The crypto market is down 4.82% in 24 hours and drops below the $2 trillion market cap, with the BTC price below $57,000. A significant loss leads to a death cross event in the crypto total market cap chart between the 50 and 200-day EMA.

With the next support at the $1.87 trillion mark, the daily RSI reveals a minor bullish divergence, projecting a potential bounce back. Fueling the market crash, the BTC price dropped by 2.77% last night and is currently down 1.73% from its opening price of $57,506.

BTC Price Performance

Over the last week, the BTC price dropped by 10.82%, undermining the 10% recovery in the prior week. With the bearish engulfing candle, the downtrend is expected to continue this week as it has dropped by 1.42%.

In the 4-hour chart, the BTC price action reveals a declining support trendline action and a lower price rejection in the recent 4-hour candle. Furthermore, it takes support from the 23.60% Fibonacci level at $55,650.

Currently, the BTC price is at $56,503, and the support level of $55,852 is tested at a lower price rejection. However, the bearish breakdown of $57,000 undermines the crucial demand zone. Further, a falling channel pattern is visible with the 50-EMA in the 4-hour chart acting as a dynamic resistance.

The daily 4-hour RSI line reveals a minor bullish divergence as the RSI line hovers over the oversold boundary.

The Bitcoin ETFs Crash

On September 3rd, the Bitcoin ETF flows faced a massive surge in the outflows, resulting in a BTC price crash.

In the $287.8 million of total outflows, Fidelity contributed $162.3 million, GBTC $50.4 million, Ark $33.6 million, and Bitwise $25 million. Blackrock’s IBIT and Wtree’s BTCW had a net zero flow amid the bear market.

Bitcoin Derivatives and Sentiments

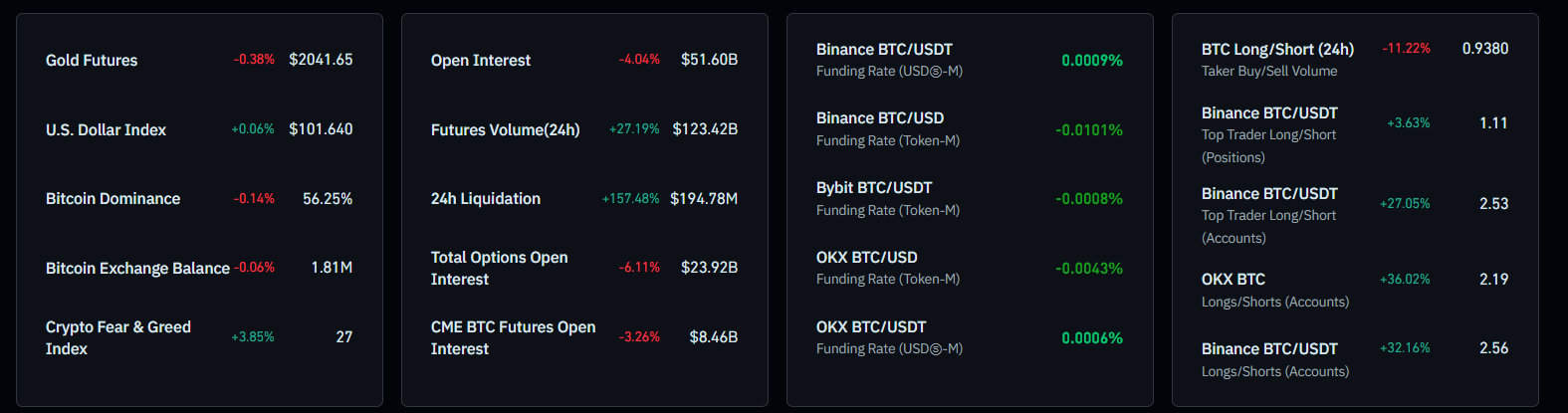

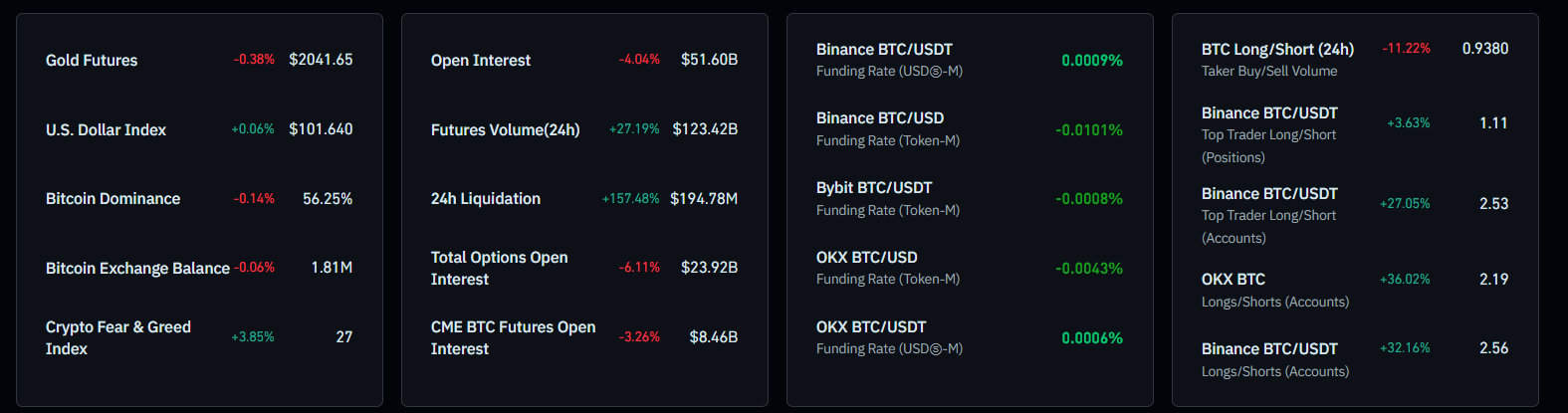

With the Fear and Greed Index at 27, the market is dominated by fear. Further, the BTC dominance is down by 0.14%.

In the derivatives market, the Open Interest of Bitcoin is down to $51.46B, a 4.26% drop in 24 hours. Further, the liquidations have increased by 160%, recording a $195M wipeout.

Hence, the rising bearish signals in the derivatives market and the declining Fear and Greed Index puts a sell sign. However, recovery signals like top traders’ BTC long/short ratio over Binance and OKX exchanges reveal underlying optimism.

Will BTC Price Hit $50K?

The increasing supply and deteriorating market sentiments warn of a bearish continuation. Regarding the 23.60% level breakdown, the next support levels are present at $54,000 and $51,335.

On the positive side, a minor recovery could retest the broken $57,000 zone near the $59,000 mark in case of an extended recovery. Concerned about how the BTC price will conclude in the year 2024? Our Bitcoin (BTC) Price Prediction addresses this and more!