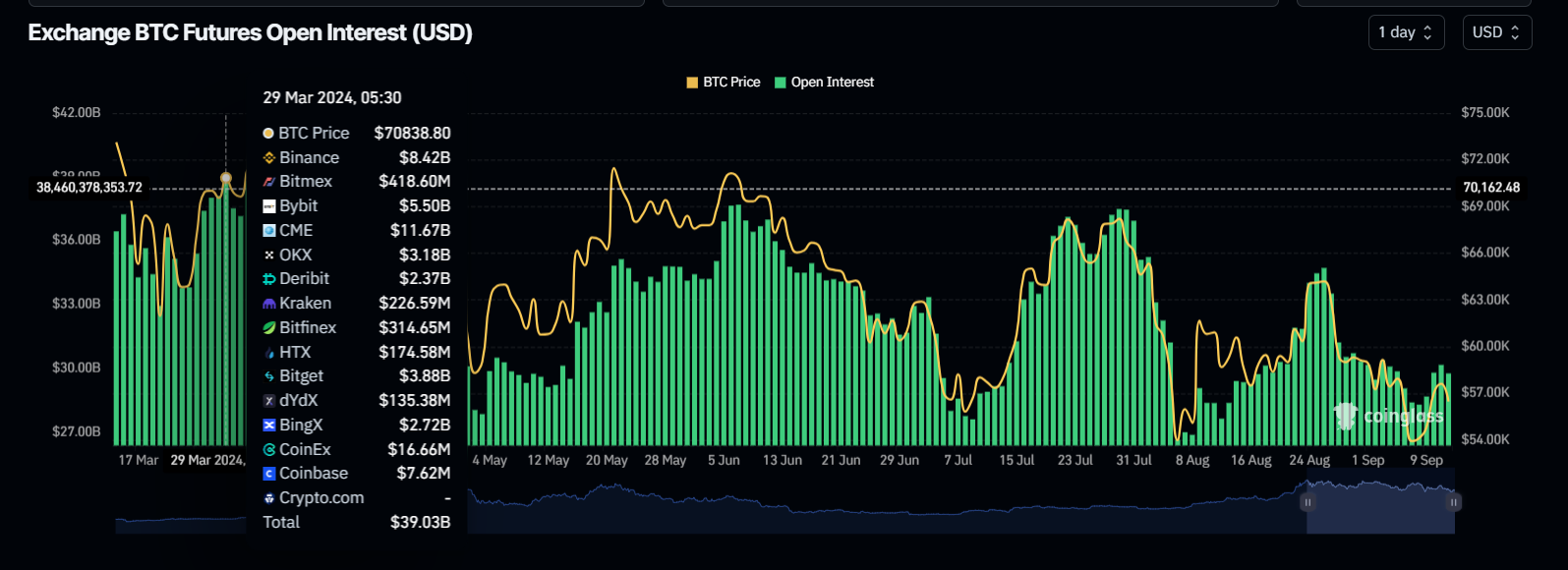

Regarding derivatives, Bitcoin’s open interest is currently at $29.76 billion. Compared to the peak of $34.72 billion on 26th August and $37.49 billion on 29th July, the declining trend of lower-high formations in the open interest continues.

As the open interest declines, the interest of buyers is in a declining phase. However, with the upcoming elections, the institutional demand is likely to increase. In 2024, the bitcoin open interest marked a high of $39.03 billion on 29th March 2024.

Factors Deciding Bitcoin’s Fate Above $60K

Based on the technical analysis, the Bitcoin price takes support over the 50 EMA in the 4-hour chart. If the uptrend continues to exceed the 38.20% level, Bitcoin is likely to reclaim the $60,000 mark.

Based on the Fibonacci level, the next target for the Bitcoin breakout rally stands at $60,500 and $62,600 at the 50% and 61.80% Fibonacci levels, respectively.

Further, the upcoming CPI data release and the FOMC meeting next week will play a crucial role in deciding the crypto market’s fate.

If you are looking for a detailed analysis of the road ahead for Bitcoin, check out Coinpedia’s Bitcoin price prediction for 2024 and the years ahead.