Onchain data Data from analytics firm Bitcoin The capitulation of miners may be coming to an end and a potential bull market for Bitcoin has begun. While Bitcoin has shown signs of recovery, it has fallen sharply, currently trading at $59,076, down about 0.72% in the last 24 hours, and the general market sentiment is turning positive. Market conditions may be increasingly conducive to growth as miners are no longer under significant pressure to sell.

What’s Happening on the Bitcoin Front?

CryptoQuant, It highlights the Hash Ribbons indicator, which monitors the 30-day and 60-day moving averages of the Hash Rate. This tool marks the end of the miner capitulation, which coincides with the Hash Rate reaching a new peak of 638 exahashes per second (EH/s). This development is notable as it marks the first such recovery since the Bitcoin halving, which reduced the block reward for miners to approximately 3,125 Bitcoins, or around $185,000. The CryptoQuant team made the following statement on the matter: A Prize Pool Worth 21 Million TL Awaits You from BinanceTR! Participating and winning has never been easier.. You can sign up to BinanceTR from this link. Get your first crypto!

“While the indicator is not designed to determine the exact price floor, it often precedes higher prices by signaling a decrease in selling pressure from miners.”

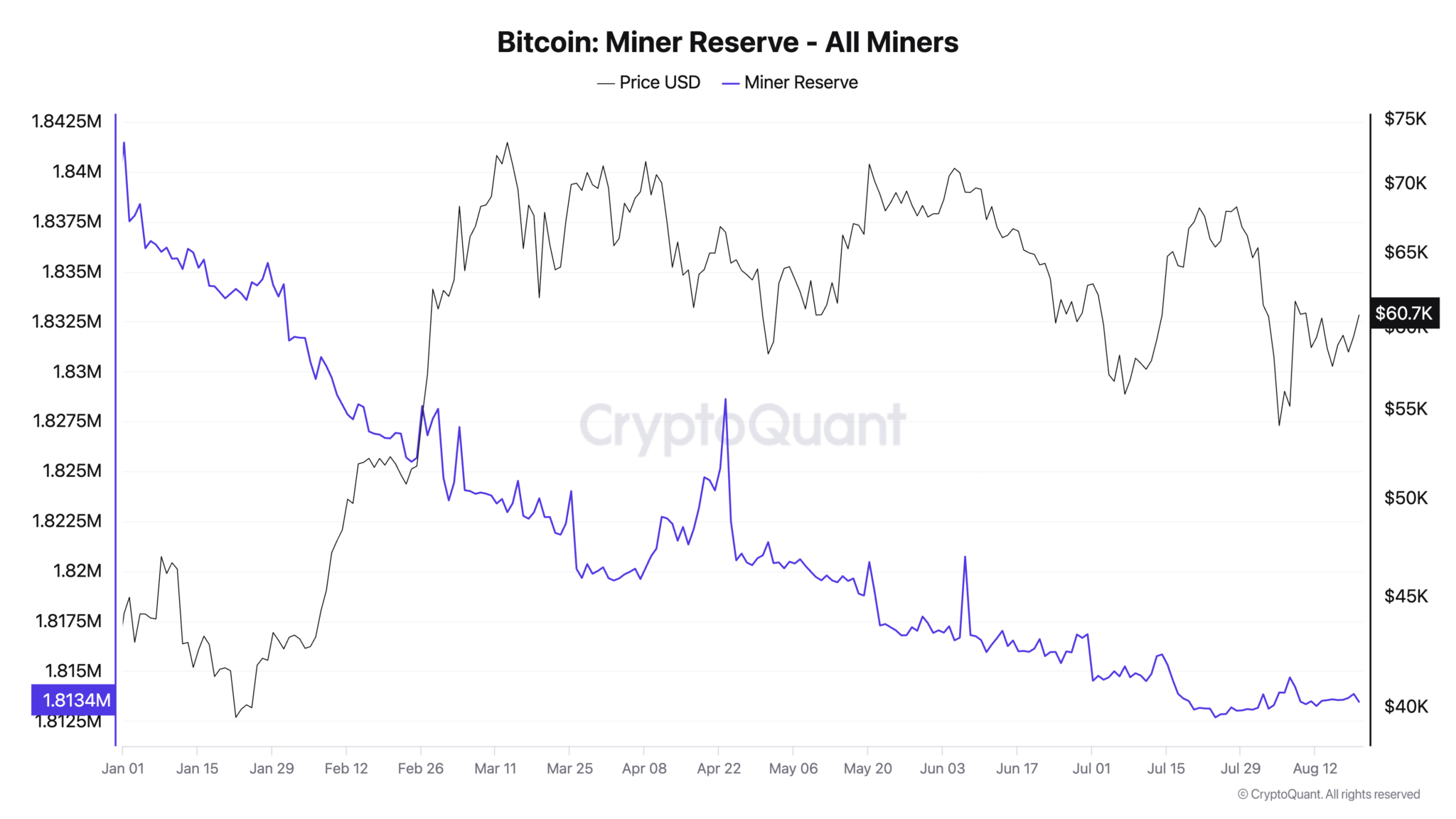

Similar levels of miner capitulation were seen in late June during the FTX bankruptcy. This is due to the cryptocurrency’s high operational costs, which exceed the revenue generated from mining it. According to data from CryptoQuant, between January and August 2024, miners sold approximately 28,018 Bitcoins, worth $1.68 billion at current market prices.

CryptoQuant analyst Maartunn said in an interview on the subject that as the economic pressure on miners has decreased, the need to sell the Bitcoin obtained by mining has decreased:

“Despite lower mining rewards, mining companies have found a way to stay in business and provide hashrate to the network.”

Details on the Subject

To Bitcoin On-chain demand for Bitcoin suggests that the consolidation phase is nearing its end. Popular analyst Axel Adler Jr. shared the following statements on the subject:

“After Bitcoin reached the $57,000 level, the average daily token transfer volume increased from $650,000 to $765,000. This coincides with Bitcoin’s price stability in the local consolidation range between $57,000-$68,000.”

This increase in transfer volume is largely due to panic selling by holders. However, Bitcoin’s price has shown resilience, indicating that the market has effectively absorbed the selling pressure. The stable price range during this period indicates a solid demand for Bitcoin, which investors see as attractively priced. Therefore, Adler JrHe believes that Bitcoin is approaching the final phase of market consolidation. Furthermore, the typical process following the Bitcoin halving event supports an outlook for an upcoming bull market.

Disclaimer: The information contained in this article does not contain investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.