With the US CPI data coming on September 11th, the crypto market heats up for a bullish recovery. As the crypto market stands on the verge of recovering the $2T mark, Bitcoin aims for a price jump to $60K.So, let’s have a closer look at the price chart and the potential impact of US CPI data on Bitcoin.

Bitcoin Price Performance

Starting with the 0.36% recovery on Saturday, the bull run in the BTC price is picking up. Followed by the 1.33% jump on Sunday, the Bitcoin price exploded with a 4% massive bullish engulfing candle.

Currently, the Bitcoin price is trading on the verge of $57,000 at $57,030. Making a doji candle with a low price rejection, the BTC price is likely to reach 23.60% Fibonacci level at $58,655.

As the bullish recovery gains momentum, the technical indicators are turning positive. The MACD indicator is on the verge of a bullish crossover between the MACD and signal lines. Further, the recent double-bottom formation at the $54,000 support level marks a positive divergence in the daily RSI line. Hence, the momentum indicators are projecting a higher possibility of a bullish trend continuing above the 23.60% Fibonacci level at $59,655.

Bulls On The US CPI Data Lookout

With the US CPI data ready to be released for August on September 11th, broader market anticipation is on the rise. The new inflation data will reflect August on Wednesday.

The general consensus expects the year-on-year data to ease to 2.6% compared to July’s 2.9%. Lower inflation data could increase the chances of a rate cut. However, if the core inflation remains at 3.2%, the FED might be cautious, reducing the rate cut chances.

Based on the month-on-month figures, both the headline and the core CPI prediction are expected to increase by 0.2%. Meanwhile, August’s US producer price index will be released on Thursday, September 12th. The markets are expecting a year-on-year increase of around 1.8% to 2.0%.

As the CPI data is expected to come in favor of increasing the chances of potential rate cuts, the Fed, the next FOMC meeting in the next eight days, will be highly scrutinized by the crypto market and the global market.

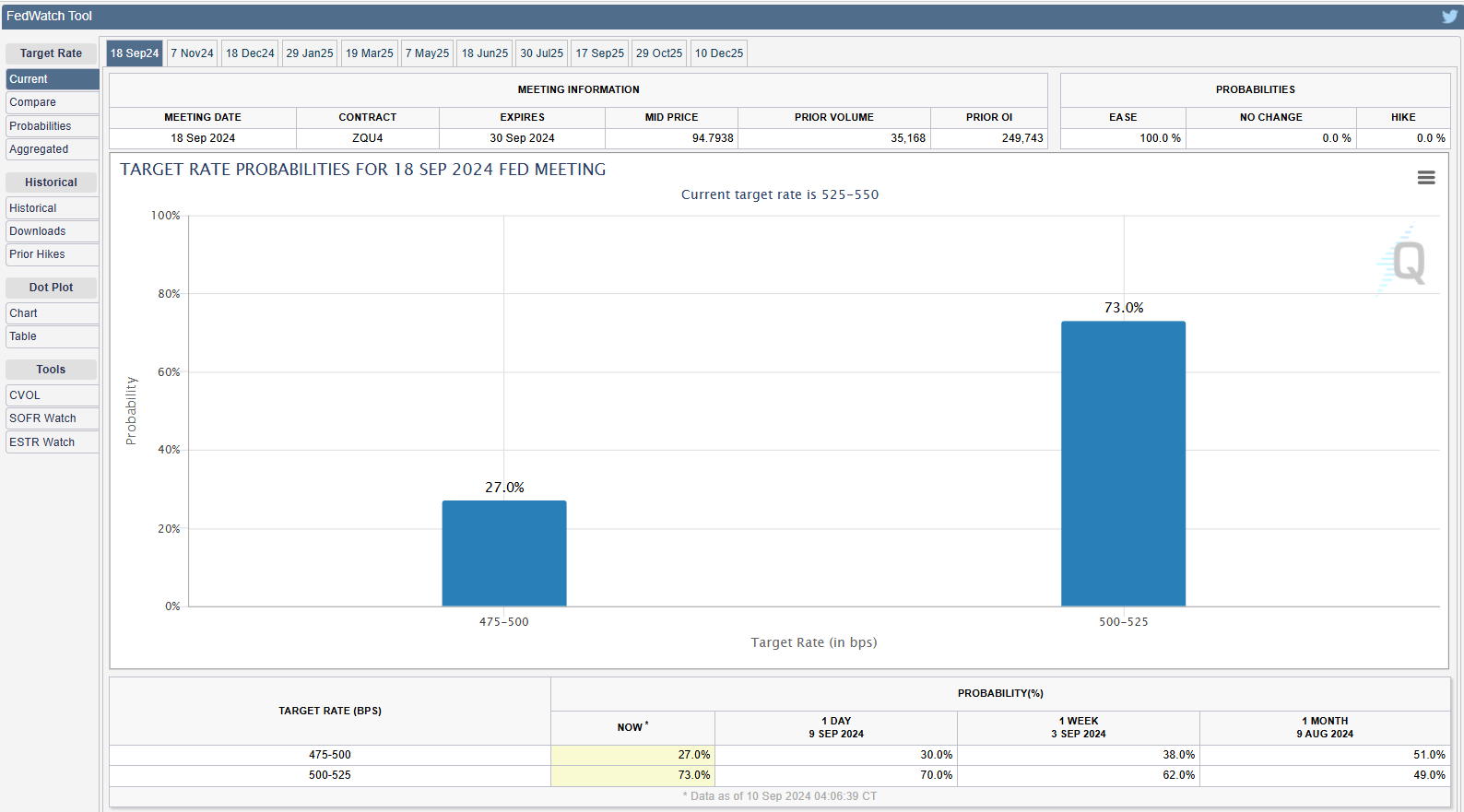

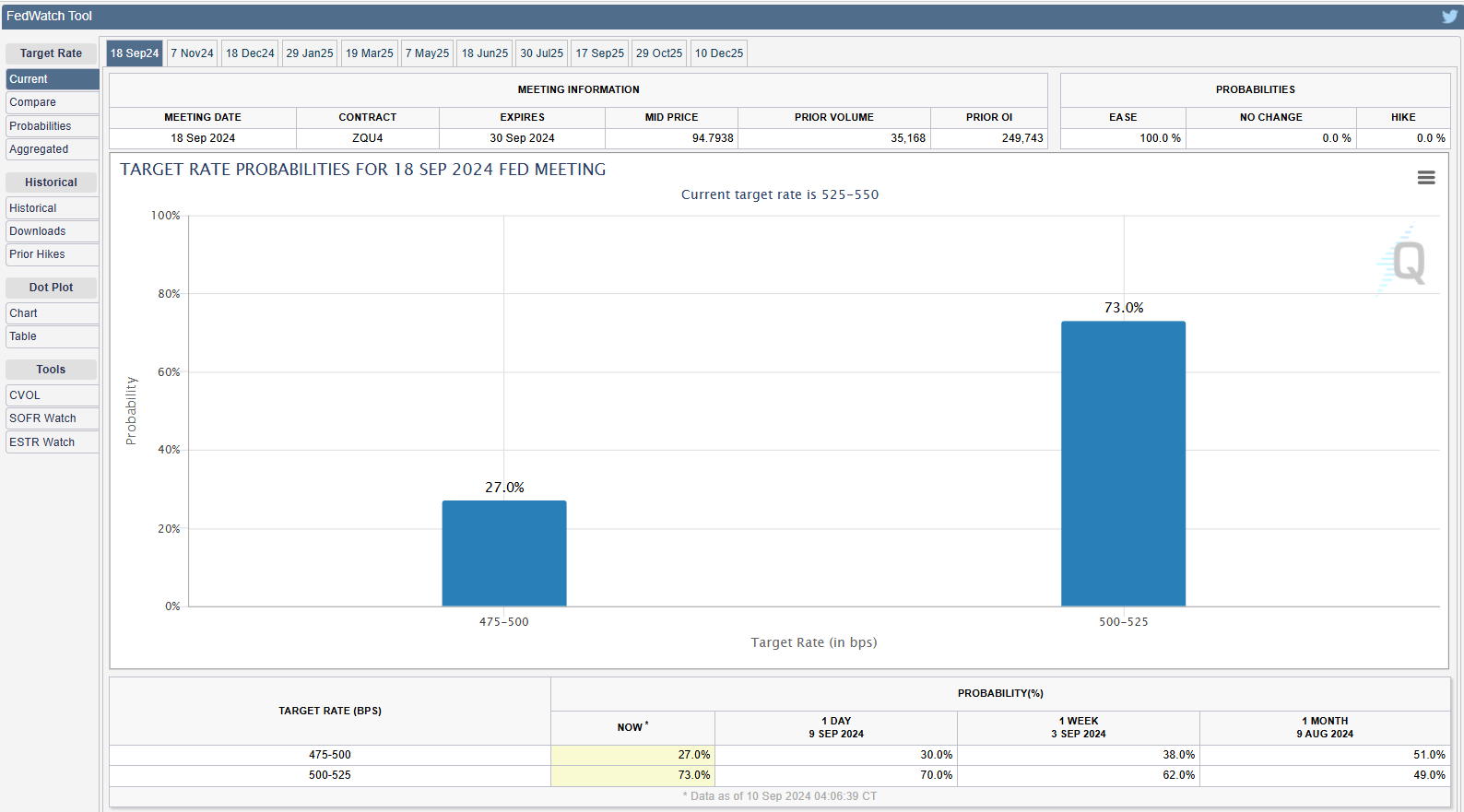

Based on the CME Group’s FedWatch tool, the chances of a 500-525 basis point rate cut have increased to 73%. This fuels the broader market momentum and will likely propel Bitcoin above $60,000 if the rate cut occurs or even before as the hype increases.

Will BTC Price Resurface Above $57K?

As the broader market anticipation for a rate cut increases, the CPI data will be a critical catalyst in the bullish road ahead. With the uptrend likely to sustain momentum, the BTC price is likely to surpass $58,655 before the release as the hype increases.

Based on the Fibonacci levels, the uptrend in Bitcoin with positive CPI numbers can reach the $60,000 mark. On the flip side, the support levels are at $55K and $52500 mark.

If you are looking for a detailed analysis of the road ahead for Bitcoin, then check out Coinpedia’s Bitcoin price prediction for 2024 and the years ahead.