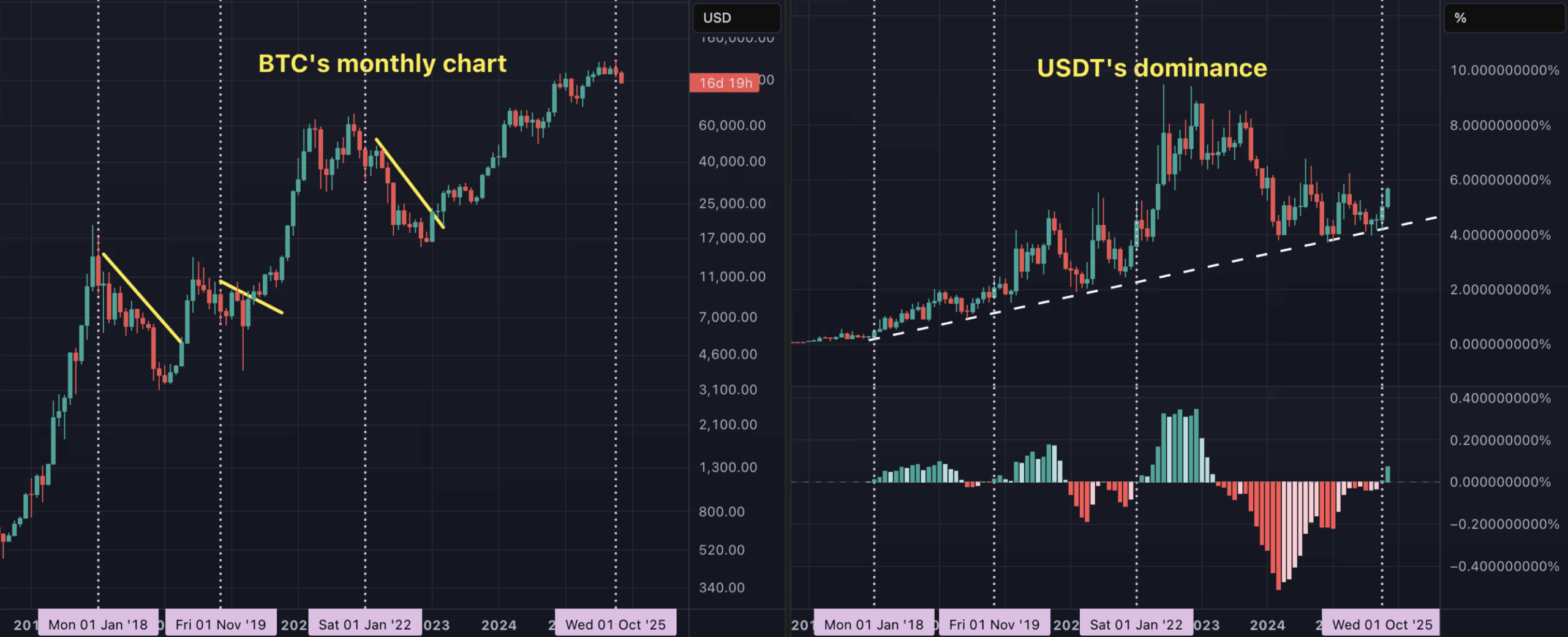

Issuer of the largest stablecoin USDT Tether‘s share in the cryptocurrency market has reached its highest level since April. This increase in market share was interpreted as a significant decrease in investors’ risk appetite and the market switching back to protection mode. It is the largest dollar-pegged stablecoin with a market value of $184 billion. USDTIt generally stands out as a safe haven for cryptocurrency investors during periods of high volatility. Bitcoin  $103,128.64The fact that ‘s value decreased by 11 percent in November to 97,000 dollars is considered as the strongest signal that the capital is turning to safe assets again.

$103,128.64The fact that ‘s value decreased by 11 percent in November to 97,000 dollars is considered as the strongest signal that the capital is turning to safe assets again.

What Does the Increase in Tether’s Dominance Mean?

Tether’s rise in market dominance cryptocurrency It is a classic indicator that emerges in periods when investors are risk-averse. Investors direct their capital to dollar-indexed assets to reduce the risk of losing value in periods of sharp price movements. In this process, Tether constitutes the majority of the transaction volume, becoming an indicator of uncertainty in the market.

stablecoin‘s play a critical role in the market as they both facilitate trading activities and serve as value preservation in times of high volatility. While the increase in the share of USDT shows that investors are taking more cautious positions, it also leads to an increase in the cash density in the market. This trend often goes hand in hand with cycles of price corrections and weakening demand.

Historical Data Reflects Market Cycles

Past data of Tether market dominanceIt shows that increases in prices generally coincide with bear markets. A common scenario is that when USDT’s market share increases, selling pressure increases in Bitcoin and other altcoins. This approach confirms the periods when investors withdraw from risky assets and look for safe havens.

Technical indicators also support the said chart. MACD Histogram crossing over the zero line historically marks the beginning of increases in USDT dominance. In such periods, the movement of capital flows away from risk means that the cautious course in the markets may continue until a new recovery phase.