XRP Coin It is one of the few altcoins that manage to stay green today. Because today was the Canary XRP ETF launch. With the increasing possibility of an attack on Venezuela, concerns about the Supreme Court decision, and overvaluation concerns on the AI front, cryptocurrencies are having a terrible day today. BTC may lose $100,000 again and the possibility of a December interest rate cut has dropped significantly. So how did the ETF launch go?

XRP Coin ETF

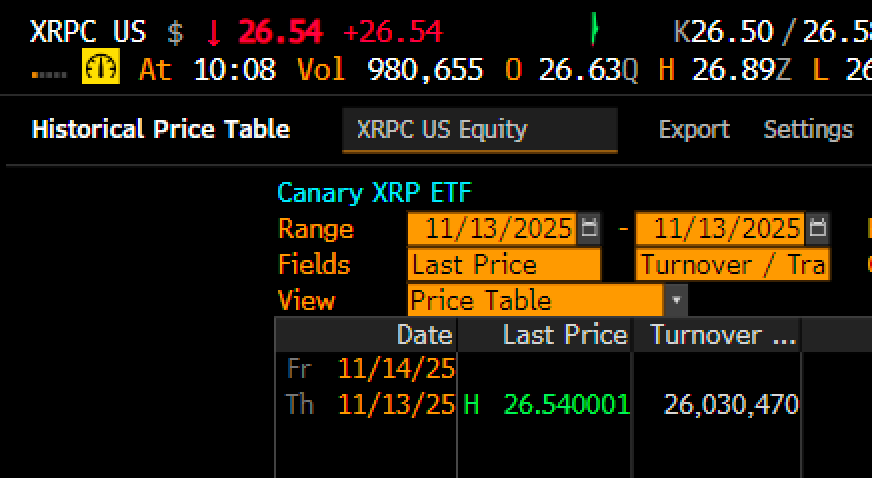

XRPC listed by code ETF It saw $26 million in volume in its first half hour. Although the overall market sentiment is terrible, it is a good start for XRP Coin. Of course, it cannot be compared to BTC and ETH launches because the conditions are completely different. Bloomberg senior ETF analyst Eric Balchunas praised the good start.

“XRPC hit $26 million in volume in the first 30 minutes, wow, it’s going to crush my $17 million prediction. It has a good chance of surpassing BSOL’s $57 million volume, which is the biggest first day of this year’s launches.”

The highly anticipated listing is a success for now, with Nasdaq approving the listing and the Securities and Exchange Commission automatically allowing the product to go live during the shutdown.

XRP Coin

XRP Coin is trying to maintain $2.4 with the support of the fund launched by crypto asset manager Canary Capital. Needless to say, the timing wasn’t great. If we had seen this listing at least in September, it would probably have had different results on the charts. However, in the long run, this listing XRP Coin It will be supportive for.

BTC ETF Although the listings did not trigger huge profits at first, the entries increased the excitement and increased the spot price after the listing. Moreover, today’s listing was the first product to launch under the Securities and Exchange Commission’s new, simplified listing standards. We will continue to see spot ETF listings for more altcoins.

While the interest rate cut forecast for December has dropped below 50%, we cannot expect big increases in the short term. The Fed’s course will take shape as US data is released in the coming weeks. If there is no massive increase in inflation and employment continues to weaken, cryptocurrencies are expected to rise as interest rate cut expectations increase again. For now, most investors seem determined to get through this transition by staying on the sidelines and watching what happens.