First day of the week Bitcoin The price visited $ 65,000 during the night hours, but a decline was observed later. After this decline, the opening of the first day of the week on Wall Street did not affect anything and Bitcoin showed a relatively stable image.

Bitcoin Comments

Price data from the market revealed that the BTC/USD pair remained below $64,000, reflecting signs of weakness in the outlook due to the low time frame. The visit of $63,128, the lowest level seen since the weekend on the Bitstamp exchange, caused market participants’ views to shift from optimism to pessimism. A Prize Pool Worth 21 Million TL Awaits You from BinanceTR! Participating and winning has never been easier.. You can sign up to BinanceTR from this link. Get your first crypto!

Material Indicators shared a post on X, the following words were included in the post:

NO straight lines.

In one chart, it was seen that the order book liquidity on Binance, the largest global exchange by volume, turned in favor of the bears.

FireCharts shows Bitcoin bid liquidity falling to $62,500. Moves like this tend to push the price down. They also tend to attract late shorts. Be careful with your positions and resist the urge to over-buy. Expect volatility leading up to the monthly close.

Meanwhile, popular cryptocurrency investors CryptoChase, He highlighted Bitcoin’s lack of aggressive follow-through that would typically be seen after a true breakout.

The more people are given the opportunity to get on board (USA is waking up), the less trust should be given IMO. After sweeping a low before a real pump, local rates are typically not quoted for hours.

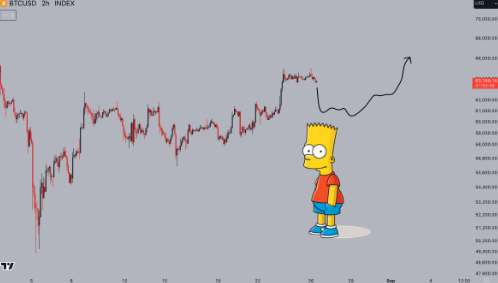

Another notable analyst in the market commented on a possible “Bart Simpson” view where the price would fall to its position at the end of last week, fueling existing concerns.

This comment was made by With gel, Still, he noted that the market “looks stronger than it has in the last few months.

The Future of Bitcoin

Last week’s positive From the USA Following positive macroeconomic data, the trading firm QCP Capital, He stated that there was a surprise because there was no continuous increase in BTC prices.

In the latest bulletin shared on Telegram, he suggested that markets already assumed the Federal Reserve would announce interest rate hikes next month, and made the following statement:

Even at the higher spot, BTC and ETH vols are currently more skewed towards Puts than Buys going into October. This is surprising given the overwhelming bullish trend. It likely indicates that the market is well positioned for this move and is very quick to take profits by selling calls.

QCP noted that BTC could continue to move between $62,000 and $67,000 in the near future.

Disclaimer: The information contained in this article does not contain investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.