On August 20th Dogecoin The price surged 6% as it attempted to retest the $0.11 level. This increase was also reflected in a significant increase in volume. Shortly afterwards, especially at the time of writing, the memecoin erased all of these gains. While DOGE holders may have hoped for another rally, this analysis suggests that it may be difficult.

What’s Happening on the Dogecoin Front?

Data from Santiment Dogecoin’s The one-day Realized Value shows a monthly low of $12.43 million. As a short form of this process, this data serves as the total cost basis for assets in an ecosystem. Given this data, Realized Value is the value of all assets relative to the last time they moved. An increase in this value indicates that the cryptocurrency may be priced higher as cheaper tokens are spent. A Prize Pool Worth 21 Million TL Awaits You from BinanceTR! Participating and winning has never been easier.. You can sign up to BinanceTR from this link. Get your first crypto!

However, the decline is largely driven by capitulation as crypto prices may revalue lower as more expensive assets are spent. Keeping the above thesis in mind, DOGE’s price may struggle to break above $0.10 despite previous bullish signals.

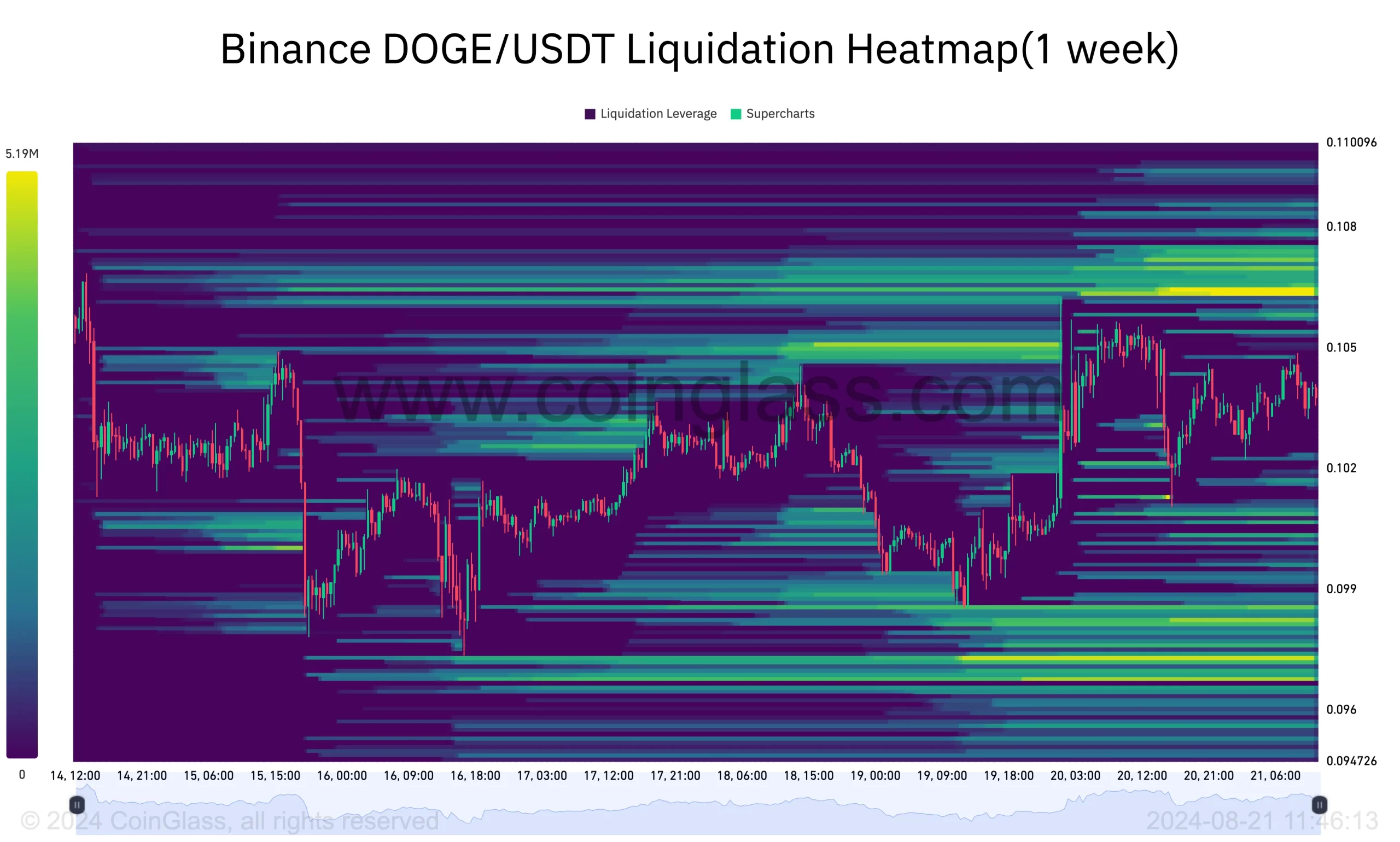

Liquidation data is another indicator that Dogecoin could be struggling. This heatmap predicts price levels where large-scale liquidation could occur. For context, liquidation occurs when an exchange forcibly closes an open position due to insufficient margin funds, in order to prevent further losses.

DOGE Chart Analysis

Technical point of view DOGE’s It sheds more light on potential price action. The Relative Strength Index (RSI) on the daily chart remains below the neutral 50.00 region. As a technical measure of momentum, a reading below the midpoint suggests that the token has yet to break out of its bearish dominance.

Although the RSI degree has increased, it needs to rise above the 50.00 point to confirm the bullish trend. Therefore, it is not unreasonable to conclude that the Dogecoin price may continue to decline below $0.09 and $0.10 unless the specified condition is met.

A look at the Fibonacci retracement levels adds more insight to the forecast. Usually, the indicator determines the price levels that a cryptocurrency can reach. At the time of writing, DOGE is hovering around the $0.10 retracement zone, where the 23.6% Fib level is located. If the market condition remains the same, the price may not be able to rise beyond this point.

However, the increase in buying pressure may change the situation. If this is the case DOGE’s The price could attempt to reach the 61.8% Fib level at $0.13. However, if the broader market crashes as it did on August 5, Dogecoin price could drop back to the $0.08 level.

Disclaimer: The information contained in this article does not contain investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.