Fidelity, a trillion-dollar asset manager, is one of the oldest giants interested in cryptocurrencies. exported cryptocurrency ETFs It is among the largest and competes with BlackRock. The Head of the Research Department of the company shared his views with the public hours ago to comment on the decline in cryptocurrencies.

Why Are Cryptocurrencies Falling?

Fidelity Research President Chris Kuiper answered the question “who is selling” in his latest assessment. The main reason for the ongoing negativity in recent months is the strong wedge in the sales appetite and the developments on the macro front. crypto coins The fact that it doesn’t support it. Even though BTC resisted stable sales and struggled to maintain six-digit prices, we saw many attempts below $100,000.

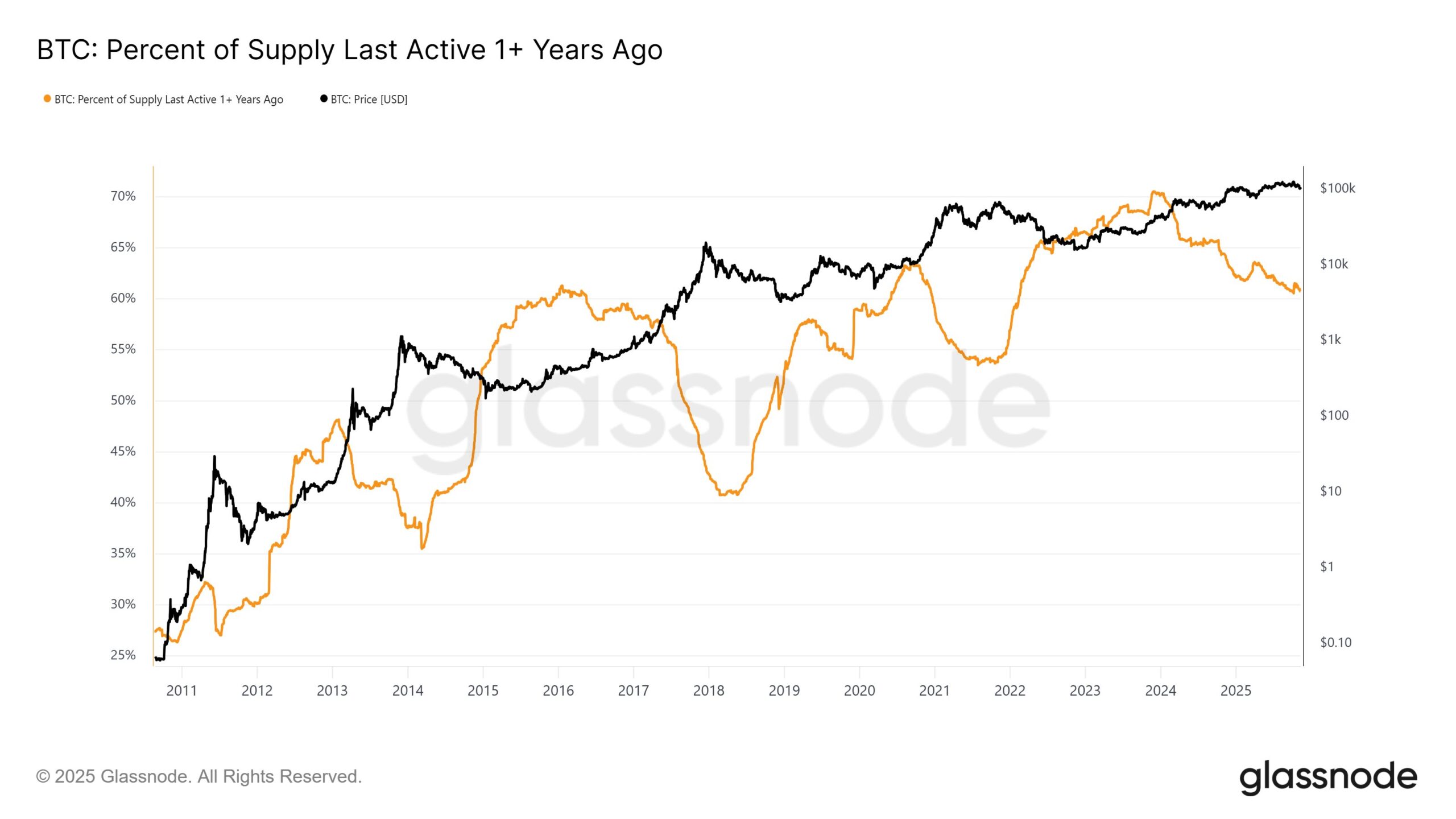

Chris agrees that long-term investors are selling, but thinks the metrics need to be considered in more detail. For this, he recommends that we look at the percentage of coins that have been active for 1 year or more.

“As you can see on the chart, this line rises in bear markets (as coins get older and people tend to hold more as they anticipate losses) and then there is often a dramatic decline as these long-term holders sell on the strength of the bull market.

What’s interesting about this cycle is that there is a relatively slight downtrend in the bull market.

There was no decline when new highs were made.

While the market is slowly moving sideways and upwards, this trend is consistently slowly decreasing. “To me, this makes psychological sense, and I see and hear it anecdotally from people, including our customers.”

But cryptocurrency Investors started to get tired. Bitcoin, which started to perform behind the stock market and even gold  $103,128.64 It feeds on this fatigue and attracts more sales. Of course, the “sales motivation due to the cycle story” that we have been expressing for weeks also makes it difficult for sellers to sell out. Chris said:

$103,128.64 It feeds on this fatigue and attracts more sales. Of course, the “sales motivation due to the cycle story” that we have been expressing for weeks also makes it difficult for sellers to sell out. Chris said:

“Everyone was waiting for the 4-year cycle to end on a high note, taking advantage of the historically strong seasonality in October and now November to sell. However, October’s strong seasonal trend did not continue, and as the calendar year draws to a close, long-term investors are trying to make tax moves and positional changes for the end of the year and close the day with the gains they made.”

“I will monitor this trend and some other indicators to gauge seller fatigue, but for now positive fundamental developments and sluggish price action continue to diverge in my view.”

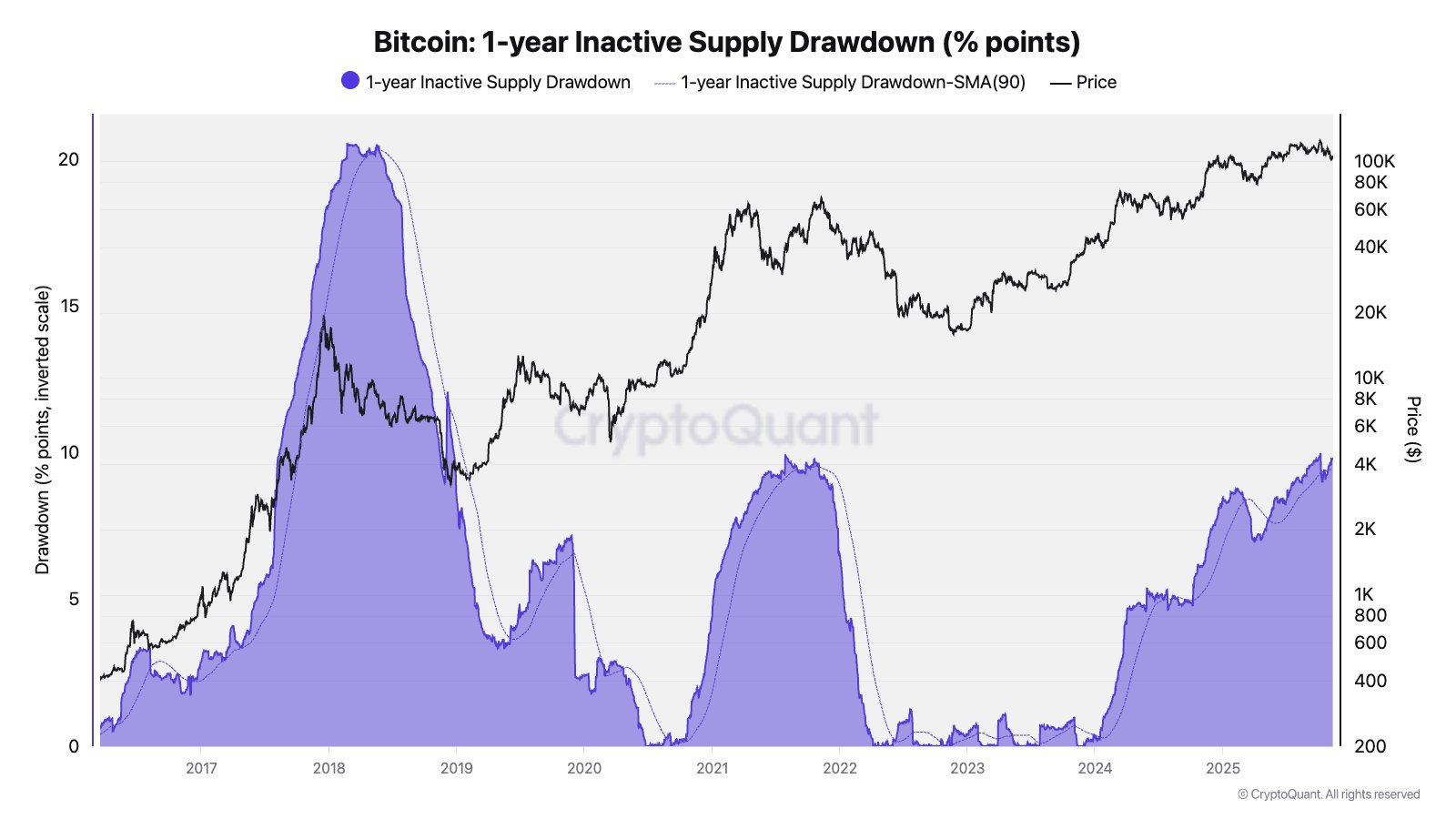

Julio Moreno from CryptoQuant gave Chris a different clue about the current situation.

“Hey Chris, another way to visualize this is to look at the 1-year inactive supply reduction as a % of total Bitcoin supply.

2017-2018: 1-year inactive supply decreased by 20%.

2021: 10 points.

2024-2025: 10 points.

The chart shows the inverted scale (left) for the 1-year inactive supply.”

Will the Decline End?

In cryptocurrencies What matters more than whether the decline will continue is how severe it may become. The motivation of investors, fed by the four-year cycle story, is that sales will accelerate as of December and that we will enter strong bear markets as of the new year. And without seeing an altcoin bull on a large scale.

However, the Fed’s transition to the monetary expansion phase and Powell’s departure in May, and the fact that many banks and financial companies will enter the crypto business as of the new year, indicate that the usual bear markets may not occur. In other words, if the sales do not intensify, we will continue to see increases through temporary decline phases that last much shorter than the usual bear markets. It is difficult to say today how this will work in balance, but it is certain that we have very different conditions than previous cycles.