Bitcoin (BTC) begins a brand new week nonetheless in vacation mode with United States monetary markets off for Independence Day.

The biggest cryptocurrency, caught beneath the more and more daunting $20,000 mark, continues to really feel the strain from the macro setting as speak of decrease ranges stays omnipresent.

After a quiet weekend, hodlers discover themselves caught in a slim vary whereas the prospect of a breakout to the upside seems more and more laborious to consider.

As one dealer and analyst singles out July 4 as the location of a “wild run to the draw back” for crypto markets, the countdown is on for Bitcoin to climate the aftermath of the most recent Federal Reserve price hike.

What else might the approaching week have in retailer? Edaface takes a have a look at the potential market-moving elements for the times forward.

BTC value bides its time over lengthy weekend

Bitcoin emerged from the weekend unscathed, however the traditional pitfalls of off-peak buying and selling stay.

The USA won’t return to buying and selling desks till July 5, offering ample alternative for some traditional weekend value motion within the meantime.

To date, the market has held off on the subject of volatility — apart from a quick spike to $18,800, BTC/USD has circled the world between $19,000 and $19,500 for a number of days.

Even the weekly shut offered no actual pattern change, information from Edaface Markets Professional and TradingView confirmed, with the psychologically vital $20,000 unchallenged.

“Whereas beneath the vary low we are able to anticipate a drop all the way down to $18,000,” well-liked buying and selling account Crypto Tony reiterated to Twitter followers as a part of a contemporary replace on July 4.

“Been a really boring few days within the markets, and that is traditional for a mid vary.”

When it comes to targets to the draw back, others continued to eye the world round $16,000.

In 2018, The Orange MA was the Backside. In 2020, The Inexperienced MA was Backside. At the moment holding the Inexperienced MA (16-17K). If it breaks then there’s a Risk of Subsequent Backside Blue MA (12-13K) $BTC pic.twitter.com/rZILTAOlXf

— Trader_J (@Trader_Jibon) July 3, 2022

With no significant Bitcoin futures hole and flat efficiency on Asian markets, in the meantime, there was little available when it comes to short-term value targets for short-timeframe merchants.

The U.S. greenback, in the meantime, continued to carry close to twenty-year highs after getting back from its newest retracement defiant.

The U.S. greenback index (DXY) stood above 105 on the time of writing.

Gold nears “blast off” towards U.S. equities

With Wall Road closed for Independence Day, U.S. equities can take a breather on Monday.

For one well-liked chartist, nonetheless, consideration is specializing in the power of shares versus gold within the present setting.

In a Twitter thread on the day, gold monitor Patrick Karim particularly flagged the valuable metallic as being about to hit a historic “blast off” zone towards the S&P 500.

After bottoming out on the finish of 2021, the ratio of gold to the S&P has recovered all through this yr, and is now about to cross a boundary, which has traditionally led to vital upside afterward.

“Gold closing in on ‘blast off zone’ versus US equities. Earlier take-offs have unleashed vital positive factors for Silver & Miners,” Karim commented.

The scenario can’t be mentioned to be the identical in U.S. greenback phrases, with USD power preserving XAU/USD firmly as a substitute beneath $2,000 since March.

Nonetheless, for silver followers, the implications are that even a modest push-through for the XAU/SPX ratio will convey vital returns.

Be aware you will not have to get again to earlier 2011 highs for the #gold versus #spx ratio to have MUCH larger nominal costs for silver & miners.

Take into consideration that for a second.

— Patrick Karim (@badcharts1) July 3, 2022

The forecast once more calls into query the extent of Bitcoin’s means to interrupt with macro developments. A breakout towards BTC for gold could be the pure knock-on impact ought to Karim’s situation play out due to ongoing correlation with equities.

“After escaping the sideways sample that had shaped for a 1.5 yr interval, the correlation coefficient elevated sharply to 86% vs S&P 500,” well-liked dealer and analyst CRYPTOBIRB summarized on the weekend.

“Now, at 0.78 ratio it stays strongly constructive.”

Fellow analyst Venturefounder famous that Bitcoin additionally stays tied to strikes within the Nasdaq.

In the meantime #Bitcoin and #NASDAQ are nonetheless trending collectively.

Be aware earlier bottoms (Dec 2018 & Mar 2020) occurred as #BTC and $QQQ correlation at peak, suggesting macro has all the time influenced BTC bottoms. We are able to predict extra possible that macro calls backside for BTC once more this time. pic.twitter.com/szmS4c6WV8

— venturef◎undΞr (@venturefounder) June 26, 2022

Towards the greenback, Edaface in the meantime reported, Bitcoin’s inverse correlation is now at 17-month highs.

Crunch time for Hayes’ “wild journey to the draw back“

July 4, other than being Independence Day, is being watched by one market participant particularly as a public vacation like no different — at the very least for Bitcoin.

With markets closed and BTC value motion already teetering on the sting of assist, Arthur Hayes, former CEO of derivatives platform BitMEX, has singled out this lengthy weekend as one lengthy day of reckoning for crypto markets.

The reasoning appears logical. The tip of June noticed the Federal Reserve elevate key charges by 75 foundation factors, offering fertile floor for an hostile response from danger property. Low-liquidity “out-of-hours” vacation buying and selling will increase the potential for unstable value strikes up or down. Mixed, the cocktail, Hayes warned final month, might be potent.

“By June 30 (second quarter finish), the Fed may have enacted a 75bps price hike and begun shrinking its steadiness sheet. July 4 falls on a Monday, and is a federal and banking vacation,” he wrote in a blog post.

“That is the proper setup for yet one more mega crypto dump.”

To date, nonetheless, indicators of what Hayes says shall be a “wild journey to the draw back” haven’t materialized. BTC/USD has stayed virtually static since late final week.

The deadline ought to be Tuesday, July 5, because the return of merchants and their capital might present liquidity wanted to regular the markets in addition to purchase up any cash going low-cost within the occasion of a last-minute downturn.

Hayes added that his prior forecasts of BTC/USD bottoming at $27,000 and ETH/USD at $1,800 already “lay in tatters” in June.

Mining problem continues to be rising

Regardless of appreciable concern over miners’ means to resist the present BTC value downturn, Bitcoin’s community fundamentals stay calm.

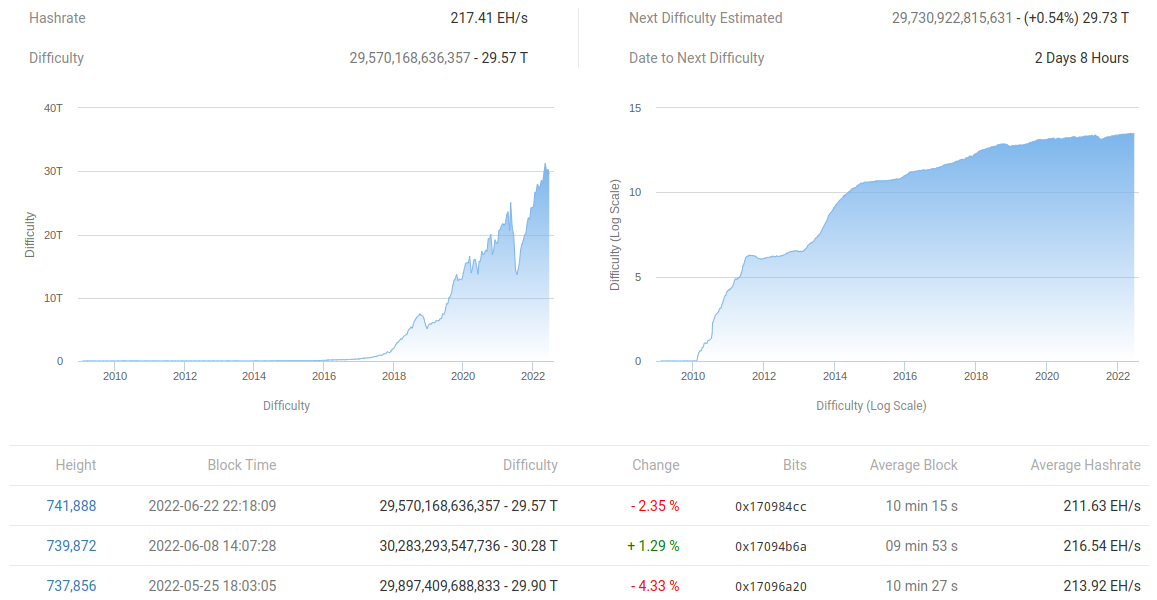

A powerful testomony to miners’ resolve to remain on the community, problem isn’t planning to scale back on the upcoming readjustment this week.

After reducing by a modest 2.35% two weeks in the past, problem, which routinely rises and falls to have in mind fluctuations in miner participation, will hardly change in any respect this time round.

In accordance with estimates from on-chain monitoring useful resource BTC.com, problem will even rise ought to present costs keep the identical, including 0.5% to what’s a metric nonetheless close to all-time highs.

In relation to miners themselves, opinions contemplate that it’s the much less environment friendly gamers — presumably newcomers with larger price foundation — who’ve been pressured to exit.

Information uploaded to social media by Charles Edwards, CEO of asset supervisor Capriole final week in the meantime places the manufacturing price for miners en masse at round $26,000. Of that, $16,000 is electrical energy, that means that miner overheads instantly affect their means to restrict losses within the present setting.

“We traded beneath Electrical Value in June, nonetheless the ground has since dropped as inefficient miners capitulate,” Edwards famous.

A sea of lows

Bitcoin on-chain metrics pointing to file overselling is nothing new this yr and in latest weeks particularly.

Associated: Prime 5 cryptocurrencies to look at this week: BTC, SHIB, MATIC, ATOM, APE

The pattern continues in July, because the community returns to eventualities not seen because the aftermath of the March 2020 cross-market crash.

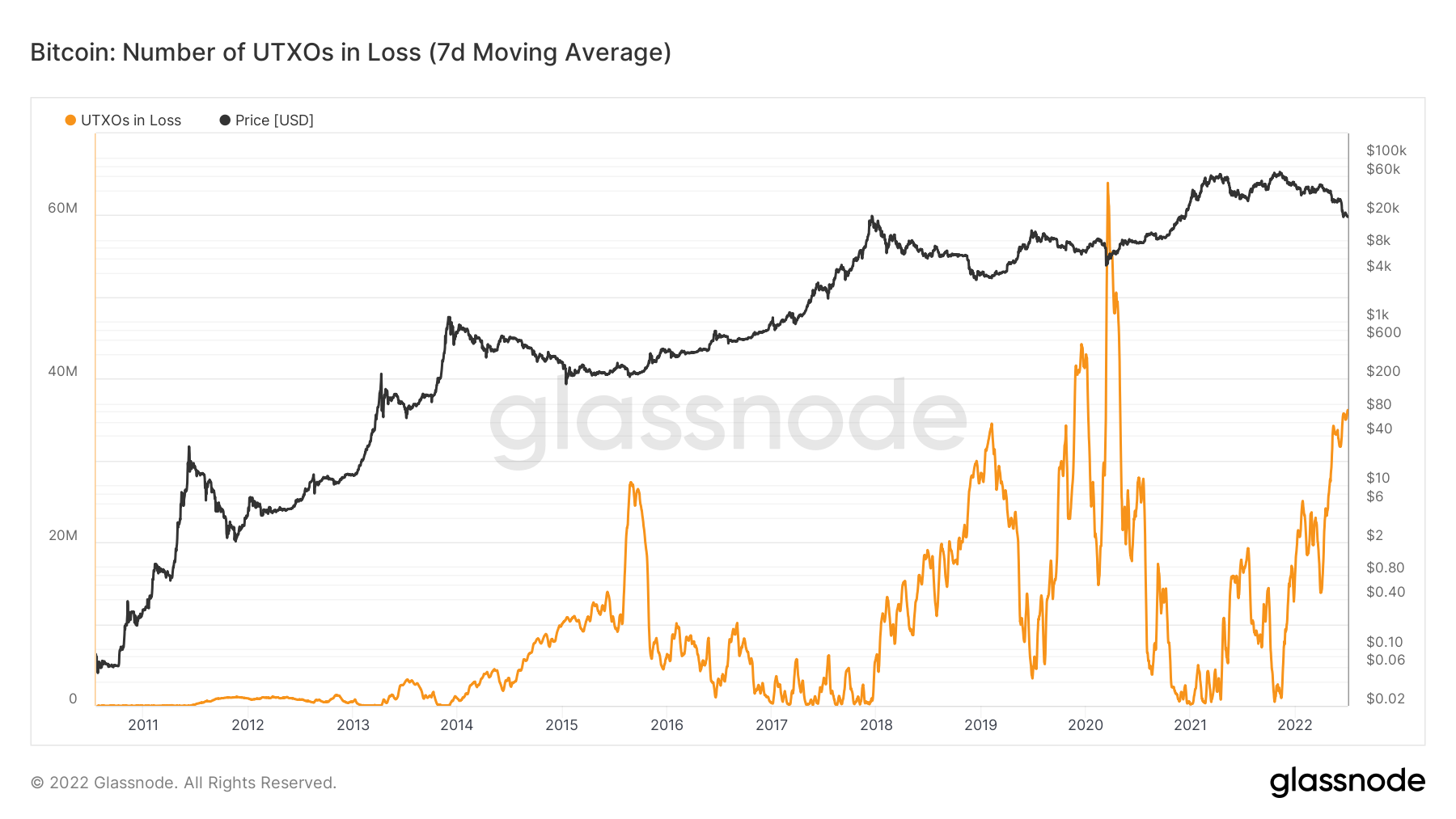

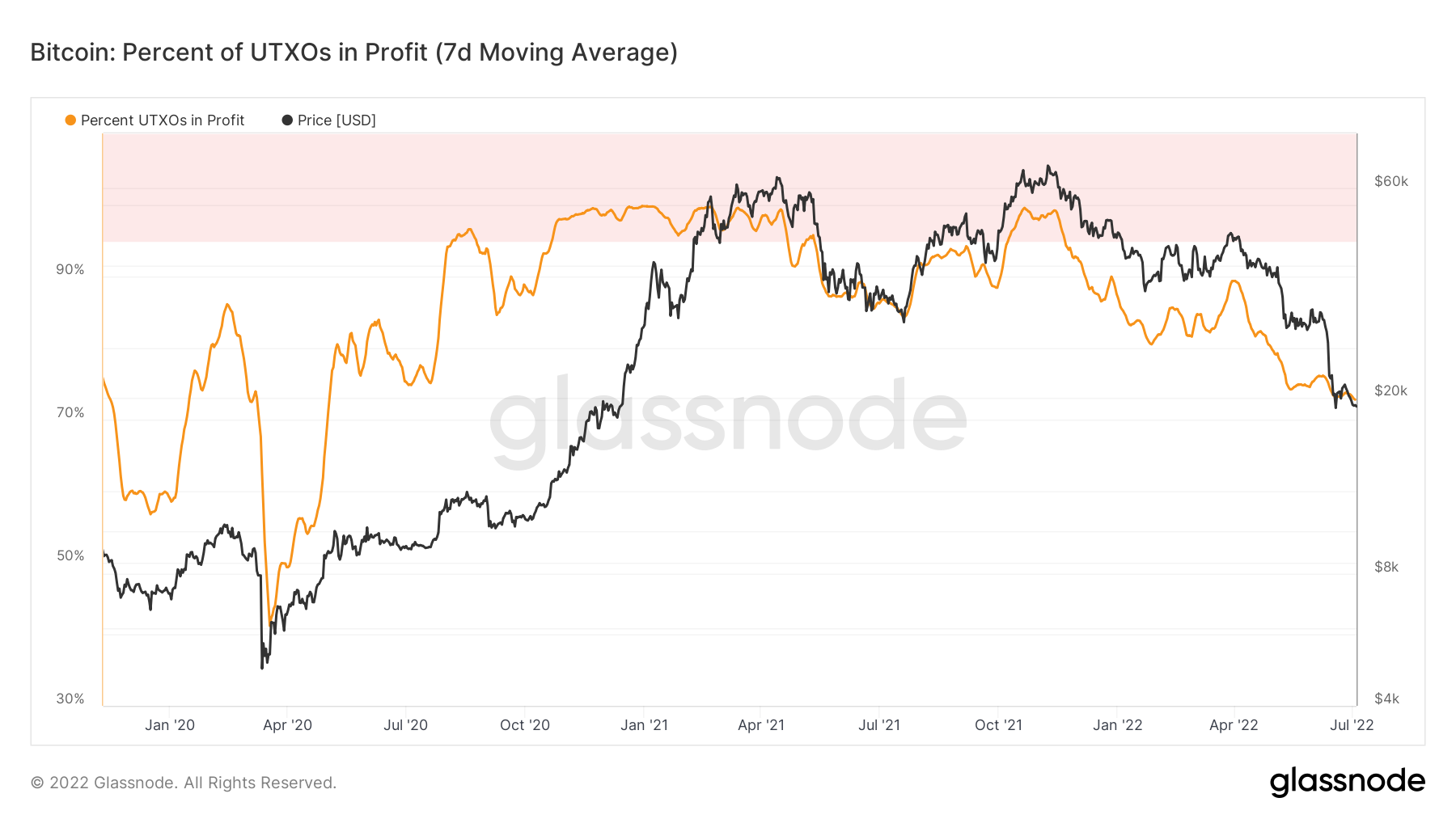

In accordance with on-chain analytics agency Glassnode, the variety of cash being spent at a loss is now the best since July 2020. Glassnode analyzed the weekly transferring common of unspent transaction outputs (UTXOs) in loss.

Equally, the proportion of UTXOs in revenue hit a two-year low of simply over 72% on July 3.

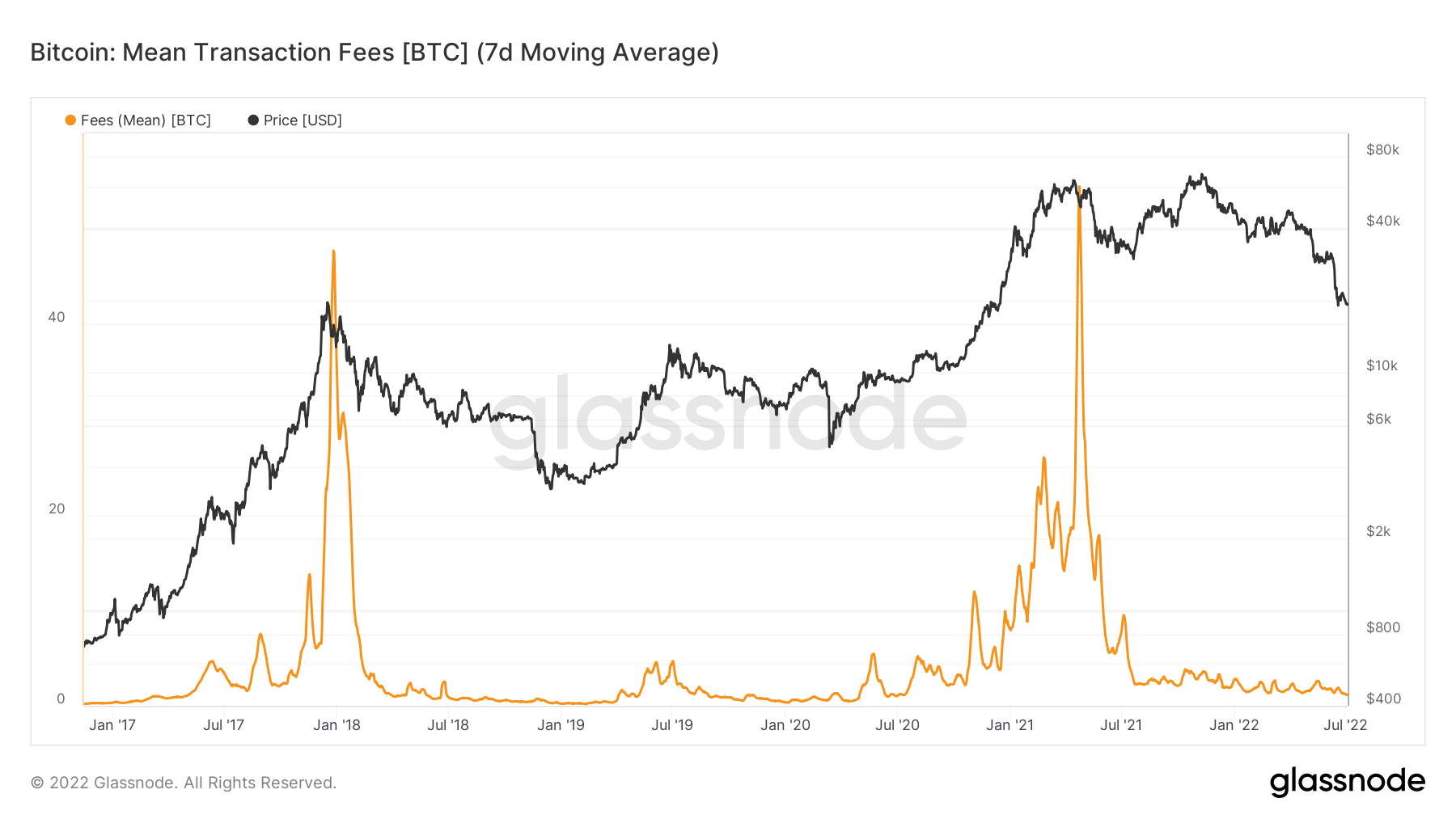

Bear markets can produce some welcome, if uncommon, silver linings. Bitcoin transaction charges, as soon as painfully excessive throughout bullish durations of intense community exercise, at the moment are additionally at their lowest since July 2020. The median price, Glassnode reveals, is $1.15.

As Edaface reported, the identical is true for Ethereum community fuel charges.

The views and opinions expressed listed below are solely these of the creator and don’t essentially replicate the views of Edaface.com. Each funding and buying and selling transfer entails danger, you need to conduct your individual analysis when making a choice.