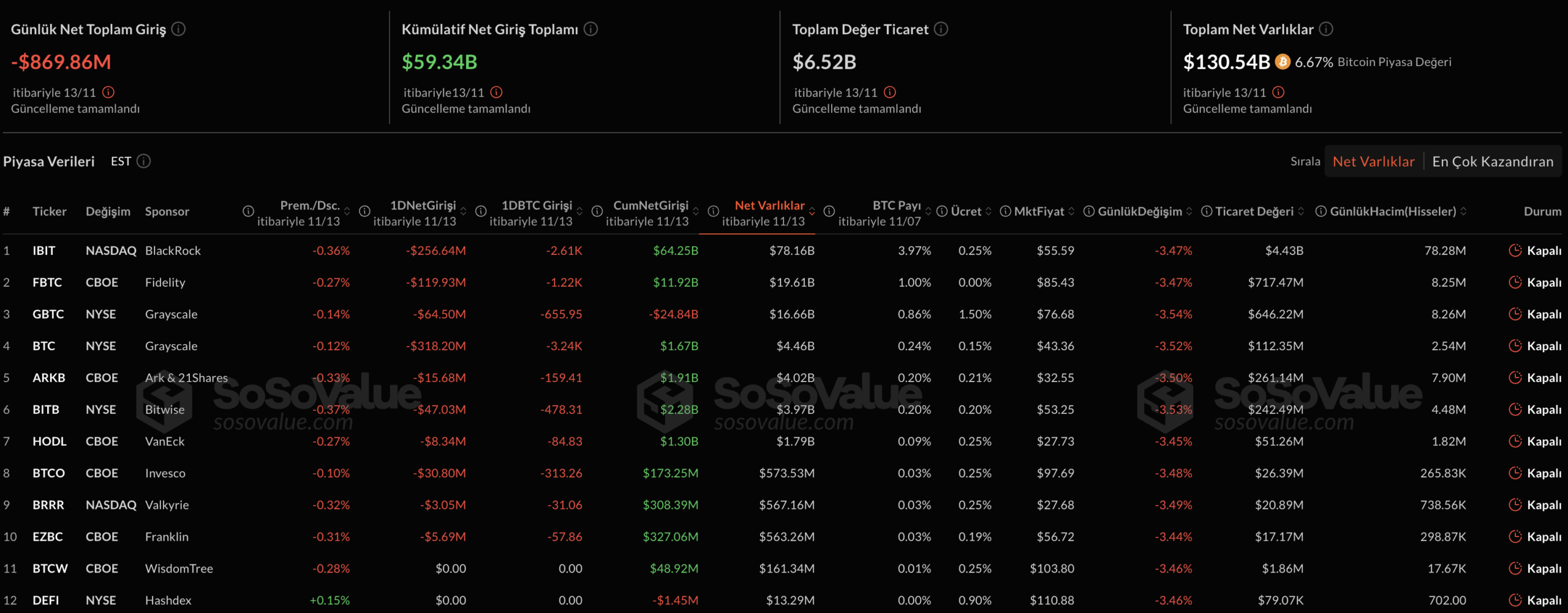

traded in the USA spot Bitcoin  $103,128.64 ETFThere was a large-scale exit from . Net outflows from 11 ETFs totaled $869.86 million on Thursday, the second-highest capital loss in history. The chart, which reached an outflow of 2.64 billion dollars in three weeks, revealed the cautious stance of investors and the loss of confidence in the market.

$103,128.64 ETFThere was a large-scale exit from . Net outflows from 11 ETFs totaled $869.86 million on Thursday, the second-highest capital loss in history. The chart, which reached an outflow of 2.64 billion dollars in three weeks, revealed the cautious stance of investors and the loss of confidence in the market.

Institutional Investors Are Averse to Risk

SoSoValue According to data, 11 spots Bitcoin The ETF attracted attention with an outflow of $869.86 million on Thursday, November 14. This figure stood out as the second largest mass outflow recorded since the launch of ETFs in January 2024. Institutional investors are reducing their Bitcoin positions due to increasing volatility and risk aversion in global markets.

Total net outflow of 2.64 billion dollars in the three-week period cryptocurrency marketIt shows that the cautious mode prevails.

Bitcoin’s decline below the $100,000 threshold caused long-term investors, in particular, to withdraw from ETFs. Increasing uncertainty in the market reduced trading volume in both spot ETFs and derivative products, while short-term selling pressure deepened. Analysts state that if there is a permanent trend below $ 100,000, further corporate dissolution may occur.

Simultaneous Exit in Ethereum ETFs

On the other hand, it seems that outflows from ETFs are not limited to Bitcoin. Ethereum  $3,510.67 Focused spot ETFs also saw outflows of $259.72 million, the highest daily outflow since October 13. This parallel movement shows that investors are turning to a general risk reduction strategy in cryptocurrencies.

$3,510.67 Focused spot ETFs also saw outflows of $259.72 million, the highest daily outflow since October 13. This parallel movement shows that investors are turning to a general risk reduction strategy in cryptocurrencies.

The price of Bitcoin was trading around $97,500 at the time of writing. It is seen that the largest cryptocurrency has lost 5 percent in value in the last 24 hours and 11 percent since the beginning of the month. Analysts state that outflows from ETFs may continue with the price decline, but in the long run, low levels may create opportunities for new entries.

Despite the outflows observed on the corporate side, some analysts think that such corrections in ETFs should be considered within the scope of the “natural liquidity cycle”. However, the general opinion is that it will be difficult to recover investor confidence unless the $ 100,000 threshold is regained.