Bitcoins, The monthly close after-hours turned sour for bulls, losing more than 2% on Sept. 1. Data from TradingView showed Bitcoin price weakness hitting a new low of $57,230 on centralized crypto exchanges, a level last seen on Aug. 16. Less liquid conditions by the middle of the weekend led to a dismal monthly close as buyers were then unable to prevent further losses.

What to Expect for Bitcoin in September?

Bitcoin ended August down 8.6%, below its average gain of 1.75%, according to data from blockchain data analytics platform CoinGlass. The figures also reflect September’s BTC/USD It reveals that it was a historically bad month for the currency pair, with average losses coming in at 4.5%. A Prize Pool Worth 21 Million TL Awaits You from BinanceTR! Participating and winning has never been easier.. You can sign up to BinanceTR from this link. Get your first crypto!

Popular investor Crypto Chase shared part of an X post on short-term market activity, explaining that the local level has taken a hit and he wouldn’t be surprised if it eventually gives up:

“Bulls want to see 55,500-56,500 hold or definitive PA above $61,000. Losing $55,000 will likely result in a view of $51,000.”

Other investors Exitpump, He noted that there was aggressive short selling at the local lows of the day, hours before the weekly close.

As Bitcoin continues to retest the channel bottom, investor and analyst Rekt Capital continued while analyzing the weekly chart:

“Bitcoin needs to make a weekly close above $58,450 to confirm the channel bottom (black) as support. Retest still in progress.”

Details on the Subject from a Famous Name

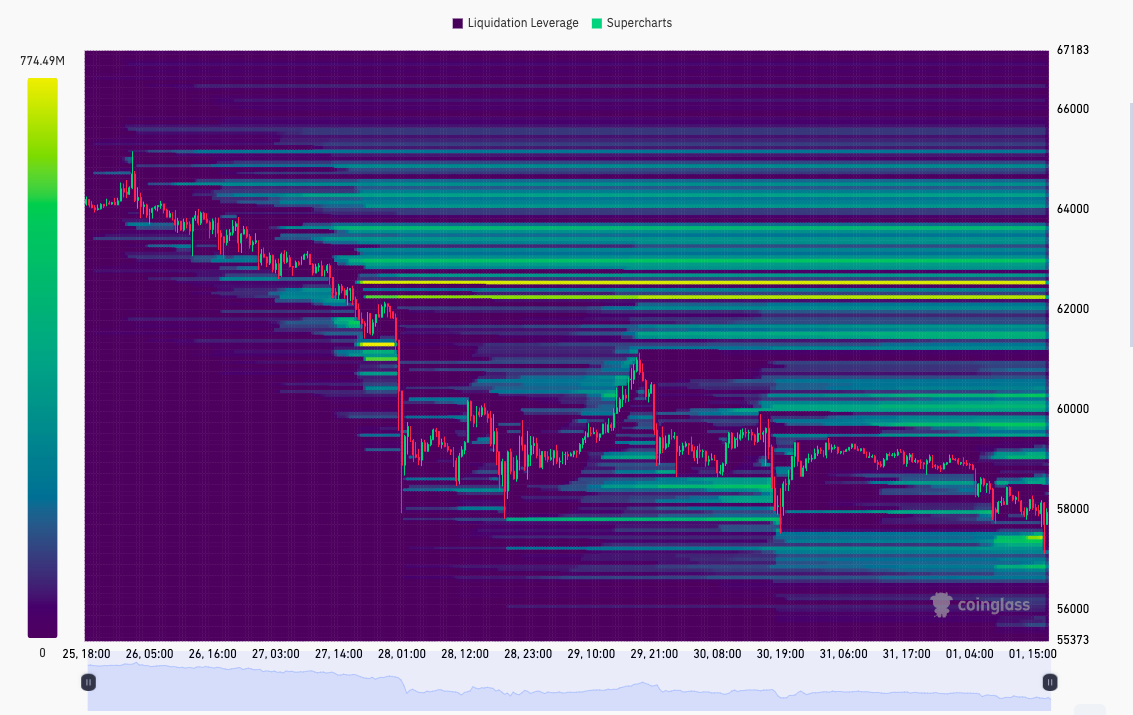

Meanwhile CoinGlass Liquidity data further extended the bearish trend, with the price continuing its downward journey in the last week of August, with popular trader CrypNuevo suggesting that both upside and downside liquidity hunts could be coming this week:

“From a trading perspective I prefer long positions, so I would prefer to see the move down first to get liquidations and fill the wick at $56,600 where I can open a long position. So I am keeping a long position at $56,600 on Sunday and Monday in case we see a false move early in the week.”

Disclaimer: The information contained in this article does not contain investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.