Spot traded in the US Ethereum ETFs reported a daily net inflow of $5.84 million on Wednesday, snapping an eight-day streak of outflows. Grayscale Ethereum Trust (ETHE) recorded a daily net outflow of $3.81 million, while BlackRock’s spot Ethereum fund saw inflows of $8.4 million and Fidelity’s FETH fund saw inflows of $1.26 million.

Spot Ethereum ETFs Generate $151 Million in Volume

Nine spot Ethereum ETFs had $151.57 million in trading volume on Wednesday, according to SoSoValue data. But that figure was well below peaks of around $900 million in trading volume that began in late July. The ETFs have collectively seen net outflows of $475.48 million. A Prize Pool Worth 21 Million TL Awaits You from BinanceTR! Participating and winning has never been easier.. You can sign up to BinanceTR from this link. Get your first crypto!

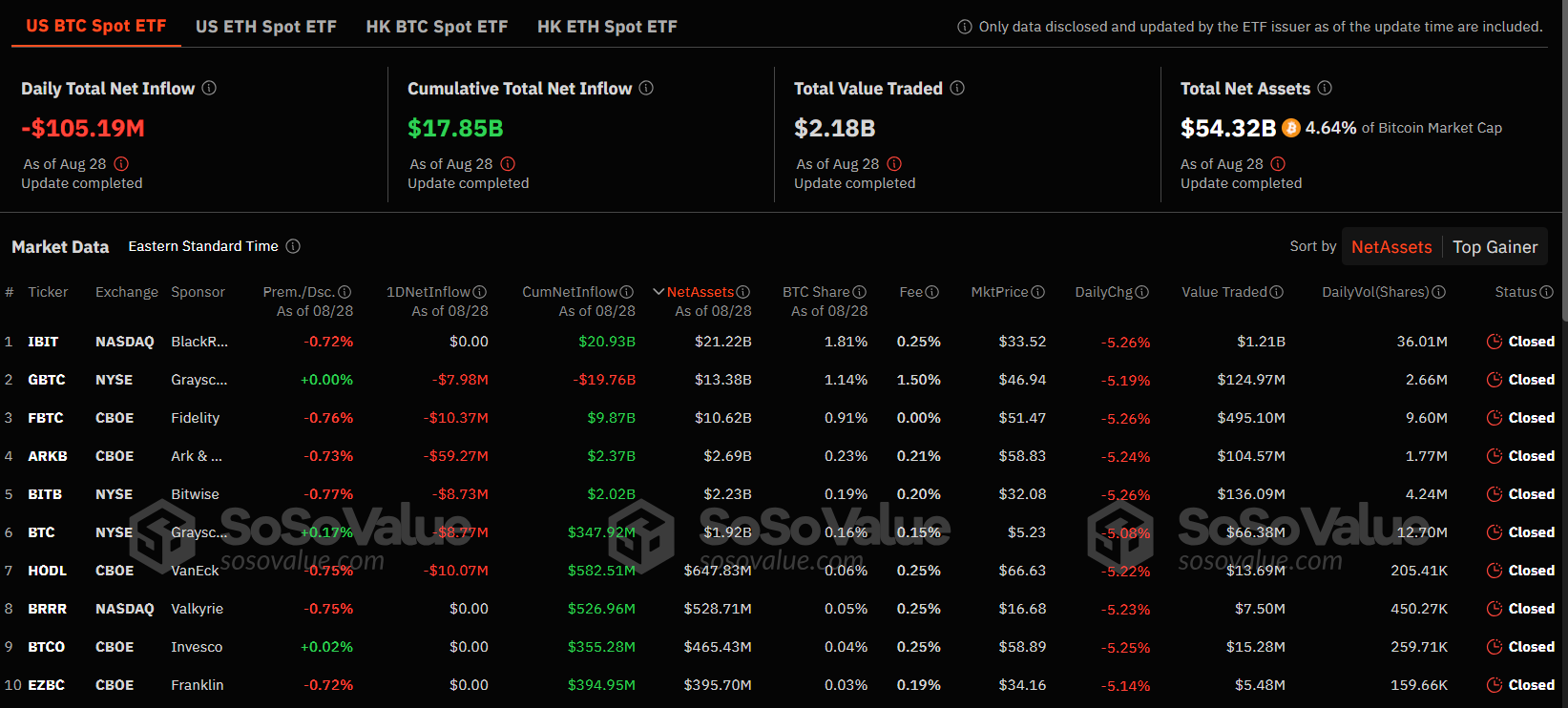

On the other hand, the US spot Bitcoin ETFs reported net outflows of $105.19 million on Wednesday. Ark and 21Shares’ ARKB fund led the pack with outflows of $59.27 million. Fidelity’s FBTC fund saw outflows of $10.37 million, while VanEck’s fund saw outflows of $10.07 million.

$2.18 Billion Trading Volume in Spot Bitcoin ETFs

Bitwise’s BITB fund, Grayscale’s mini Bitcoin trust, and Grayscale’s GBTC funds also reported net outflows of about $8 million. BlackRock’s IBIT fund was the largest spot Bitcoin ETF by net assets, while five other Bitcoin ETFs reported zero inflows on Wednesday.

Spot Bitcoin funds in the U.S. saw a total trading volume of $2.18 billion on Wednesday, up from $1.2 billion on Tuesday. Since the beginning of the year, these funds have recorded net inflows of $17.85 billion.

Latest Situation in the Cryptocurrency Market

Bitcoin fell 0.21% in the last 24 hours to $59,369, while Ethereum was trading at $2,537, up 2.25%. The volatility in cryptocurrency markets also seems to be directly linked to the performance of ETFs.

The developments indicate a growing divergence between Ethereum and Bitcoin ETFs, while also indicating a renewed interest in Ethereum among investors. Bitcoin ETFs are still facing big outflows, and the volatility in crypto markets could be a precursor to bigger financial strategies in the future.

Disclaimer: The information contained in this article does not contain investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.