Bitcoins, It has had a good start to 2024, rising over 40% since the start of the year. This has been supported by a number of positive fundamental factors, including the launch of spot Bitcoin exchange-traded funds in the US and the halving event that reduced the amount of Bitcoin given to miners by 50%.

What to Expect on the Bitcoin Front?

Unlike previous cycles, Bitcoin price reached new all-time highs ahead of the halving, leading many analysts to predict a supercycle during the current halving year. More than 123 days have passed since the Bitcoin halving, and Bitcoin price has yet to surpass its pre-halving all-time high. A Prize Pool Worth 21 Million TL Awaits You from BinanceTR! Participating and winning has never been easier.. You can sign up to BinanceTR from this link. Get your first crypto!

From Coinglass The data shows that Bitcoin has always delivered positive returns in Q4 halving years, with gains of 58% and 168% in 2016 and 2020, respectively. Furthermore, the Bitcoin price has delivered positive returns in eight of the eleven years between 2013 and 2023, with an average gain of 88%.

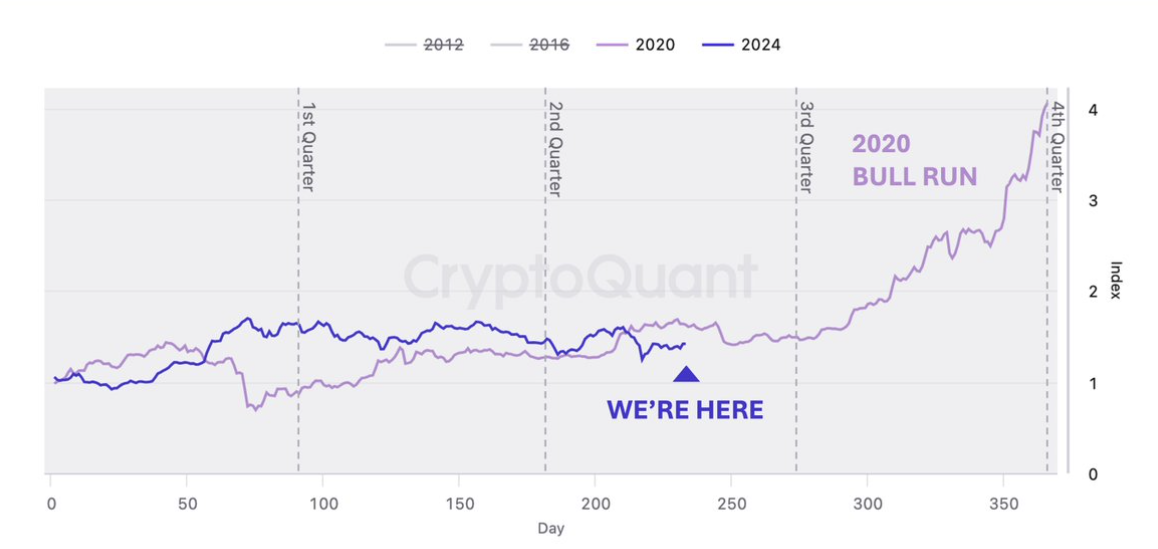

If history repeats itself, Bitcoin has a 73% chance of recovering in the fourth quarter of 2024. CryptoQuant founder and CEO Ki Young Ju analyzed Bitcoin’s price action during the 2020 halving event and found that the recovery began in the 4th quarter:

“Last Bitcoin “The bull rally from the halving cycle started in Q4. Whales will not let Q4 be boring with a flat annual performance.”

According to Young Ju, the Bitcoin price is in an accumulation phase, which suggests that it could start a parabolic uptrend as it enters the last quarter of 2024.

Details on the Subject

From TradingView Data from Bitcoin shows that Bitcoin’s price action has formed a series of higher lows on the daily chart but has remained below the 200-day exponential moving average (EMA) over the past seven days.

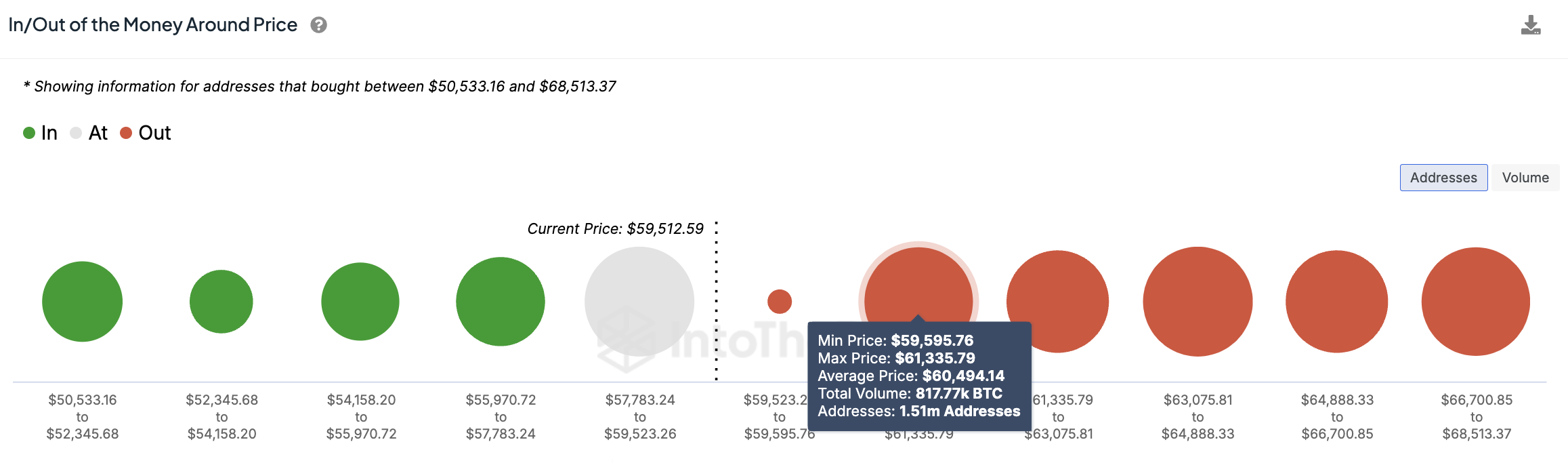

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model reveals that Bitcoin is facing relatively stiff resistance on the recovery path compared to downside support. The 200-day EMA average at $59,423 is located close to the $59,500 to $61,300 price range, where approximately 817,770 Bitcoin were previously purchased by approximately 1.51 million addresses.

This suggests that high demand-side liquidity is needed to push Bitcoin price beyond the 200-day EMA average and then above the resistance provided by the 50-day and 100-day EMA averages at $61,383 and $62,323 respectively, and break out of the current consolidation. If this does not happen, Bitcoin price could drop to the $57,500 level or even lower, revisiting the $54,500 level, analyst Mark Cullen said.

Disclaimer: The information contained in this article does not contain investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.