Recently, Jerome Powell, the chair of the Federal Reserve of the United States of America, hinted that it would cut the interest rates in September. So, next month, the cryptocurrency sector is likely to witness some big movements. At present, the price of Bitcoin stands at $63,051.88. In the last 30-days it has seen a fall of around 6.6%. Can the proposed economic action influence the BTC price? An overview!

US Fed Chair’s Big Announcement on Rate Cuts

It was during a speech at an economic symposium in Jackson Hole that Powell gave the sensational hit about the possible rate cuts. When we analyse his statement, what we understand is that the US administration no longer considers inflation as a threat, but for them the biggest threat is the risk to jobs.

US Economy August 2024: A General Overview

The US Fed Funds Interest Rate now stands at 5.5%. In late 2019, it was around 1.75%. In March, 2020, it was reduced to 0.25%. It remained at that level until late Feb, 2022. Later, it slowly, as well as consistently, climbed up. In late December, 2022, it reached as high as 4.5%. In late July, 2023, it hit a peak of 5.5%. Since then, it has stayed in that mark, showing no fluctuations.

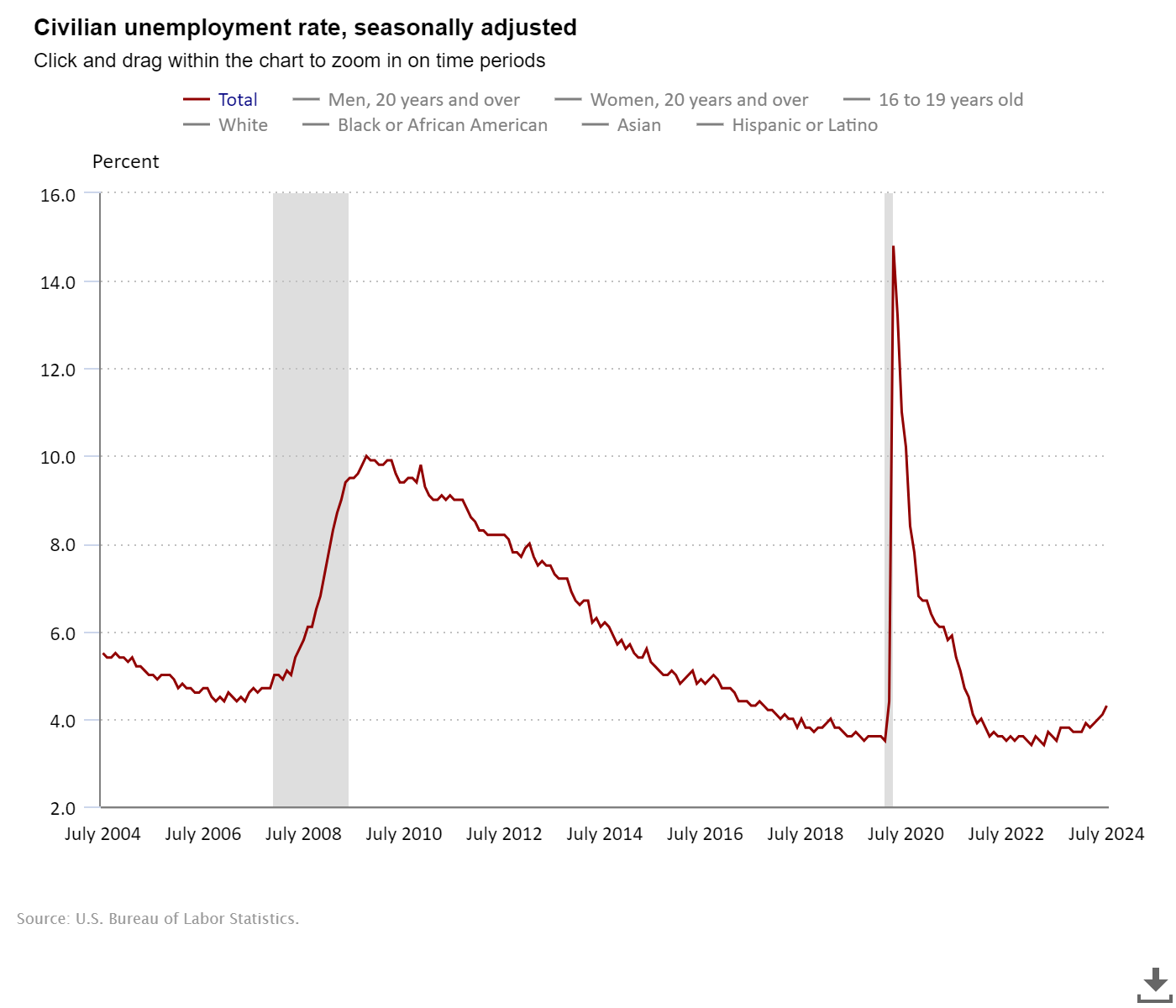

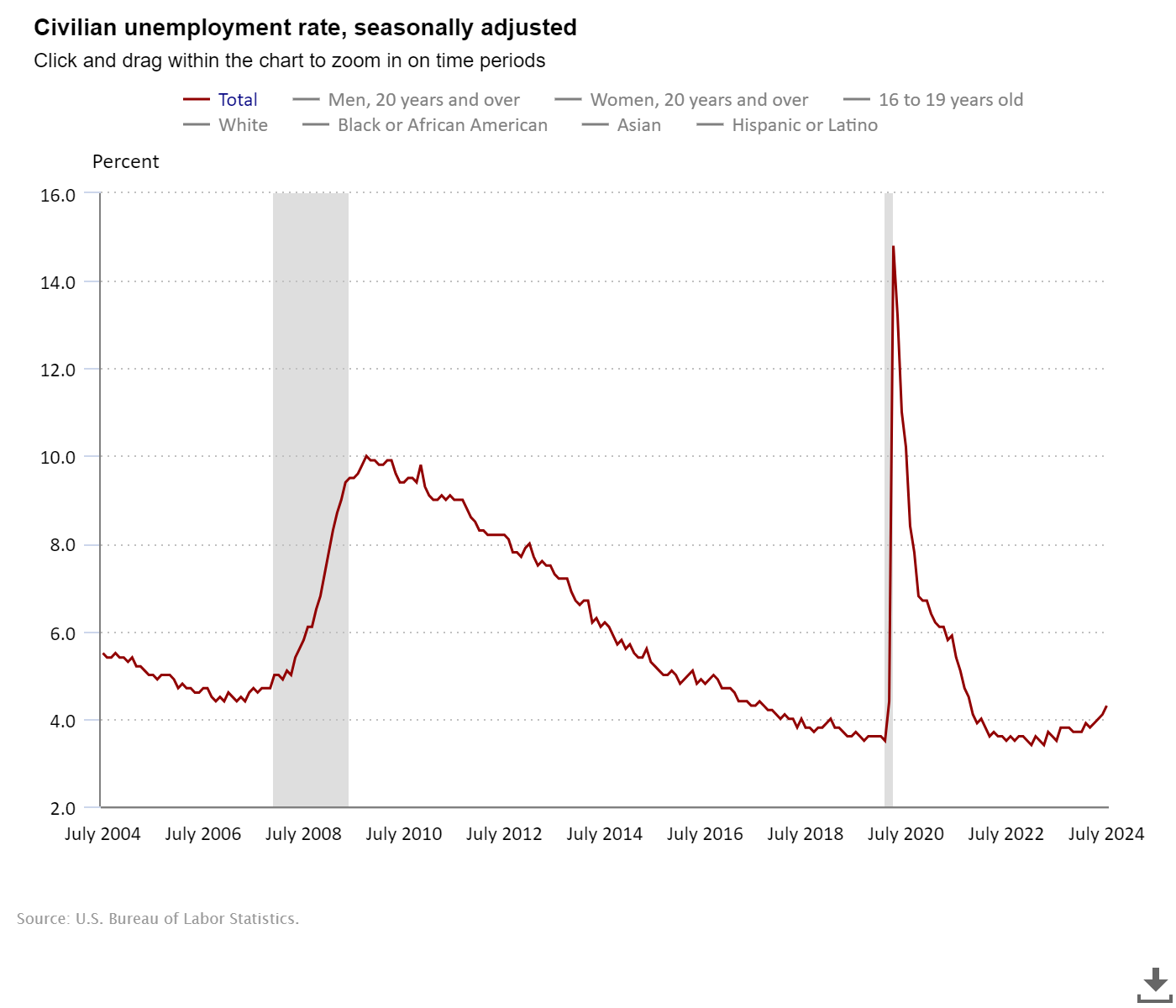

The Civilian Unemployment Rate of the United States now stands at 4.3%. Though it was as high as 14.8% in April, 2020, it was brought down to as low as 3.4% in April, 2023. This year, a consistent increase in the rate has been witnessed. In the beginning of the year in January, 2024, it was nearly 3.7%. In May, it crossed the mark of 4.0%. Last month, it was 4.1%.

It seems that the US administration is worried about the present trend in the US employment landscape, which appears very dull.

Impact of US Fed Rate Cuts

An interest rate cut usually boosts its economy, as it makes borrowing cheaper. The proposed interest rate cut in the US would pump more funds into the economy. It would encourage spending and investment.

What Bitcoin Enthusiasts Can Expect

It is natural that a rate cut makes bonds unattractive. That means there are chances that the funds currently parked in bonds may be deviated to the crypto market. There are several instances in the past that backs the theory that a Fed Rate cut positively influences the price of BTC.

Let’s see what happened in the BTC market in March 2020.

Despite the fact that the global economy was going through a worst pandemic, even in the middle of that uncertainty, the Bitcoin market experienced a consistent rise, and remained largely unaffected by the global economic slowdown.

In conclusion, we can expect some big momentum in the cryptocurrency market, especially the Bitcoin market in the coming months. Maybe, it will be the beginning of the next BTC bull run? Do you agree? Comment!

Also Check Out: Ethereum News: ETH Price Plunges Again! Will This Trigger the Next Crypto Crash?